Macerich announced that it has sold its Paradise Valley Mall, a non-core shopping center asset in Phoenix for $100 million to a joint venture between RED Development and its affiliates. The company added that it finalized the transaction on March 29.

Macerich’s (MAC) Paradise Valley Mall is a 92-acre site that the newly formed joint venture intends to convert into a community of multi-family residences, offices, high-end grocery, restaurants, and retail shops.

The US mall owner revealed that it has retained 5% interest in the newly formed joint venture. The transaction has generated net proceeds of $95 million to the real estate investment trust (REIT) company.

As per the terms of the joint venture deal, the site will cover approximately 6.5 million square feet of building area. Of the total, approximately 3.25 million square feet area will be used for residential space and the remaining 3.25 million square feet for non-residential purposes such as retail shops, restaurants and offices. (See Macerich stock analysis on TipRanks)

Macerich President Ed Coppola said, “As the retail landscape continues to evolve here in Arizona and around the country, our decision to realize the market value of this non-core asset makes sense for Macerich.” He further added “Our focus remains on Macerich’s top-tier, market-dominant properties that will continue to benefit from the industry’s increasing momentum toward high-quality destinations.”

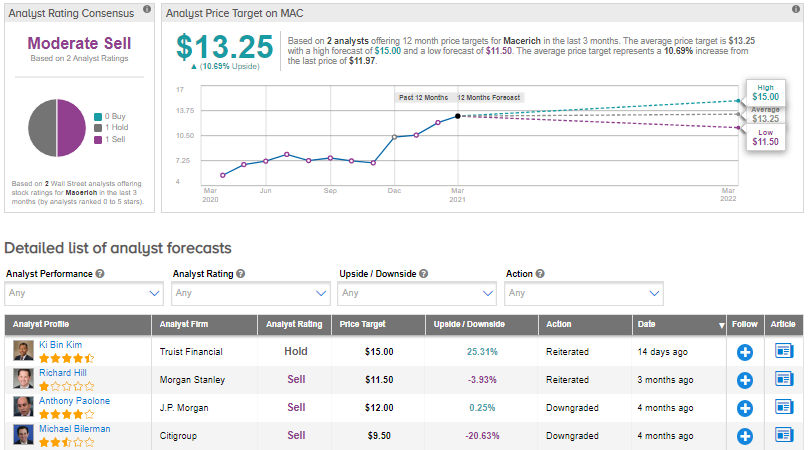

On March 22, Truist Financial analyst Ki Bin Kim raised the stock’s price target to $15 (25.3% upside potential) from $14 and reiterated a Hold rating. Kim’s upbeat price target for Macerich is a part of his broader research on REITs. The analyst raised his estimates based on the industry’s latest quarterly performance along with recent events, revenue growth and expenses assumptions.

Overall, the rest of the Street has a Moderate Sell consensus rating based on 1 Hold and 1 Sell. The average analyst price target of $13.25 implies upside potential of about 10.7% to current levels. Shares have gained about 114.9% in one year.

Related News:

Bausch Health Sells Amoun Pharmaceuticals For $740 Million

Aytu BioPharma Sells U.S. Rights For Natesto To Acerus Pharma; Street Sees 131.5% Upside

Franklin Electric Snaps Up Puronics