The pandemic restricted people to their homes and many made the best of this opportunity by remodeling their homes and taking up pending home improvement projects. The recent blockbuster results of home improvement retailers Home Depot and Lowe’s clearly indicated the shift in consumers’ discretionary spending from apparel buying and restaurant dining to home goods.

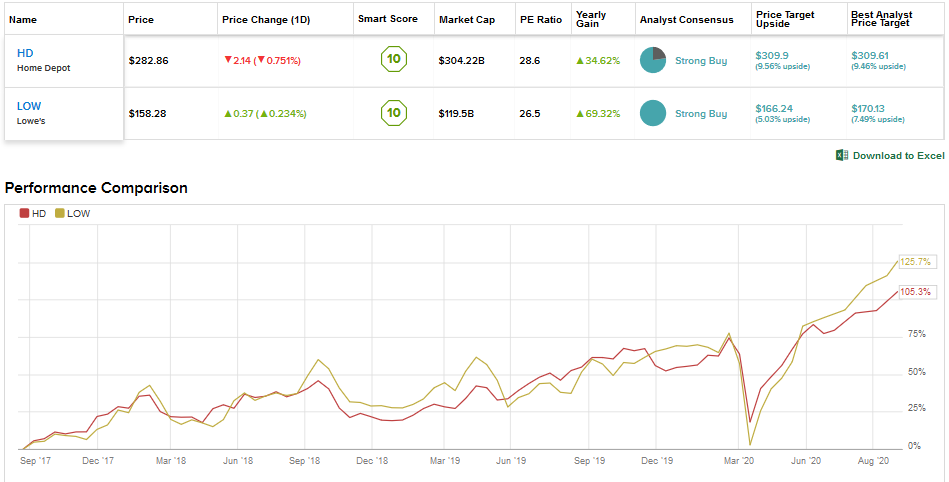

Using the TipRanks’ Stock Comparison tool, we will place the two home retailers alongside each other to see which stock offers the most compelling investment opportunity right now.

Home Depot (HD)

Home Depot, which operates 2,293 stores, benefited immensely from the rise in demand from DIY (do-it-yourself) customers as they took up deck building, painting, and home repairs amid the pandemic. Sales to Pro customers grew double digits.

The company’s sales for the fiscal second quarter (ended August 2) rose 23.4% to $38.1 billion as overall comparable sales or comps surged 23.4% with US comps growing 25%. Notably, 13 of the company’s 14 merchandising departments generated double-digit comps while the kitchen and bath department comps increased by high single-digit.

Strong sales drove a 26.8% growth in the EPS to $4.02, even as the company incurred $480 million in additional expenses amid the pandemic.

Strength in several big-ticket categories, like, appliances, riding lawnmowers and Patio Furniture, was partially offset by softer sales in certain indoor installation categories, like special-order kitchens and countertops.

Home Depot says it will continue to enhance its online channel. Sales through digital platforms surged about 100% in the second quarter supported by facilities like buy online and pick up in-store.

The company now plans to open three new distribution centers in Georgia over the next 18 months to facilitate flexible delivery and pick-up options for Pro and DIY customers.

Home Depot indicated that the momentum in comparable sales growth in the first two weeks of August was at levels similar to the second quarter. The company expects increasing demand from Pro customers as markets continue to reopen.

On August 19, Merrill Lynch analyst Elizabeth Suzuki upgraded Home Depot to Buy from Hold and said that it is not too late to buy the stock. Suzuki raised the price target to $330 from $290.

“Although home improvement spending in the coming quarter may decelerate amidst sequentially declining government stimulus/unemployment benefits, we believe that the longer-term tailwinds for the home improvement industry are generally favorable,” the analyst opined. (See HD’s stock analysis on TipRanks)

Home Depot stock has risen 29.5% year-to-date and an average 12-month price target of $309.90 reflects further upside of 9.56%. The Strong Buy consensus for Home Depot stock is based on 17 Buys and 5 Holds.

Lowe’s (LOW)

Like its larger peer Home Depot, Lowe’s also experienced impressive sales growth in the fiscal second quarter, in fact at an even higher rate. Lowe’s sales grew 30.1% Y/Y to $27.3 billion. Overall comps rose 34.2% with US comps growth coming at 35.1%. Online penetration grew to 8% of the top line with sales through Lowes.com rising 135%.

Lowe’s experienced an unprecedented growth of 20% across all its merchandise categories as customers spent more time at their homes due to the pandemic and focused on enhancing their homes, creating work and study space, and repair and maintenance projects. Pro comps growth in the second quarter was in the mid-20s but was outpaced by DIY comps.

Lowe’s second-quarter adjusted EPS grew by an impressive 74.4% Y/Y to $3.75. Higher sales and margin expansion drove the bottom-line growth. Lowe’s, which operates 1,968 stores, incurred $460 million in COVID-19 related expenses, including incremental wages in the second quarter.

To address the spike in demand for home improvement goods and boost its sales, Lowe’s plans to enhance its product offerings, simplify its stores and provide better services. The company is also investing in supply chain infrastructure and prioritizing omnichannel capabilities.

Indeed, LOW plans to open 50 cross-dock delivery terminals, seven bulk distribution centers and four e-commerce fulfillment centers over the next 18 months.

Lowe’s has a smaller exposure to Pro customers compared to Home Depot. The company intends to deepen its relationship with Pro customers through several initiatives, including the multi-year nationwide roll-out of a tool rental program. (See LOW stock analysis on TipRanks)

Lowe’s did not provide any specific guidance due to the uncertain business environment but stated that the sales trends in July continued in August with strength across DIY and Pro customers.

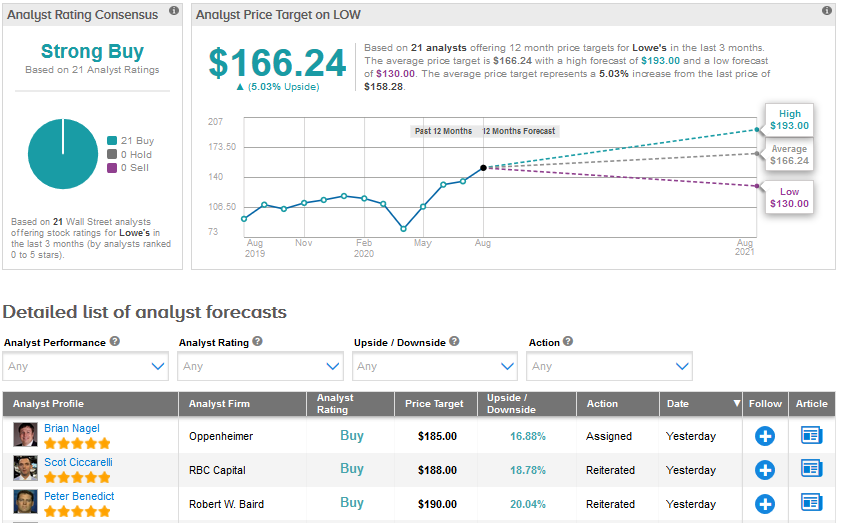

Oppenheimer analyst Brian Nagel reiterated his Buy rating for Lowe’s and raised the price target to $185 from $150.

Nagel said, “For a while, we have highlighted Lowe’s as one of the most compelling larger cap names in our expansive coverage universe, owing to a favorable industry backdrop, limited price competition, and the efforts of new senior leadership to improve performance and ultimately narrow a long-standing operating gap between LOW and Home Depot (HD).”

Following the results, all 21 analysts covering Lowe’s stock have a Buy rating, implying a unanimous Strong Buy consensus. Lowe’s stock has advanced 32% so far this year. An average price target of $166.24 reflects an upside of 5.03% over the next 12-months.

Choosing between two good retailers

Both Home Depot and Lowe’s have proved their strength through their latest results. Unlike several companies who suspended dividend payments, both Home Depot and Lowe’s continued to reward investors with dividends amid the crisis.

Analysts expect continued strength in the home category to benefit these companies. But with the entire Street bullish on Lowe’s, it looks to be a better buy currently. Moreover, Lowe’s is trading at a lower valuation compared to Home Depot.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment