Alphabet Inc.’s (GOOGL) Google has announced that it is expanding its subscription service known as Play Pass to nine new countries this week.

The Android service, which offers hundreds of free games and apps, will soon be available in Australia, Canada, France, Germany, Ireland, Italy, New Zealand, Spain, and the UK. Last September, the service launched to Android users in the U.S. at $4.99 per month offering access to over 350 games and apps which were all ad-free and without any in-app purchases.

In a July 14 press release, Google stated that since the service was launched, they’ve “added over 150 new titles—from racing games to drawing apps—to the Play Pass catalog, and are continuing to add new content every month.”

Additionally, Play Pass will have a new annual subscription option for $29.99 in the U.S. By comparison, Apple’s (AAPL) game subscription service known as Apple Arcade goes for $49.99 per year and offers only video games.

Consumers spent an estimated $23.4 billion worldwide in Q1 2020- the largest ever quarter, according to data from App Annie. The App Store yielded $15 billion and Google Play reaped $8.3 billion. Both amounts were an increase of 5% year-over-year on their respective platforms with Google Play up nearly 25% year-over-year with nearly 10 billion game-related downloads. The Q1 increase has been largely attributed to COVID-19 lockdowns.

On July 14, Google CEO Sundar Pichai highlighted the impact of the pandemic during an online Google Cloud conference keynote speech saying that the company plans to use Google Cloud more to accommodate people as they operate from home.

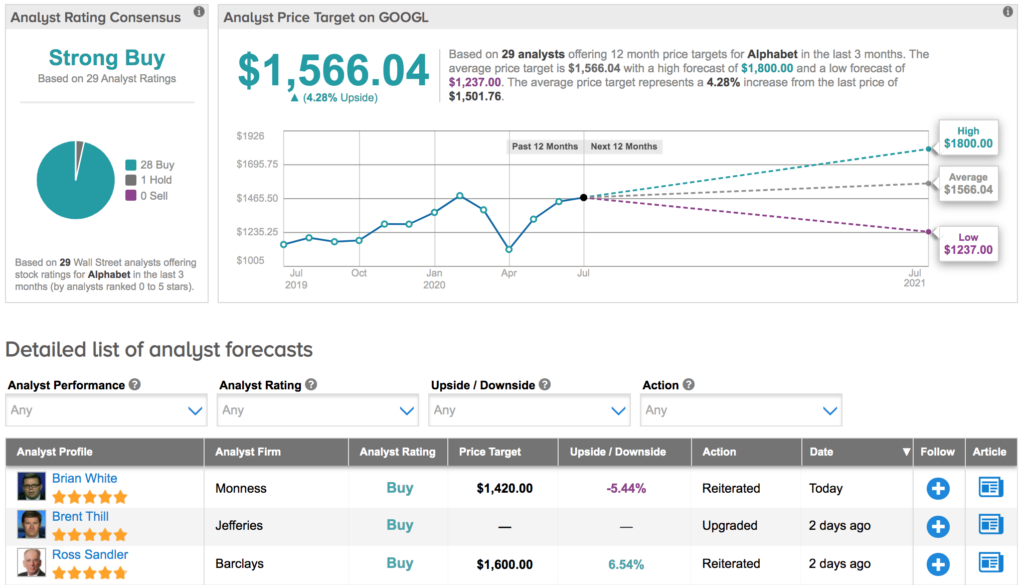

Monness analyst Brian White commented on the keynote on July 15, saying that he expects “Alphabet will struggle with weak digital ad spending and other headwinds in the near term.” He added, “We remain optimistic around trends at Google Cloud and yesterday’s event highlighted the growing success of this business.” He reiterated a Buy rating on Alphabet’s stock and a price target of $1,420 implying downside potential of 5%.

Overall, 28 analysts assign Buy ratings, 1 Hold rating, and no Sell ratings, giving GOOGL a Strong Buy Street consensus. The average analyst price target stands at $1,566.04 suggesting 4% upside potential, with shares already up 12% year-to-date. (See Alphabet’s stock analysis on TipRanks).

Related News:

Google Snaps Up 7.7% Stake In India’s Jio Platform For $4.5B

Cloud Tailwinds Could Trigger Further Upside for Microsoft Stock, Says 5-Star Analyst

Microsoft Acquires CyberX to Boost Azure’s IoT Security