Alphabet Inc.’s (GOOGL) Google Cloud has formed a partnership with Orange S.A. (ORAN) to advance its IT infrastructure for cloud and edge computing.

Shares were down 1% on July 28 at $1,518.09 per share.

The tech giant will provide cloud computing and analytics to the French telecom’s global customers. In a July 28 press release, Orange stated, “Google Cloud further reinforces its presence in Europe as a significant player in the cloud sector providing advanced technologies and services across all major industries, including businesses both small and large.”

Adding the fourth largest telecom giant in Europe to its cloud computing clientele represents another recent win for the Google Cloud portfolio. On July 8, Google Cloud became Deutsche Bank’s (DB) data provider with a 10-year deal. Following this, on July 9, GOOGL forged a multi-year agreement with Renault (RNLSY) to provide the automaker with its enterprise-level services.

Alphabet CEO Sundar Pichai said, “The strength of Orange’s network, combined with Google Cloud’s platform, will help pave the way for new advanced cloud and edge computing services for the telecommunications industry in Europe.” He added, “We look forward to working together with Orange to bring new services and applications to customers and businesses alike, while also continuing to grow our support for European enterprises in their digital transformation journeys.”

The agreement will also involve the creation of an “Innovation Lab” to develop data and AI for 5G and edge computing to service B2B, Wholesale, and B2C markets. Neither company disclosed the financial terms of the deal.

Needham analyst Laura Martin said on July 7 that “Google is the dominant search engine in the U.S. and Europe with global shifts in advertising benefiting the company.” She added, “Risks to our price target include COVID-19’s impact on consumer spending and ad spending growth.” As of July 28, she maintains a Buy rating on the stock and a price target of $1,800, which implies 19% upside potential.

Likewise, MKM Partners analyst Rohit Kulkarni maintains a Buy rating on the shares while raising his price target from $1,500 to $1,700 (12% upside potential). He says that the Google Cloud platform will likely sustain annual growth of over 50%.

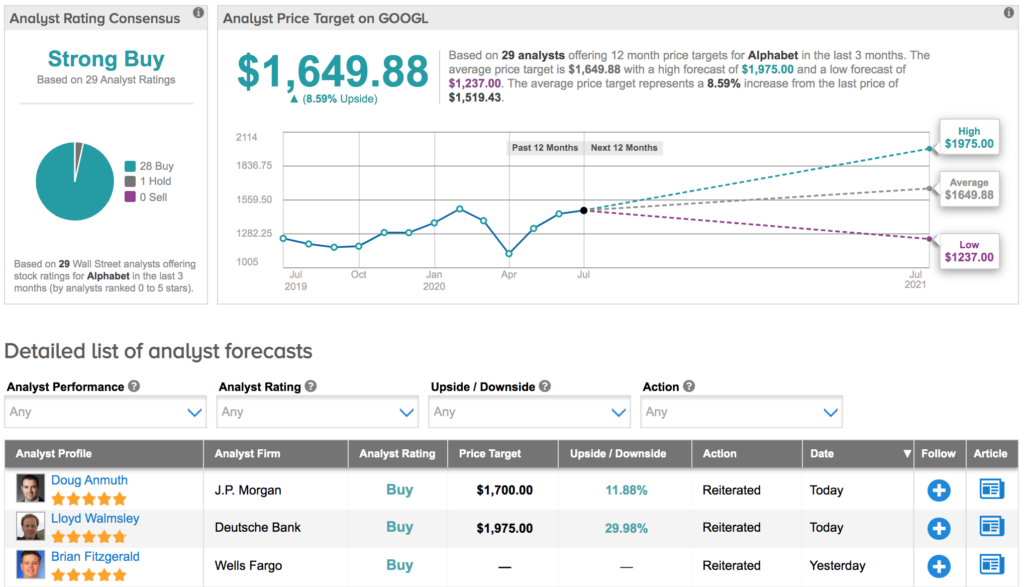

Overall, 28 analysts assign Buy ratings, 1 Hold ratings, and no Sell ratings, giving GOOGL a Strong Buy Street consensus. The average analyst price target stands at $1,649.88, suggesting 9% upside potential, with shares already up 14% year-to-date. (See Google’s stock analysis on TipRanks).

Related News:

SAP, E.ON Partner To Develop Cost-Cutting Cloud Energy Data Platform

Amazon To Create 1,000 Jobs In Ireland To Meet Cloud Services Demand

Adobe, IBM Partner On Hybrid Cloud For Banking, Healthcare Industries