General Motors (NYSE: GM) is introducing a new online parts marketplace with about 45,000 repair and maintenance parts to sell. The available parts include oil filters, engine and cabin air filters, batteries, brake pads, accessory belts, cooling hoses and windshield wiper blades.

The move forms part of the company’s expectations that the online marketplace will make up a $40 billion total addressable market by 2030 and significant revenue growth is anticipated from this effort.

General Motors plans to offer parts, accessories, digital products delivered over-the-air and subscriptions through a single digital storefront. Customers will be able to choose home delivery or pick up their order at one of over 800 participating dealers.

Notably, parts purchased through the online store are eligible for Chevrolet, Cadillac, Buick and GMC rewards programs, i.e., customers will earn points that can be used to pay for parts, accessories or Certified Service at participating dealers.

General Motors’ Chief Digital Officer, Edward Kummer, said, “We are placing software and digital services at the center of every part of our business. The future of GM retail lies at the intersection of digital and physical e-commerce. Whether it’s selling parts or vehicles, GM will meet our customers where it’s most convenient for them.”

Wall Street’s Take

Last week, RBC Capital analyst Joseph Spak maintained a Buy rating on General Motors with a price target of $74 (25.9% upside potential).

Overall, the Street has a bullish outlook on the stock with a Strong Buy consensus rating based on 12 Buys and 3 Holds. The General Motors stock price prediction of $75.57 implies upside potential of about 28.5% from current levels.

News Sentiment

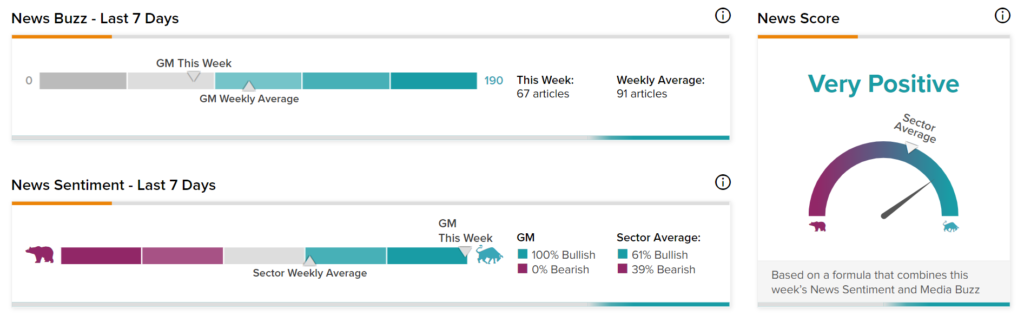

News Sentiment for General Motors is Very Positive based on 67 articles over the past seven days. All articles have Bullish sentiment, compared to a sector average of 61%, and none have Bearish Sentiment, compared to a sector average of 39%.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Vuzix Deepens Partnership with AMA; Street Says Buy

Truist Financial Posts Better-Than-Expected Q4 Earnings

U.K.’s Payments Regulator Fines Mastercard, Four Others for Cartel Behaviour