Merrill Lynch raised Salesforce price target to $235 (14.6% upside potential) from $210, in anticipation of solid 2Q results. The software company is set to report its quarterly results on Aug. 25.

Merrill Lynch analyst Kash Rangan maintained a Buy rating on Salesforce’s (CRM) stock, saying he expects a “modest beat and raise quarter”, with a recovery in 2021. Rangan added that “Q2 rev growth could come in at 25% (14% org) vs our model at 22.6% (12% org) and cRPO (current remaining performance obligation) could come in at 19% (15% org) vs our 16.5% (12% org) given that trends continue to strengthen from April Q (17% org cRPO) but off of tougher comps.”

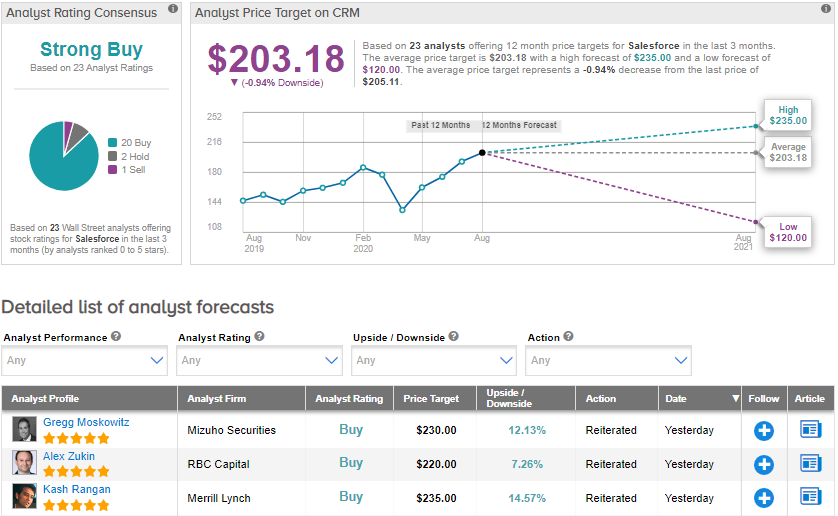

Mizuho Securities analyst Gregg Moskowitz also raised the stock’s price target to $230 (12.1% upside potential) from $210 and maintained a Buy rating on the stock. Moskowitz believes that the company should benefit from its “large 8-figure deal” with a US federal agency this quarter. Salesforce remains the analyst’s top pick over the near- to mid-term.

Salesforce sold all of its 2.8 million shares it owned in the popular video-conferencing company Zoom Video Communications (ZM) during the second quarter, according to a SEC filing published on Aug. 10. In addition to Zoom, Salesforce also divested its 2.2 million remaining shares of Dropbox in the quarter.

Currently, the Street has a bullish outlook on the stock. The Strong Buy analyst consensus is based on 20 Buys, 2 Holds, and 1 Sell. Given the year-to-date stock price increase of 26.1%, the average price target of $203.18 now implies that the shares are more than fully priced. (See CRM stock analysis on TipRanks).

Related News:

TJX Shares Drop 7% After Bigger 2Q Loss

Target Spikes 12% As Digital Sales Drive Blowout Quarter

Jack Henry Shares Dip On Lower FY21 Guidance