Shares of JD.com (JD) gained 2.5% at the time of writing after the e-commerce company reported decent results for the third quarter of 2021 on the back of strong demand for online shopping.

Adjusted earnings per share (EPS) during the quarter stood at RMB3.16 ($0.49), down 7.6% from the same quarter last year. Net revenues increased 25.5% year-on-year to RMB218.7 billion ($33.9 billion).

This growth can be attributed to a 22.9% rise in net product revenues, which contributed 86.9% to the total revenues. Net service revenues increased 43.3% to RMB32.7 billion ($5.1 billion).

The company’s annual active customer accounts climbed to 552.2 million in the twelve months ended September 30, 2021, from 441.6 million in the twelve months ended September 30, 2020. (See JD.com stock charts on TipRanks)

JD.com incurred research and development expenses worth RMB4 billion ($0.6 billion), compared to RMB4.1 billion in the year-ago quarter. Also, fulfillment expenses, which primarily include procurement, warehousing, delivery, customer service and payment processing expenses, increased 23.2% to RMB14.3 billion ($2.2 billion).

The Chief Financial Officer of JD.com, Sandy Xu, said, “We were also pleased to see our key strategic initiatives including the third-party marketplace and omni-channel strategies begin to generate positive results. Going forward, we will continue to focus on building high-quality businesses and investing in technologies and core capabilities to ensure JD’s sustainable growth in the long term.”

See Top Smart Score Stocks on TipRanks >>

Stock Rating

Overall, the Street is bullish on the stock and has a Strong Buy consensus rating based on 12 unanimous Buys. The average JD.com price target of $101.75 implies upside potential of about 22.4% from current levels.

Website Traffic

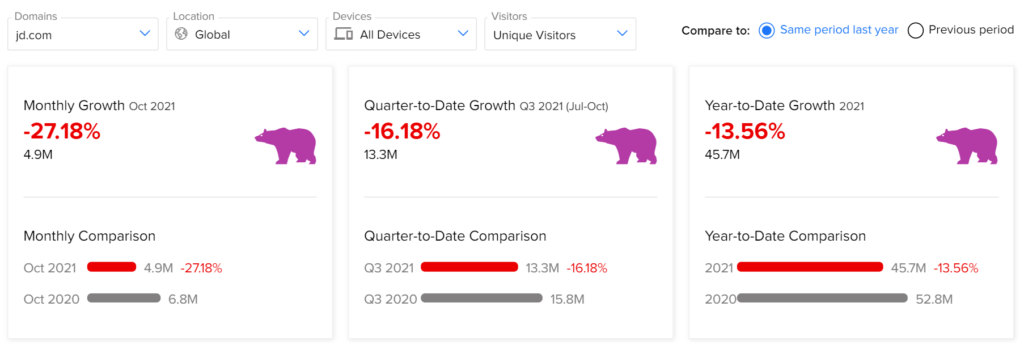

TipRanks’ Website Traffic tool, which uses data from SEMrush Holdings (SEMR), the world’s biggest website usage monitoring service, offers insight into JD.com’s performance.

According to the tool, compared to the previous year, the JD.com website recorded a 27.2% monthly decrease in global unique visits in October. Meanwhile, year-to-date website traffic growth has declined 13.6% against the same period last year.

Related News:

Baidu Slips 5.5% as Q3 Revenues Miss Expectations

nCino to Acquire SimpleNexus for $1.2B

AbbVie’s Gets EC Approval for SKYRIZI