LiveRamp Holdings reported better-than-expected 3Q results. Moreover, the data connectivity platform provider’s 4Q and fiscal 2021 revenue outlook came in ahead of the Street consensus. However, shares dropped 3.2% in Monday’s extended trading session.

LiveRamp (RAMP) reported 3Q earnings of $0.14 per share after a loss of $0.03 per share in the year-earlier period. Quarterly EPS exceeded the Street estimates of $0.07 per share as gross and operating margins improved.

Revenue grew 17% to $120 million during the reported quarter and surpassed analysts’ expectations of about $113.1 million. The company’s subscription sales, which contributed 78% to total revenue, increased 15% year-over-year. Further, marketplace & other revenue rose 27% to $26 million.

As for the fourth quarter, LiveRamp forecasted sales of $116 million, which is above analysts’ expectations of $113.2 million and reflects year-over-year growth of 10%.

For fiscal 2021, the company projects revenue of $440 million, up 16% year-over-year. Analysts were expecting fiscal 2021 revenue to come in at $430.4 million. (See LiveRamp stock analysis on TipRanks)

Separately, LiveRamp announced the acquisition of cloud data platform, DataFleets. The company said, “This acquisition expands LiveRamp’s data protection capabilities to unlock greater data access and control for its customers. In addition, the deal opens up new use cases as well as new markets for distributed data collaboration through LiveRamp Safe Haven.”

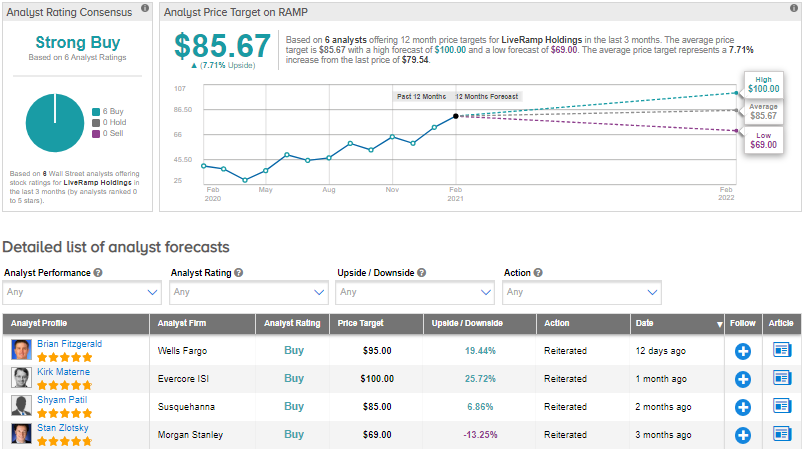

On Jan. 28, Wells Fargo analyst Brian Fitzgerald raised the stock’s price target to $95 (19.4% upside potential) from $87 and maintained a Buy rating.

In a note to investors, Fitzgerald said that he expects internet stocks like LiveRamp to deliver strong performance in 2021 as well, on the back of improving economic fundamentals, led by broadening vaccine distribution, gradual ease of quarantine restrictions, and a likely third dose of stimulus in the US.

Overall, the Street has a firmly bullish outlook on the stock, with a Strong Buy consensus rating based on 6 unanimous Buys. The average analyst price target of $85.67 implies upside potential of about 7.7% to current levels. Shares have gained about 94.7% over the past year.

Related News:

Peloton’s 2Q Results Top Estimates But Delivery Delays Push Shares Down

Illinois Tool’s ‘Record’ Operating Margin Drives 4Q Profit Beat

Linde’s 1Q Profit Outlook Tops Estimates After 4Q Beat; Shares Gain