Alphabet Inc’s Google (GOOGL) announced on Wednesday that it signed an agreement to acquire a 7.7% stake in Reliance Industries’ digital unit Jio Platforms Ltd. for $4.5 billion to enter India’s promising internet market.

The investment by the California-based search giant values Jio Platforms at an equity value of 4.36 trillion rupees ($58.01 billion). Jio Platforms, a majority-owned subsidiary of Reliance Industries, is a next-generation technology platform focused on providing affordable digital services across India, and has more than 388 million subscribers.

“Reliance Industries, and Jio Platforms in particular, deserve a good deal of credit for India’s digital transformation. The pace and scale of digital transformation in India is hugely inspiring for us and reinforces our view that building products for India first helps us build better products for users everywhere,” Google CEO Sundar Pichai said. “Our joint collaboration will focus on increasing access for hundreds of millions of Indians who don’t currently own a smartphone while improving the mobile experience for all.”

Google and Jio have also entered into a commercial agreement to jointly develop an entry level affordable smartphone with optimizations to the Android operating system and the Play Store, the companies said in a statement.

India’s Jio has in recent months attracted investments from a string of large corporates, including Silverlake, Facebook, and Qualcomm Inc. (QCOM). Google’s acquisition takes the total investments into Jio by financial and strategic investors to 1.52 trillion rupees ($20.22 billion).

The search giant’s acquisition comes just days after announcing that it will commit $10 billion for investments into India over the next 5-7 years through a mix of equity investments, partnerships, and operational, infrastructure investments.

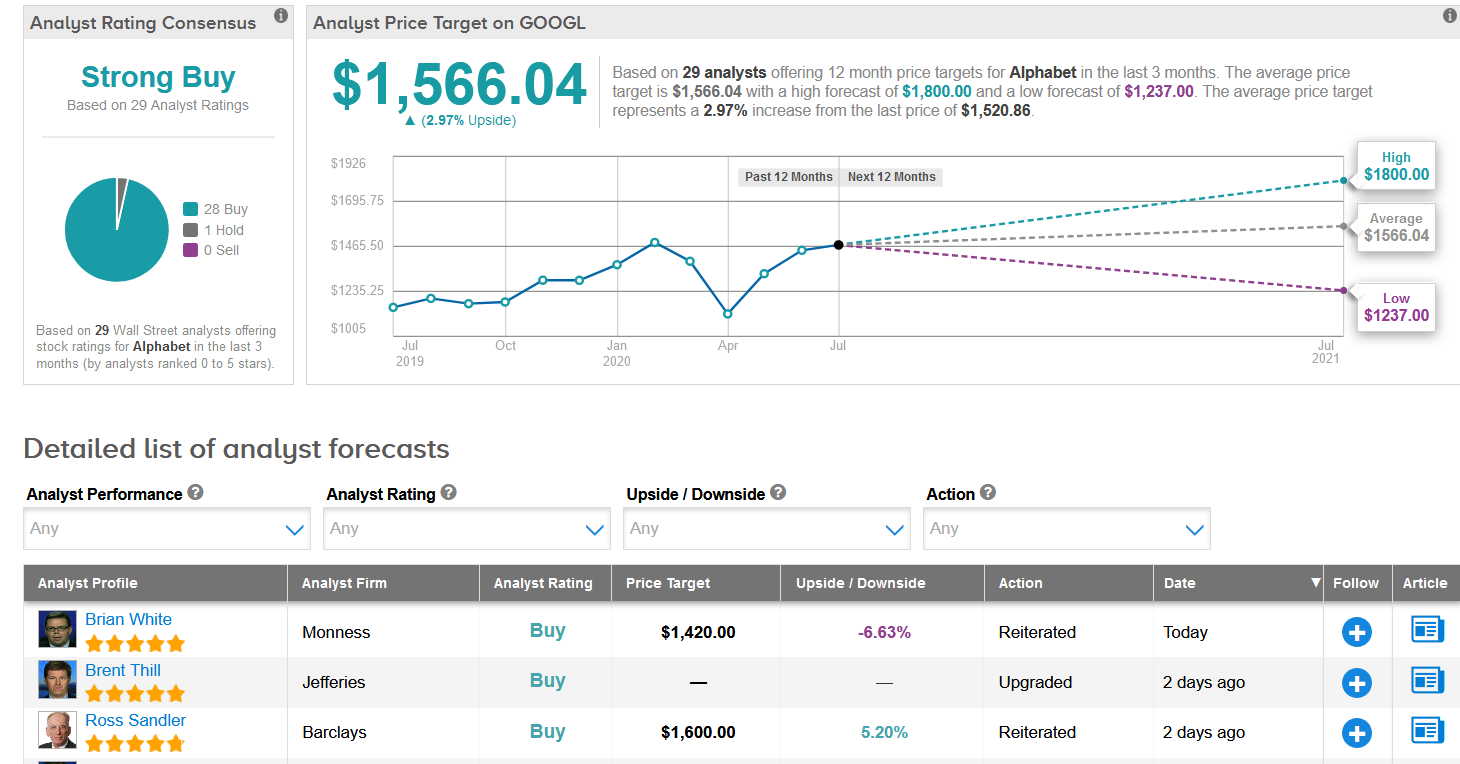

Shares in Google have fully recovered since dropping to a low in March and are now trading 14% higher than at the start of the year. Indeed following the rally, the stock’s upside potential now looks more limited. The average analyst price target of $1,566.04 indicates shares will advance a modest 3% over the coming year. (See Alphabet’s stock analysis on TipRanks)

Meanwhile, five-star analyst Brian White at Monness projects some downside potential in the shares amid expectations that Alphabet’s earnings will be depressed in the coming quarters and revenue growth will be well below historical trends due to the impact of the coronavirus pandemic.

“For the foreseeable future, we anticipate Alphabet will struggle with weak digital ad spending trends and other headwinds…including uncertainty over the impact of recent ad boycotts and anti-trust investigations,” White wrote in a note to investors. “However, we believe the stock remains inexpensive and represents a core holding as this crisis accelerates the digital transformation trend.”

White has a Buy rating on the stock with a $1,420 price target (6.6% downside potential)

Overall, the Wall Street rating outlook for Google remains bullish. The Strong Buy analyst consensus boasts 28 Buys versus 1 Hold.

Related News:

Comcast’s NBCUniversal Rolls Out Peacock Streaming Service

Microsoft To Spin-Off Xiaoice, China’s Teenage Chatbot

Google In Talks To Buy $4B Stake In India’s Jio Platform – Report