Microsoft (MSFT) has picked Morgan Stanley (MS) as a strategic cloud computing partner in the financial services industry. It is a multipronged arrangement. In addition to running its workloads to Microsoft’s Azure cloud platform, Morgan Stanley will contribute to unlocking opportunities that Microsoft’s cloud provides to financial services companies.

Morgan Stanley operates in more than 41 countries, offering a suite of financial services ranging from investment banking to wealth management. It is undergoing a digital transformation and has decided to use Microsoft’s cloud tools to accelerate that process. (See Morgan Stanley stock analysis on TipRanks)

Other than using Microsoft’s cloud for its operations, Morgan Stanley will contribute its industry expertise to help Microsoft develop cloud products that would make it easier for the financial services industry to shift to the cloud.

“Our partnership will empower innovation for the industry while ensuring stringent compliance and regulatory guidelines are met,” commented Microsoft’s cloud and artificial intelligence executive Scott Guthrie.

Financial services companies not only face continually changing customer needs but are also subject to complex regulations. This situation has created challenges for the industry’s digital transformation. Microsoft and Morgan Stanley engineering teams will collaborate to develop cloud products that meet the financial services industry’s requirements. (See Microsoft stock analysis on TipRanks)

Jefferies analyst Brent Thill reiterated a Buy rating with a price target of $290 on Microsoft stock. The analyst’s price target implies 17.27% upside potential. Thill remains bullish on Microsoft after learning about the Teams and Azure product updates at the company’s Build developer conference.

“Developers continue to be integral to businesses’ digital transformation efforts…MSFT unveiled product announcements for Teams and Azure at its Build conference, with the focus on making products more dev-friendly, open, and extensible,” noted Thill.

Consensus among analysts is a Strong Buy based on 25 Buys. The average analyst price target of $297.96 implies 20.49% upside potential to current levels.

MSFT scores a “Perfect 10” on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

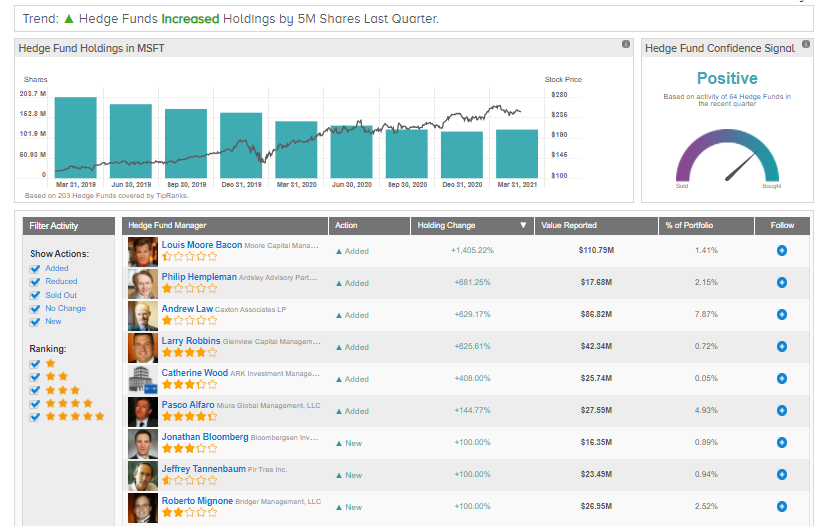

According to TipRanks’ Hedge Fund Trading Activity tool, confidence in MSFT is currently Positive, as 64 hedge funds increased their cumulative holdings by 5 million shares in the last-quarter.

Related News:

Coinbase Card Comes to Apple Pay and Google Pay

Cloudera Agrees to $5.3B Private Equity Buyout; Stock Up 24%

Nokia Accelerates Introduction of 5G Services Across Australia