Shares in Microsoft Corp. (MSFT) and FedEx Corp. (FDX) rose after the two companies announced a multi-year collaboration to help “transform commerce” for faster and more efficient deliveries.

The financial terms of the partnership were not disclosed. As part of the collaboration, FedEx will power Microsoft’s intelligent cloud software, including its Azure and Dynamics 365 platforms. As a result, businesses will have an “unprecedented” level of control and insight into the global movement of goods, the companies said in a joint statement.

The announcement drove FedEx shares up 9.9% to $10.73 in midday trading. Microsoft advanced 1.6% to $186.12.

“FedEx has been reimagining the supply chain since our first day of operation, and we are taking it to a new level,” said Frederick W. Smith, chairman and CEO at FedEx. “Together with Microsoft, we will combine the immense power of technology with the vast scale of our infrastructure to help revolutionize commerce and create a network for what’s next for our customers.”

FedEx networks link more than 99% of the world’s gross domestic product across 220 countries and territories.

FedEx Surround, the first service of the collaboration, will allow businesses to enhance supply chain visibility by leveraging data to provide near-real-time analytics into shipment tracking, which is aimed to drive more precise logistics and inventory management.

Businesses will also be able to retrieve knowledge of global commerce conditions and external challenges in near-real-time, such as severe weather or natural disasters, mechanical delays, clearance issues, and incorrect addresses. The data-driven insight will give customers the ability to intervene early and act to avoid logistical slowdowns before they occur to reduce friction and costs.

“Now more than ever, organizations are counting on an efficient and capable supply chain to remain competitive and open for business,” said Microsoft CEO Satya Nadella.

Five-star analyst Alex Zukin at RBC Capital raised Microsoft’s price target to $200 from $196 and kept his Buy rating on the shares after meetings with investors.

Zukin said that although Microsoft will not be immune to macro demand trends, its broad product portfolio should benefit from increasing cloud demand as more companies seek to adopt its cloud and collaboration offerings to better enable remote work, disaster recovery, and flexibility. Zukin expects Microsoft’s revenue and gross profit growth to accelerate as Azure and Office 365 expand within its sales mix.

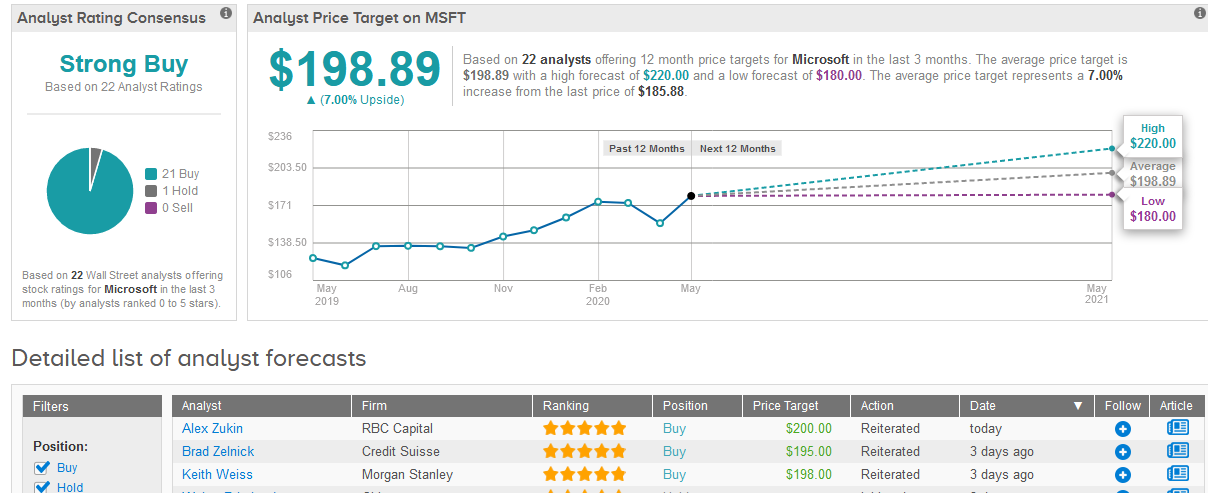

TipRanks data shows that overall Wall Street analysts are almost unanimously bullish on Microsoft’s stock. Twenty-one out of the 22 analysts have Buy ratings and 1 has a Hold rating adding up to a Strong Buy consensus. The $198.89 average price target provides investors with 7% upside potential in the shares in the coming 12 months. (See Microsoft stock analysis on TipRanks).

Related News:

Microsoft, UnitedHealth Launch Back-to-Work Covid-19 Screening App

Microsoft Buys Metaswitch For Cloud-Based Telecoms Move, 5G Expansion

Apple is Said to Snap Up Startup NextVR For Virtual Reality Content; Top Analyst Sees Buying Opportunity