Hewlett Packard Enterprise (HPE) has entered into an agreement to acquire Silver Peak, a software-defined wide area network (SD-WAN) company, to boost its edge-to-cloud solutions, in a deal valued at $925 million.

Shares rose 2.7% to $9.50 in early afternoon trading. As part of the transaction, Silver Peak will be combined with HPE’s Aruba business unit to further accelerate the adoption of transformational technologies in the large and fast-growing SD-WAN space. HPE expects the combination to drive “significant” revenue opportunities and to be accretive to Intelligent Edge segment revenue growth and gross margin.

The company estimates that the transaction, which is set to close in the fourth quarter of HPE’s fiscal year 2020, to be neutral to non-GAAP EPS in FY22.

The need for secure work-from-home experiences triggered by the coronavirus pandemic has generated massive growth in connected devices and cloud requirements, which in turn is accelerating demand for complementary SD-WAN solutions, HPE said.

“HPE was an early mover in identifying the opportunity at the edge and that trend is accelerating in a post-COVID world,” said HPE CEO Antonio Neri. “With this acquisition we are accelerating our edge-to-cloud strategy to provide a true distributed cloud model and cloud experience for all apps and data wherever they live. Silver Peak’s innovative team and technology bring critical capabilities that will help our customers modernize and transform their networks to securely connect any edge to any cloud.”

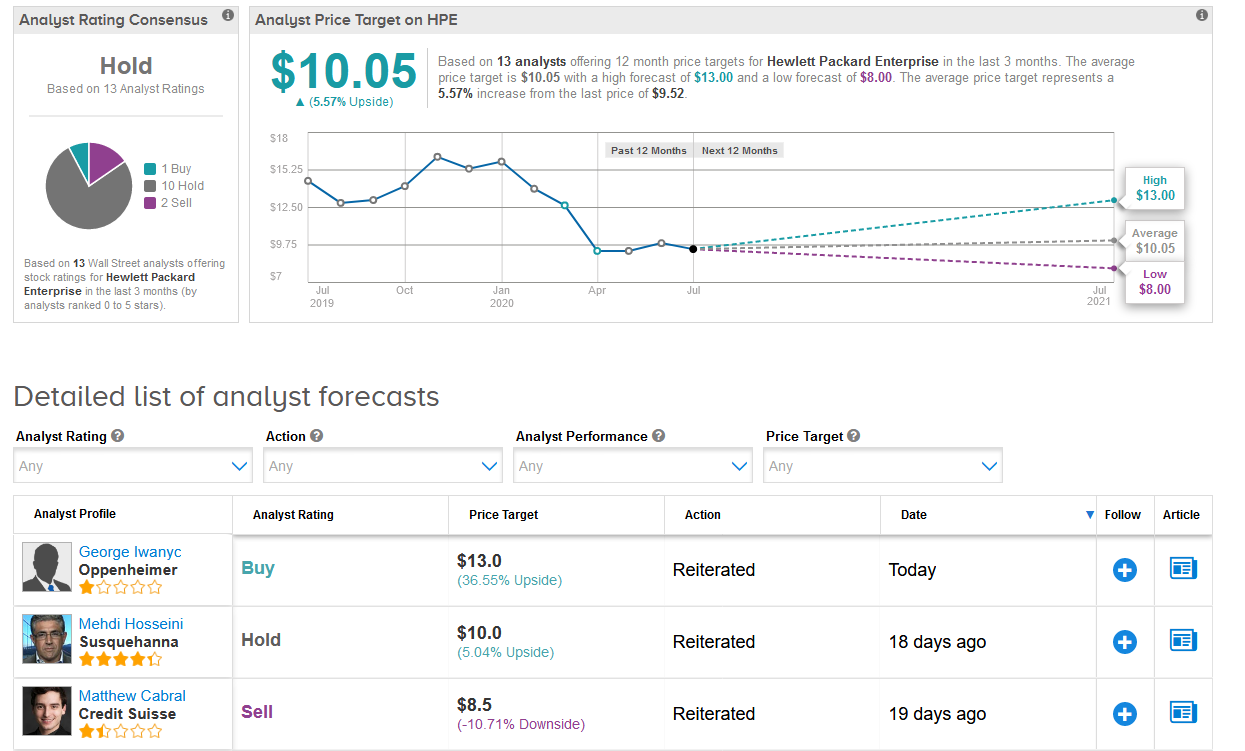

Oppenheimer analyst George Iwanyc on Monday reiterated a Buy rating on the stock with a $13 price target (36% upside potential), saying that the acquisition is “positive”.

“Silver Peak’s differentiated and reliable technology strengthens HPE Aruba’s portfolio, make cross-selling opportunities more likely, and accelerates its transition to higher-margin subscription revenues,” Iwanyc wrote in a note to investors.

With HPE shares down 40%, the rest of the Street currently has a cautious outlook on HPE’s stock. The Hold analyst consensus breaks down into 10 Hold ratings and 2 Sell ratings versus Iwanyc’s Buy rating. The $10.05 average analyst price target implies 5.6% upside potential in the shares over the coming year. (See HPE stock analysis on TipRanks)

Related News:

Google To Invest $10 Billion For Digital Push In India

Qualcomm Buys Stake In Reliance’s Jio For $97.1M To Support 5G Rollout In India

Google Stops Project For Cloud Services In China