Home Depot topped Street estimates for quarterly sales as the DIY and repair supply retailer benefited from an increase in home renovations while consumers were stranded indoors during the coronavirus pandemic.

Home Depot’s (HD) net sales in the second quarter jumped 23.4% to $38.1 billion year-on-year, beating analysts’ expectations of $34.53 billion. US comparable sales rose 25% during the period. In addition, net income increased 24.5% to $4.33 billion, or $4.02 per share. Analysts had estimated a profit of $3.71 per share.

“The investments we have made across the business have significantly increased our agility, allowing us to respond quickly to changes while continuing to promote a safe operating environment. This enhanced our team’s ability to work cross-functionally to better serve our customers and deliver record-breaking sales in the quarter,” said Home Depot CEO Craig Menear. “We remain focused on continuing the momentum of our One Home Depot investment strategy that we believe will position us for continued growth over the long-term, while at the same time maintaining flexibility to navigate the demands of the current environment.”

To meet demand during the coronavirus pandemic, Home Depot in the reported quarter invested about $480 million in additional benefits for employees, including weekly bonuses for hourly workers in stores and distribution centers. Year-to-date, the company has spent about $1.3 billion on enhanced pay and benefits in response to COVID-19.

Home Depot employs more than 400,000 workers. As of the end of the second quarter, it operated a total of 2,293 retail stores in 50 US states, the District of Columbia, Puerto Rico, the US Virgin Islands, Guam, 10 Canadian provinces and Mexico.

Furthermore, the DIY retailer announced that its board of directors declared a second quarter cash dividend of $1.50 per share. The dividend is payable on Sept. 17 to shareholders of record on the close of business on Sept. 3. This is the 134th consecutive quarter the company has paid a cash dividend.

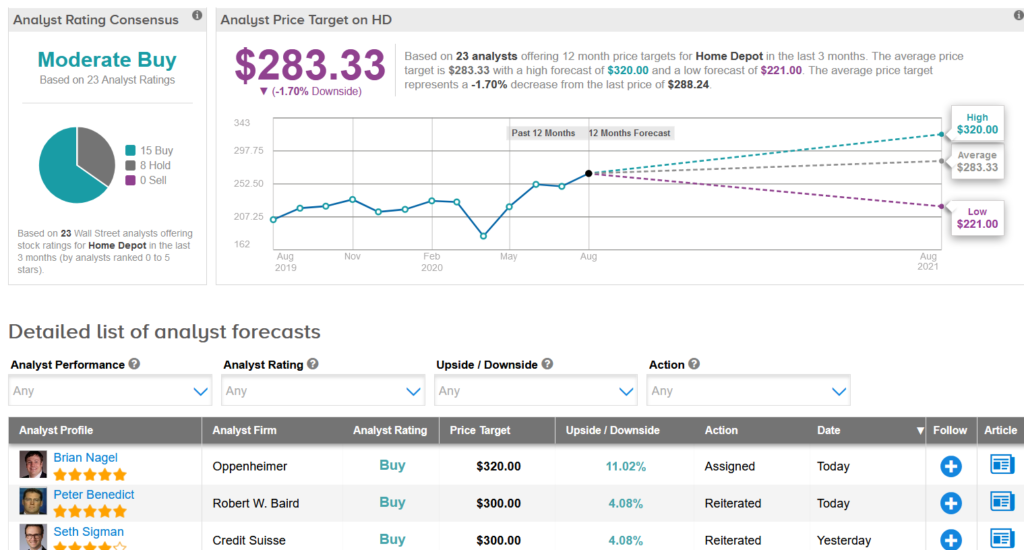

Shares are gaining 1% to $291 in the pre-market session after advancing 2.7% ahead of today’s earnings on Monday. With the stock up 32% so far this year, the $283.33 average analyst price target, implies 1.7% downside potential to current levels.

Oppenheimer analyst Brian Nagel reiterated a Buy rating on the stock with a $320 price target, calling the 2Q performance “outstanding”.

“For a long while, we have highlighted Home Depot as one of the best run retailers in the US, if not the world,” Nagel wrote in a note to investors. “Early in the COVID-19 crisis, we identified HD and home improvement retail as clear winners through and beyond the pandemic.”

Wells Fargo analyst Zachary Fadem said he expects HD’s record share price to move higher today as the 2Q results exceeded the high bar of expectations.

“We view sustainability of strong Q2 trends the largest needle-mover for shares going forward, and considering recent improvement in leading housing metrics (turnover, etc.), de-urbanization, an extended stay-at home lifestyle and lingering government stimulus benefits, we see ample levers supporting continued upside into 2H20,” Fadem wrote in a note. The analyst maintained a Buy rating.

Overall, the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is divided between 15 Buy and 8 Hold ratings. (See HD stock analysis on TipRanks)

Related News:

Walmart Delivers Earnings Triumph; E-Commerce Sales Double

Apple TV+ Unveils First Bundle With CBS All Access and Showtime

Amazon Said To Be In Talks To Invest In Cloud Company Rackspace