Gilead Sciences lowered its 2020 guidance due to the global progression of the COVID-19 pandemic and uncertainty in forecasting sales of remdesivir, its pandemic vaccine treatment approved in the US for infected hospitalized patients. Shares are down 1.1% in Thursday’s pre-market trading.

Gilead (GILD) reduced its full-year revenue outlook to a range of $23 billion to $23.5 billion from a range of $23 billion to $25 billion on July 30. Wall Street analysts had been looking for $24.1 billion. The high end of the diluted EPS forecast was cut to $6.60 versus the $7.65 guidance provided previously.

For the third quarter ended Sept. 30, Gilead reported that remdesivir generated $873 million in revenues, falling short of the $960 million analysts had been looking for. The company said that remdesivir revenue is generated in a “highly dynamic and complex global health environment, which continues to evolve. As a result, revenue is subject to significant volatility and uncertainty.”

Overall, total revenues in the reported quarter increased 17% to $6.6 billion year-on-year driven by higher volume and stronger patient demand, which topped the Street consensus of $6.31 billion. The company reported adjusted earnings per share of $2.11, surpassing analysts’ estimates by 21 cents.

“The recent acquisition of Immunomedics has effectively transformed Gilead’s growth story. Building on the foundation of our strong core business, which proved its durability once again this quarter, we have now significant opportunity to drive additional growth at an accelerated pace,” said Gilead CEO Daniel O’Day. “Trodelvy, an approved medicine with extensive potential for patients with a range of tumor types, adds to our growing portfolio of transformational medicines. By following the strategy we laid out at the start of this year, we have significantly improved Gilead’s near and long-term growth potential.”

In addition, the company’s Board of Directors has declared a cash dividend of $0.68 per share of common stock for the fourth quarter of 2020. The dividend is payable on Dec. 30, to stockholders of record at the close of business on Dec. 15.

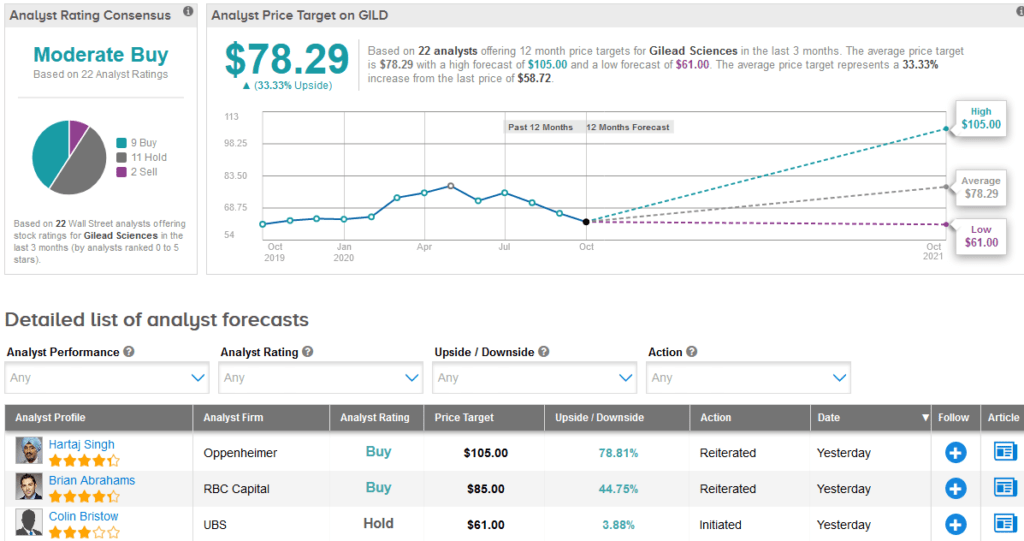

Shares in Gilead have declined about 9.6% year-to-date with the $78.29 average analyst price target indicating 33% upside potential lies ahead in the coming 12 months.

Following the results, J.P. Morgan analyst Cory Kasimov reiterated a Hold rating on the stock with a $74 price target.

“Looking ahead, we believe much of the focus / debate will be around how big and durable of a product remdesivir can be as well as other opportunities for growth (i.e., Trodelvy, HIV/PrEP, filgo, oncology/cell therapy, and further M&A/BD),” Kasimov wrote in a note to inevstors. “While we believe GILD’s long term prospects have improved on the heels of the IMMU deal (and others), we’re still having a hard time finding material drivers of growth in the near-to-intermediate term.”

The rest of the Street is cautiously optimistic on the stock. The Moderate Buy analyst consensus is based on 9 Buys versus 11 Holds and 2 Sells. (See Gilead stock analysis on TipRanks).

Related News:

Ford Sees 2020 Profit As Truck Demand Picks Up; Shares Gain 5%

Boeing Posts Quarterly Loss As Air Travel Halt Dents Sales; Shares Dip

Amazon Hires 100,000 Seasonal Workers Ahead Of Peak Holiday Period