General Electric generated cash flow of $4.4 billion in the fourth quarter and reported better-than-expected revenue during the period. Shares closed 2.7% higher on Jan. 26.

Previously, GE (GE) had provided guidance for free cash flow of $2.5 billion during the fourth quarter. For the full year 2020, free cash flow generated was $600 million. GE targets free cash flow of $2.5 billion to $4.5 billion this year.

The conglomerate’s fourth quarter total revenue fell 16% to $21.93 billion year-on-year, but topped analysts’ expectations of $21.75 billion. Adjusted earnings per share slumped to 8 cents from 20 cents and fell short of the Street consensus of 9 cents.

Segment by segment analysis showed that sales at its aviation unit sank 35% to $5.85 billion year-on-year, but beat analysts’ estimates of $5.66 billion. The company’s renewable energy unit generated revenue of $4.44 billion, a decline of 6% year-on-year and came in slightly below analysts’ expectations of $4.48 billion.

“As 2020 progressed, we significantly improved GE’s profitability and cash performance despite a still-difficult macro environment,” GE CEO H. Lawrence Culp said. “The fourth quarter marked a strong free cash flow finish to a challenging year, reflecting the results of better operations as well as strong and improving orders in Power and Renewable Energy.”

Looking ahead, Culp continued, “Momentum is growing across our businesses. We are in leading positions to capture opportunities in the energy transition, precision health, and the future of flight.”

In 2020, GE cut debt by $16 billion and by $30 billion since the beginning of 2019. The company ended 2020 with $37 billion of liquidity. (See GE’s stock analysis on TipRanks).

For this year, GE projects adjusted earnings per share of $0.15 to $0.25 as revenues are forecasted to grow organically in the low-single-digit range.

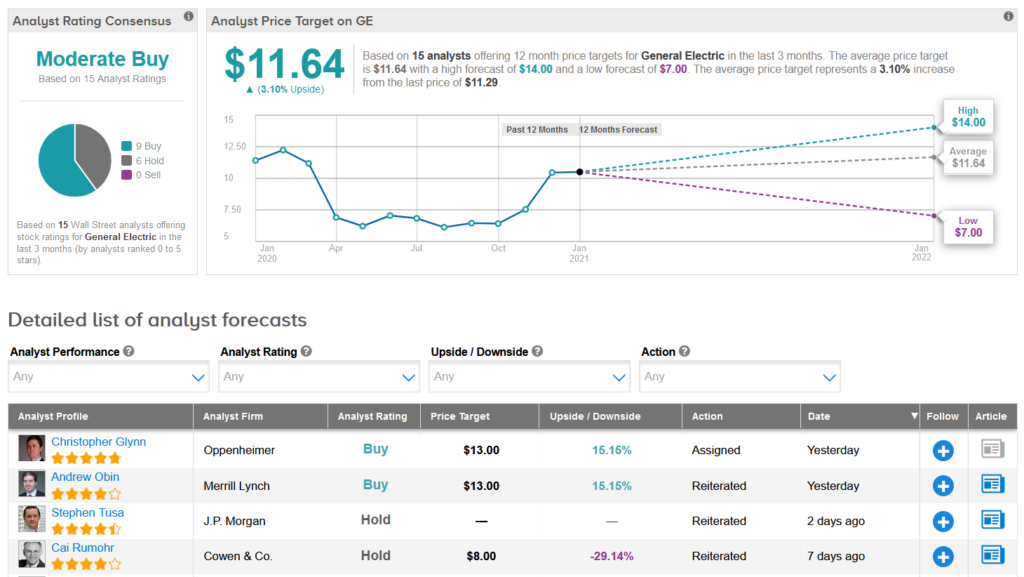

GE shares have propelled almost 60% over the past three months. Following the earnings results, Oppenheimer analyst Christopher Glynn lifted the stock’s price target to $13 (15% upside potential) from $12 and maintained a Buy rating.

“We are revising ’21E to $0.22 from $0.32, and ’22E remains $0.50,” Glynn wrote in a note to investors. “We are raising PT, reflecting 23x our current ’22E FCF/share of $0.56 on mature profile for FCF performance targets.”

The rest of the Street is cautiously optimistic about the stock. The Moderate Buy analyst consensus is led by 9 Buy ratings versus 6 Hold ratings. The average price target of 11.64 indicates upside potential of 3.1% over the next 12 months.

Related News:

Beyond Meat, PepsiCo Form Plant-Based Snack Venture; Shares Pop 18%

F5 Networks Sinks 7.5% As 2Q Sales Outlook Disappoints

Verizon Adds Fewer Postpaid Subscribers Than Expected In 4Q; Shares Drop