Moleculin Biotech (MBRX) on Tuesday announced that a second round of independent laboratory testing has confirmed the anti-viral activity of its drug candidate WP1122 as a potential treatment against coronavirus. The news is pushing shares up 33% to $1.46 in early market trading.

Moleculin said that it contracted with IIT Research Institute for additional in vitro testing of its WP1122. The testing involved a cell viability assay in the VERO E6 cell line infected with SARS-CoV-2 and compared the therapeutic effects of 2-deoxy-D-glucose or 2-DG (the active ingredient in WP1122) alone with those of WP1122, a 2-DG prodrug. Results of a previous test earlier this year, showed that 2-DG reduced the virus that causes COVID-19 by 100% in in vitro testing.

“Having validation in yet another virus host cell line provides additional confidence in the antiviral activity we are seeing,” said Moleculin CEO Walter Klemp. “We are also gaining confidence that in vitro testing results for this class of compounds are significantly affected by the concentration of natural glucose in the microenvironment present during viral replication and continued infection.”

Based on feedback from the U.S. Food and Drug Administration (FDA), Moleculin believes it may need to show activity in COVID-19 animal models to successfully submit a request for Investigational New Drug (IND) status for WP1122. In addition, the company is working with IITRI to conduct preclinical toxicology testing, which is currently under way.

Klemp added that other compounds in its portfolio against SARS-CoV-2 and other life-threatening viruses will also be tested.

“We believe WP1122 is promising, but we also don’t want to overlook additional opportunities to potentially provide new and better solutions to other viral diseases,” he said.

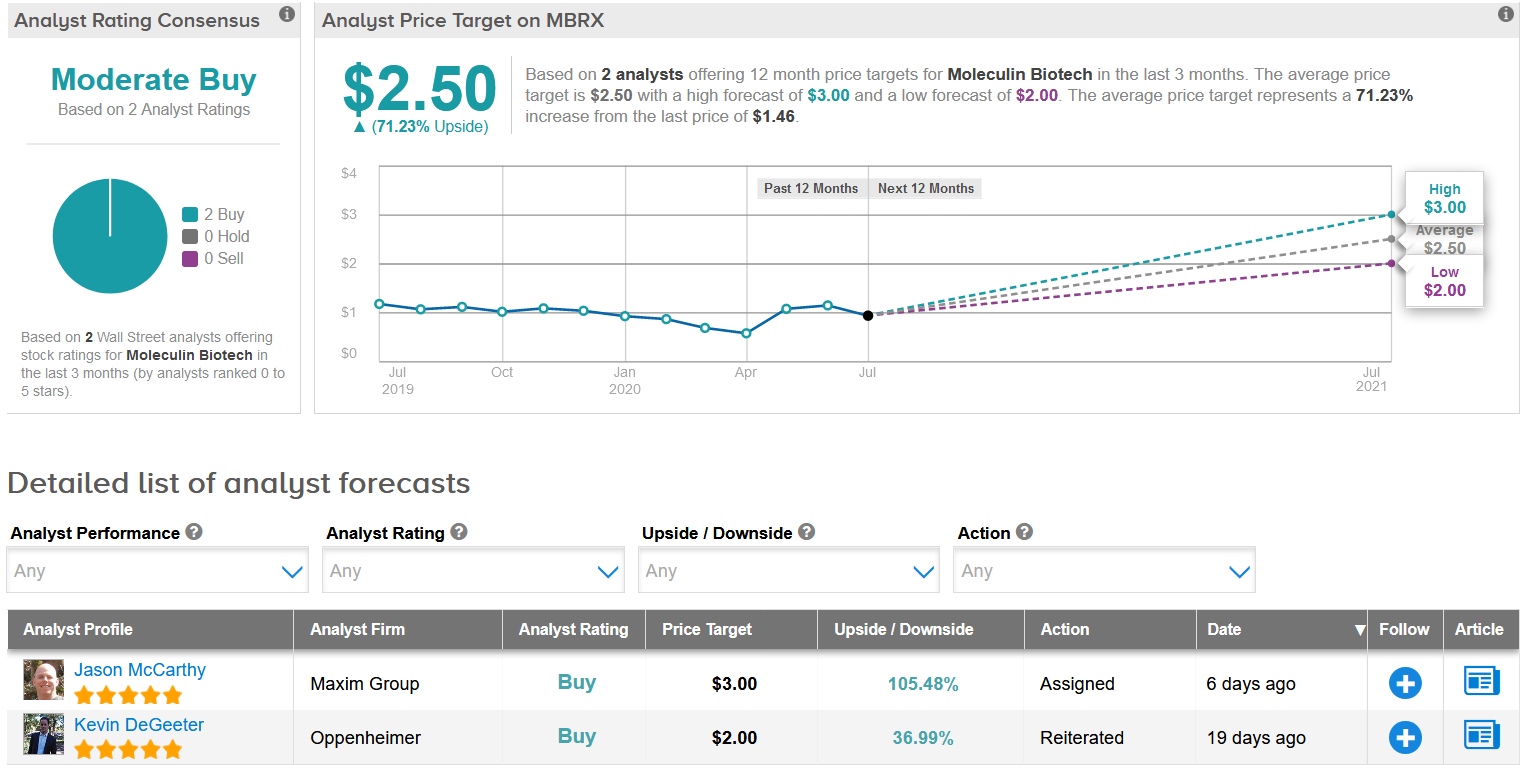

Only two analysts have published recent ratings on MBRX- and both rate the stock a buy. Based on an agreement with Sterling Pharma announced earlier this month to produce WP1122 and support development plans to initiate a clinical trial for the potential treatment of COVID-19, Maxim Group analyst Jason McCarthy initiated the stock with a Buy rating and a $2 price target (37% upside potential). (See MBRX’s stock analysis on TipRanks)

“WP1122 is unlike other drugs in development for COVID-19 as far as we know, as it targets glucose metabolism, which is key for rapid viral genome production,” McCarthy wrote in a note to investors. “Preclinical work could also support WP1122 for the potential treatment of other viral infections as well as certain cancers.”

The analyst expects the company to file IND application with the FDA in 2H20.

Related News:

NuVasive Spikes 5% After-Hours On Sharp Procedure Rebound

Acadia Plunges 12% As Depressive Study Misses Goals; Analyst Says Buy

Is Novavax’s (NVAX) Super-High Valuation Justified? This Analyst Says ‘Yes’