Shares in debt-strapped Hertz Global Holdings (HTZ) dropped 7% in pre-market trading after the car rental company suspended a planned $500 million share offering.

The stock sank to $1.86 in pre-market trading. Bankrupt Hertz said it withdrew the offering until further notice after the U.S. Securities and Exchange Commission (SEC) said that it has put its share prospectus under review.

“After discussions with the [SEC] Staff, sales under the Program were promptly suspended pending further understanding of the nature and timing of the Staff’s review,” Hertz said in a SEC filing.

The share offering was announced after a bankruptcy judge last Friday approved the car rental company’s request to sell up to $1 billion of common stock to take advantage of its recent share rally. Since Hertz filed for bankruptcy at the end of last month, the stock has surged from a low of 56 cents on May 26 to a high of $5.53 on June 8.

At the same time though, Hertz had warned investors that there was a significant risk that shareholders won’t receive recovery under the Chapter 11 proceedings and that its “common stock will be worthless”.

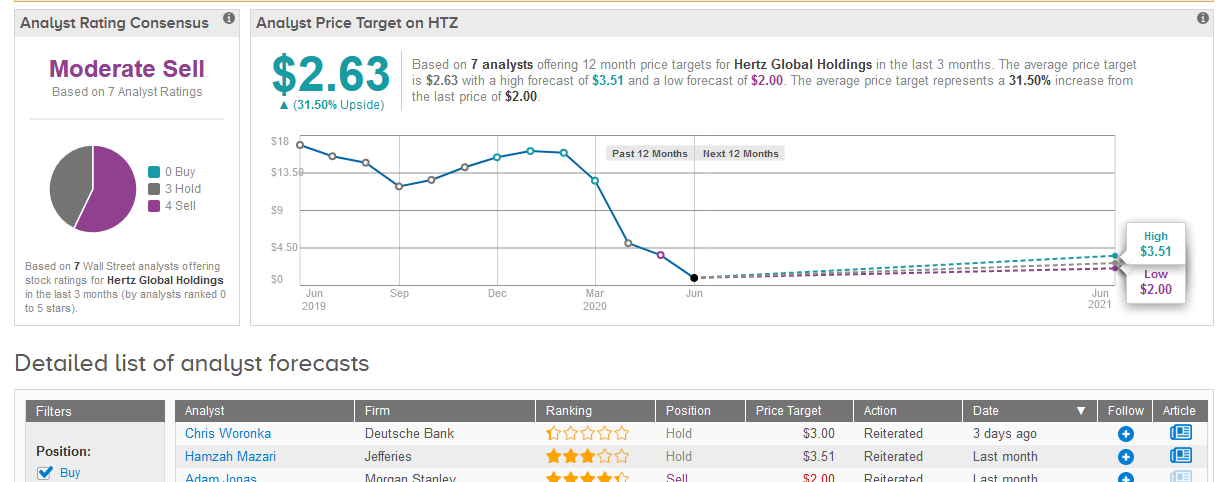

The stock has been hit hard plunging 87% this year. The troubled car rental company has a bearish Moderate Sell consensus from the Street with 3 Hold ratings and 4 Sell ratings.

Deutsche Bank analyst Chris Woronka has a Hold rating on the stock with a $3 price target, saying that a lot of uncertainty remains about how Hertz will continue its operations.

“At some point the company will need to ‘turn over’ its existing fleet and purchase new vehicles as replacements in order to offer customers a competitive product,” Woronka wrote in a note to investors. “It’s unclear to us whether HTZ will have ample liquidity (or borrowing power) with which to fund new fleet purchases, particularly since the existing fleet will have moved further down the depreciation curve relative to where a fleet on a “normal” replacement cycle would be at that time.”

Meanwhile, the average analyst price target stands at $2.63, implying 32% upside potential in the shares over the coming year. (See Hertz stock analysis on TipRanks).

Related News:

Bankrupt Hertz Tanks 24% Amid Plans To Sell $500 Million In New Shares

Bankrupt Hertz Pops 51% In Pre-Market On $1 Billion Share Sale Plan

Chesapeake Energy To File For Bankruptcy, Potentially This Week- Report