Shares in Logitech International (LOGI) surged 5.8% after the tech company reported a 14% increase in quarterly sales as stay-at-home orders tied to the coronavirus pandemic boosted demand for its computer products.

The stock appreciated 5.8% to $54.07 in pre-market U.S. trading.

Total sales grew 14% to $709 million in the quarter ended March, driven by double-digit growth of its video collaboration, gaming, and creativity & productivity products. Net operating income advanced 23% to $79 million during the same comparative period. For the full 2020 fiscal year, net income increased 10% to $387 million year-on-year, exceeding the company’s latest outlook of $365 million to $375 million.

“Logitech’s products have never been more relevant,” said Logitech President and CEO Bracken Darrell. “Video conferencing, working remotely, creating and streaming content, and gaming are long-term secular trends driving our business. The pandemic hasn’t changed these trends: it has accelerated them.”

Logitech said that the demand for cloud-based video collaboration accelerated through the quarter, as more workers set up home offices, teachers adopted video for distance learning, and doctors implemented telemedicine.

“We believe this trend toward video everywhere will continue to be embraced across all room types, including home offices, and we will continue to invest in both our go-to-market capabilities and our product portfolio,” the company said.

Looking ahead, the company maintained its fiscal year 2021 outlook for mid single-digit sales growth in constant currency and for an increase in operating profit of $380 million-$400 million.

As of the end of March 2020, Logitech had cash and cash equivalents of $716 million, its highest cash balance ever, it said.

Shares in Logitech have been on a gaining streak in the past two months, surging 51% to $51.10 as of Monday in U.S. trading.

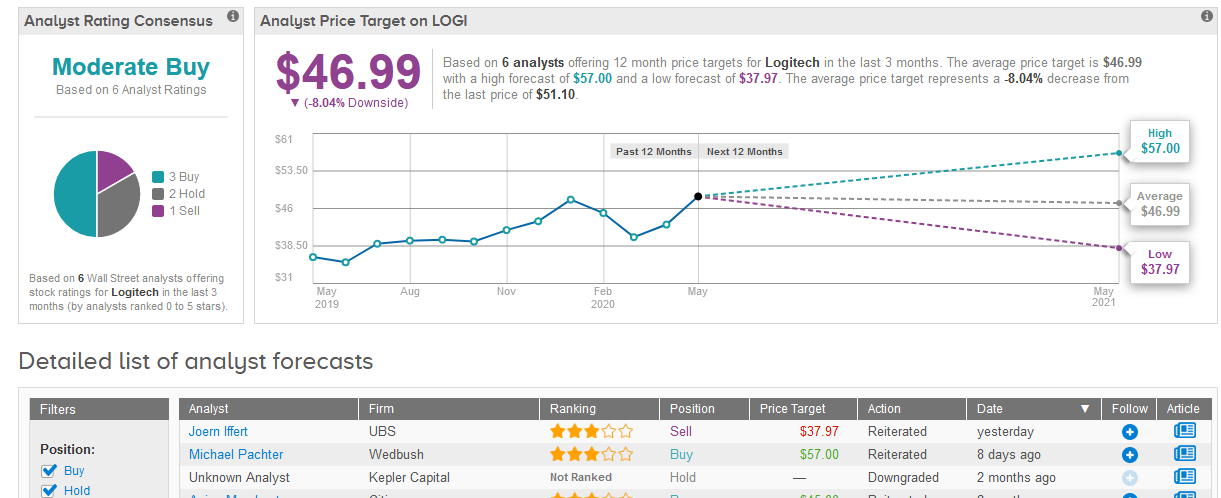

Michael Pachter, analyst at Wedbush raised the stock’s price target to $57 from $48, while sticking to a Buy rating.

“Global quarantines have driven accelerated growth in various categories, with the long – term benefit of expanding Logitech’s recurring user base,” said Pachter. “Logitech’s consistent earnings growth with investor -friendly capital allocation should support shares of LOGI near the high-end of its historical range, given the boost from quarantines and as the overhang from supply chain disruption dissipates in FQ1:21.”

The rest of Wall Street analysts are divided on the stock with 3 Buys, 2 Holds and 1 Sell, that add up to a Moderate Buy consensus rating. The $46.99 average price target is less optimistic than Wedbush, as it implies 8% downside potential in the shares in the next 12 months. (See Logitech stock analysis on TipRanks).

Related News:

Microsoft to Splash $1.5 Billion on Italy’s Cloud Business Transformation

Twitter Ramps Up Fight Against Misleading Covid-19 Information

ON Semiconductor Quarterly Earnings Miss Amid Virus Pandemic, Sees Orders Coming Back