Johnson & Johnson announced Tuesday that the European Commission (EC) has approved an extended use of imbruvica (ibrutinib) in combination with rituximab for the treatment of adult patients with chronic lymphocytic leukaemia (CLL).

J&J (JNJ) said that the EC decision is based on data from the Phase 3 E1912 study that showed previously untreated patients aged 70 years or younger treated with ibrutinib plus rituximab lived longer without disease progression than those treated with chemo-immunotherapy regimen fludarabine, cyclophosphamide and rituximab (FCR). The study was designed and conducted in the US by the ECOG-ACRIN Cancer Research Group (ECOG-ACRIN) and sponsored by the National Cancer Institute (NCI), which is part of the US National Institutes of Health.

“We are delighted with the EC’s decision approving the use of ibrutinib in combination with rituximab for these patients,” said J&J’s Patrick Laroche. “This new non-chemotherapy combination regimen can offer extended remission, as well as fewer chemotherapy-related side effects for patients living with CLL.”

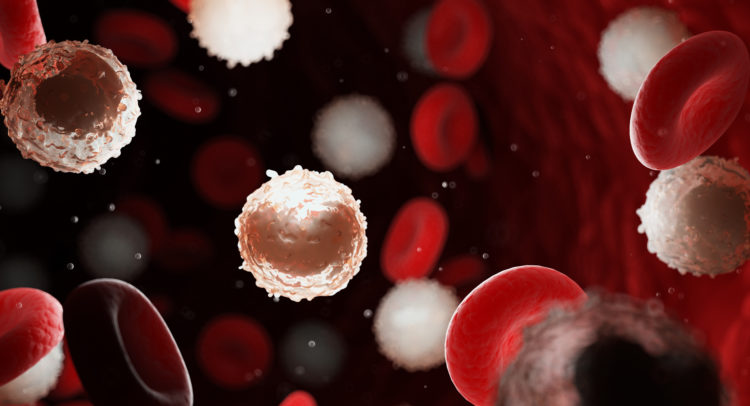

CLL is a slow-growing blood cancer of white blood cells. The overall incidence of CLL in Europe is approximately 4.92 cases per 100,000 persons per year and is about 1.5 times more common in men than in women. CLL is predominantly a disease of the elderly, with a median age of 72 years at diagnosis.

The study evaluated 529 previously untreated patients with CLL aged 70 years or younger (median age, 58 years) who were randomly assigned to receive six cycles of ibrutinib plus rituximab, followed by ibrutinib until disease progression or unacceptable toxicity, or six cycles of FCR.

At a median follow-up of 37 months, patients treated with ibrutinib plus rituximab lived longer without disease progression, with a progression-free survival (PFS) rate of 88%, compared to 75% for patients treated with FCR. The study also showed an overall survival (OS) advantage for patients treated with the ibrutinib-based therapy.

JNJ shares have fully recovered since plunging to a multi-year low in March and are now trading 1.9% higher than at the start of year. (See JNJ stock analysis on TipRanks).

Credit Suisse analyst Matt Miksic recently reiterated a Buy rating on the stock with a $163 price target, saying that intra-quarter analysis of JNJ’s US pharma business for July appears to be tracking roughly in-line with his estimates for Q3.

“JNJ’s Pharma franchises are less affected by COVID-19 than device businesses, which are more directly tied to elective procedures, making the stock attractive for investors concerned about the potential resurgence of COVID-19 infections and the potential corresponding impact on elective surgery trends,” Miksic wrote in a note to investors.

Overall, the rest of the Street shares Miksic’s bullish outlook on the stock. The Strong Buy analyst consensus boasts 7 unanimous Buy ratings. That’s with a $166.86 average price target indicating upside potential of 12% in the coming 12 months.

Related News:

Morgan Stanley Turns Bullish On Eli Lilly, Lifts PT

Australia Signs $1.2B Covid-19 Vaccine Deals With AstraZeneca, CSL

Is Trevena Stock a Buy Right Now? This Is What You Need to Know