Fulgent Genetics Inc. (FLGT) said it was granted Emergency Use Authorization (EUA) for its Covid-19 home testing kit by the US Food and Drug Administration (FDA) sending shares up 18% in Tuesday’s after-market trading.

Shares rose to $19.50 in extended market trading. Beginning next week, the provider of genetic testing solutions will offer the testing service through Picture Genetics, the company’s consumer-initiated genetic testing platform.

Individuals interested in ordering testing services must qualify for the service through an online eligibility screener, which will prioritize those who are most in need of testing. Eligible individuals will receive Fulgent’s collection materials in the mail to self-collect their specimen with a mid-turbinate nasal swab, which will then be sent back to the company’s laboratory in Temple City, California. Patients will receive their results through the Picture Genetics platform within 24-48 hours from receipt of the sample.

In addition, Fulgent has partnered with a national clinician network for its at-home Covid-19 test which will oversee the process including approval of each test ordered, monitoring of materials produced, and review of reports provided for patients after testing is completed.

“As the coronavirus continues to spread, options for testing remain limited and many eligible individuals are unable to get the testing they need,” said Brandon Perthuis, Fulgent’s Chief Commercial Officer. “We believe our at-home testing service will both enable at-risk individuals, particularly those at the front lines of this pandemic, to more readily access testing solutions, while potentially offering a solution for organizations to screen employees as they return to work.”

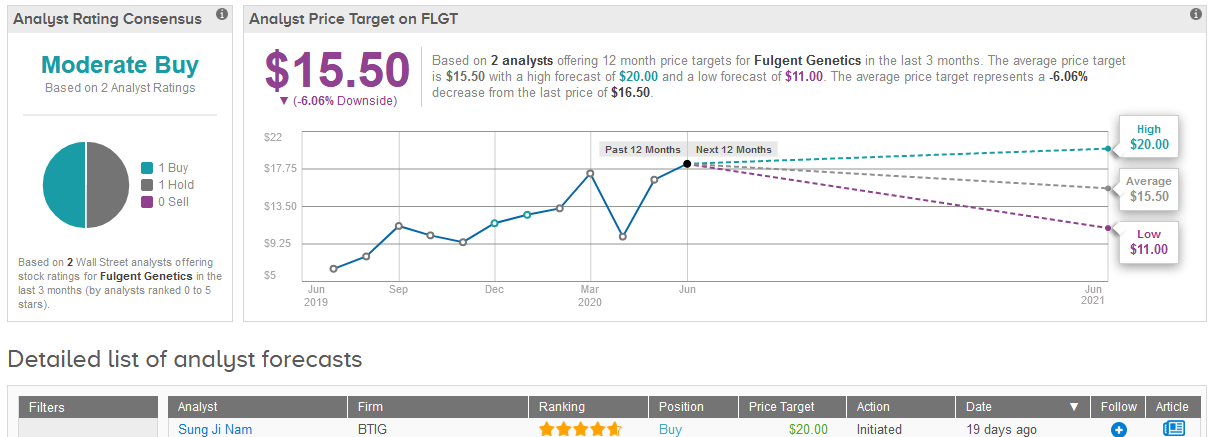

Shares in Fulgent have more than doubled in the past three months. The stock closed at $16.50 on Tuesday. (See Fulgent stock analysis on TipRanks)

Five-star analyst Sung Ji Nam at BTIG at the end of May initiated coverage of the stock with a Buy rating and a $20 price target, reflecting 21% upside potential in the shares in the coming year.

The analyst expects Fulgent’s “strong growth momentum” to continue over the next few years as the company expands product offerings and customer base.

Related News:

AstraZeneca Inks Europe Deal For 400M Covid-19 Vaccine Doses

Israel Is Said To Be In Talks To Buy Moderna’s Covid-19 Vaccine Candidate

5 Promising Covid-19 Vaccines Picked For Trump’s Operation Warp Speed