Honeywell International Inc. (HON) has created a new unmanned aerial systems (UAS) unit as it sees growth opportunities in the urban air mobility and drones market.

The provider of aerospace products and services said the new unit will use the company’s engineering resources and know-how to transform urban air taxis, drone delivery of parcels and all forms of autonomous flight.

The products the unit will be working on, include a “fly-by-wire” autopilot system that automatically ensures aircraft stability even if the pilot is “hands off” for extended periods of time and artificial intelligence software that tracks landing zones for precise vertical landings every time.

The UAS unit will also act as a systems integrator for all Honeywell products and services that could be used in this industry. These offerings include aircraft systems such as avionics, electric and hybrid-electric propulsion and thermal management, flight services such as unmanned air traffic management, and ground operations services such as predictive aircraft maintenance analytics.

“Urban Air Mobility and Unmanned Aerial Systems will play an increasing role in the future of aerospace, with potential applications in all-electric urban air taxi vehicles, hybrid-electric unmanned cargo drones, optionally piloted airplanes, delivery drones and everything in between,” said Honeywell Aerospace president and CEO Mike Madsen. “Honeywell has already contributed many technological advancements to these markets, and is well positioned to continue growing our portfolio to meet customer needs and help shape the future of autonomous aviation and urban transport.”

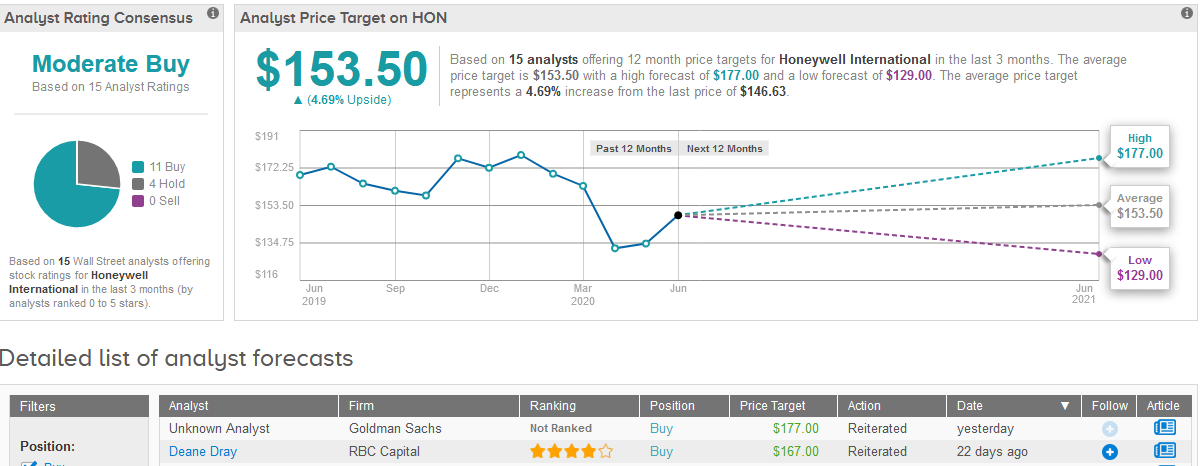

Shares in Honeywell rose 1.5% to $146.63 on Monday. The stock has recouped some of this year’s earlier losses but is still trading 17% lower than at the start of 2020.

Five-star analyst Gautam Khanna at Cowen & Co last month maintained a Buy rating on the stock with a $145 price target, saying that the company is well positioned with a strong balance sheet and management team to confront a “severe cyclical decline in core franchises”.

“Q2 is apt to be a “throw away” Q as EPS troughs (peak restructuring expenses & trough demand/de-stock), so it may take a few Qs for investors to gain conviction in where numbers will shake out when the smoke clears,” Khanna wrote in a note to investors.

The rest of Wall Street analysts are cautiously optimistic on Honeywell’s stock. The Moderate Buy analyst consensus shows 11 Buy ratings versus 4 Hold ratings. Meanwhile, the $153.50 average price target forecasts shares will rise 4.7% in the coming 12 months. (See Honeywell stock analysis on TipRanks).

Related News:

Global Airlines Are Set To Lose $84.3 Billion In 2020, IATA Says

United Airlines Secures $5 Billion Loan To Shore Up $17 Billion Liquidity Chest

Airbus Gets No New Aircraft Orders In May Amid Aviation Crisis