The focus and resources of several biotech and pharma companies have shifted toward developing a vaccine or treatment for COVID-19. However, there are many companies in the healthcare space that have a strong product portfolio and a promising pipeline and could offer attractive investment opportunities for investors irrespective of their success in coming up with a treatment for the novel coronavirus.

We will analyze two leading pharma companies Gilead Sciences and Pfizer and use Tipranks’ Stock Comparison tool to arrive at the stock which offers a more compelling investment opportunity.

Pfizer (PFE)

Pfizer has been in the news for its COVID-19 vaccine candidate BNT162b2, which the company is developing in collaboration with BioNTech (BNTX). Last month, Pfizer and BioNTech proposed expanding the late-stage trial of BNT162b2 to include 44,000 participants, up from the originally planned 30,000 participants. The two companies reaffirmed that they expect a conclusive readout on the efficacy of the vaccine by the end of October.

Meanwhile, Pfizer is expected to complete the spin-off its Upjohn unit to Mylan in the fourth quarter. Upjohn, which sells off-patent drugs, has been a drag on Pfizer’s performance and the company is spinning off the unit to focus on higher-growth, more profitable drugs.

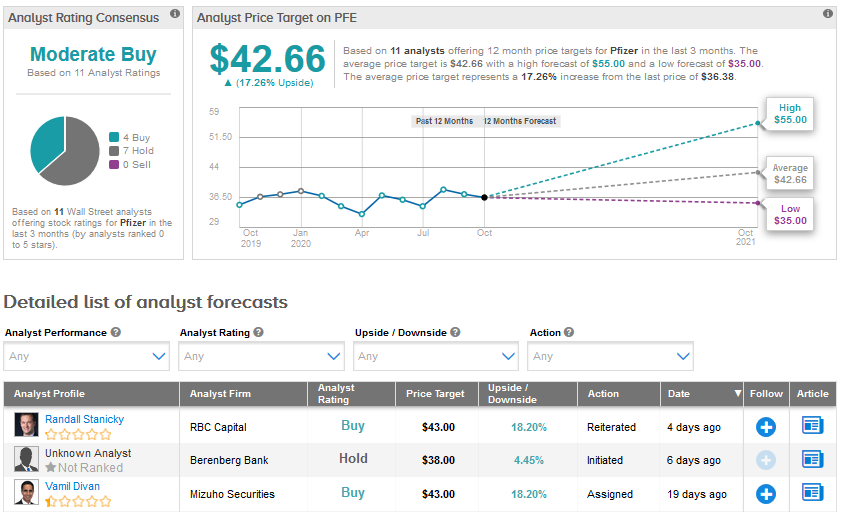

On Oct. 1, RBC Capital analyst Randall Stanicky reiterated a Buy rating for Pfizer with a price target of $43. In a research note to investors, the analyst stated, “With the announced deals to divest its Consumer and Upjohn businesses, PFE will be left with a cleaner platform in 2021 and beyond with best-in-class revenue and EPS growth through 2025. Importantly, that growth is not predicated on major pipeline contribution or acquisitions, providing solid visibility.”

The analyst added that Pfizer’s earnings base also comes with relative defensiveness and a supportable dividend of >5% in the current uncertain COVID-19 environment. (See PFE stock analysis on TipRanks)

Pfizer’s 2Q revenue fell 11% Y/Y to $11.8 billion as Upjohn’s sales declined 32% due to generic competition for Lyrica in the US. The sales decline also reflected the impact of the deconsolidation of Pfizer’s Consumer Healthcare business following the formation of a joint venture with GlaxoSmithKline in 2019.

Meanwhile Pfizer’s Biopharma unit’s 2Q revenue grew 4% despite challenging conditions. The unit’s strength lies in its blockbuster blood thinner treatment Eliquis (Pfizer co-markets Eliquis with Bristol Myers Squibb) as well as the oncology portfolio which includes metastatic breast cancer blockbuster drug Ibrance and other high-growth meds like Inlyta and Xtandi. The company’s heart drugs Vyndaqel and Vyndamax also have strong prospects.

Aside from its COVID-19 vaccine, Pfizer’s goal is to deliver five vaccines by 2025. The company’s pipeline has 89 projects spread across six therapeutic areas, including 23 in Phase 3. With a strong pipeline, the company aims to generate revenue growth (compounded annual growth rate) of at least 6% over the next five years.

The Street’s Moderate Buy consensus for Pfizer is based on 4 Buys, 7 Holds and no Sells. The stock has declined 7.2% so far in 2020 but the average analyst price target of $42.66 suggests a possible upside of 17.3% ahead.

Gilead Sciences (GILD)

Gilead Sciences raised investors’ hopes earlier this year when its antiviral drug remdesivir (Veklury) was considered a potential treatment for COVID-19. However, concerns about the effectiveness of the drug crushed investor sentiment.

In May, the FDA granted remdesivir an emergency use authorization, allowing hospitals and doctors to use the drug on hospitalized COVID-19 patients even though the drug has not been formally approved by the authority. Gilead is currently developing an inhaled version of the drug.

Gilead faced a setback in August when the FDA rejected the company’s approval application for rheumatoid arthritis drug, filgotinib. The FDA requested data from the company’s ongoing studies designed to assess whether filgotinib impacts sperm counts. These studies are expected to produce preliminary results in the first half of 2021, which implies delay in seeking FDA approval for the potential blockbuster drug.

At the same time, Gilead and Galapagos recently announced the approval of filgotinib (sold under the name Jyseleca) in the European Union as well as in Japan.

Last month, Gilead announced a $21 billion deal to acquire Immunomedics. The acquisition will give Gilead access to Immunomedics’ metastatic triple-negative breast cancer drug Trodelvy, which is expected to be a blockbuster drug over time. The acquisition is also expected to strengthen Gilead’s oncology portfolio, which includes Yescarta and Tecartus blood cancer therapies.

Following the announcement of the Immunomedics deal, Maxim analyst Jason McCarthy upgraded Gilead to Buy from Hold with a price target of $88. McCarthy stated that this could be a cornerstone acquisition for Gilead’s expanding oncology portfolio and that Trodelvy could be a platform product, expanding into multiple indications and earlier stage treatment, including as a combination with some of Gilead’s other oncology assets. (See GILD stock analysis on TipRanks)

The pandemic impacted Gilead’s 2Q performance with revenue declining 9.5% Y/Y to $5.14 billion due to weak demand for certain drugs, including core hepatitis treatments, and competition from generics.

Also, HIV product sales declined 1% to $4 billion in 2Q but the company indicated that it was seeing signs of recovery in the key franchise and is confident about its long-term HIV leadership. Gilead’s HIV franchise includes Biktarvy, which generated revenue of $1.6 billion in just 2Q.

As of mid-August, Gilead’s pipeline had 74 programs, including long-acting HIV candidate lenacapavir.

Overall, 9 Buys, 10 Holds and 2 Sells add up to a Moderate Buy consensus for Gilead. The stock has declined 4.3% so far this year but has an upside potential of about 29% based on the average analyst price target of $80.18.

Conclusion

Both Gilead and Pfizer pay attractive dividends with Gilead’s dividend yield of 4.38% slightly higher than Pfizer’s yield of 4.18%. Currently, the upside potential in Gilead stock and the proposed acquisition of Immunomedics make the stock more attractive compared to Pfizer.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment