Facebook Inc. (FB) announced on Monday that it has delayed the release of its second-quarter results by a day to July 30 so that CEO Mark Zuckerberg can provide testimony before a US congressional hearing.

The decision was made after the House Judiciary Committee hearing was rescheduled to July 29, the original date of the financial results release. The four CEO’s of the world’s powerful tech companies – Apple’s (AAPL) Tim Cook, Amazon’s Jeff Bezos (AMZN), Google’s (GOOGL) Sundar Pichai and Facebook’s Zuckerberg – have all agreed to appear before the committee, which will be held by its antitrust subcommittee.

The hearing is scheduled to discuss allegations related to the dominance and market power of the online platforms and whether the tech giants are abusing their power or stifling their competitors.

Facebook’s Zuckerberg plans to portray his company as an American success story in a competitive and unpredictable market, now threatened by the rise of Chinese social media apps around the world and increasingly, at home, with the popularity of TikTok, Bloomberg reported, citing people familiar with the matter, who asked not to be identified because the CEO’s remarks aren’t yet public.

The broader argument the CEO seeks to make is that any weakening of U.S. companies will give market share to Chinese companies abroad, particularly in high-growth markets like India. The line of argument may resonate with U.S. President Donald Trump, who has increased U.S. tensions with China through trade policy. Recently, Trump warned he may ban TikTok, a social media app owned by China-based ByteDance Ltd.

Shares in Facebook have surged a stellar 60% since mid-March as the social media network has been benefiting from a user boom during the coronavirus pandemic, which accelerated the need for remote social engagement as well as for online business and working tools.

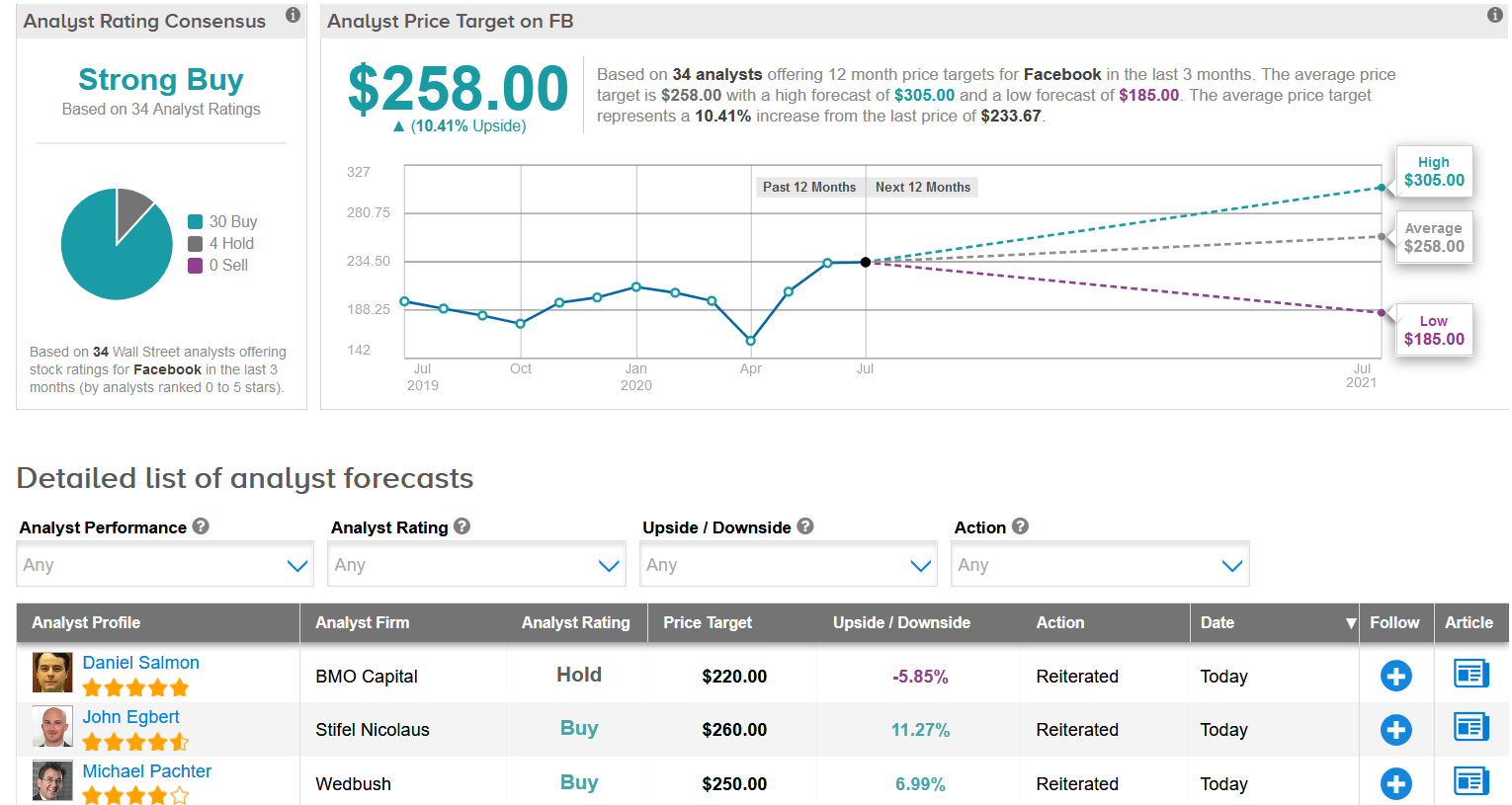

In light of the recent rally, the $258 average analyst price target implies a more modest 10% upside potential in the coming 12 months. (See Facebook stock analysis on TipRanks).

Ahead of Facebook’s financial results, Stifel Nicolaus analyst John Egbert reiterated a Buy rating on the stock with a $260 price target, saying that the company is well-positioned to weather the current headwinds.

“Recovering demand from advertisers during May and most of June will likely enable Facebook to deliver modest y/y growth in 2Q despite the ad industry declining overall. However, given persistent COVID headwinds and advertisers pausing campaigns in June, ad agency reads are more opaque than usual for 2Q, while July trends are even more difficult to ascertain,” Egbert wrote in a note to investors on July 27. “However, we believe Facebook [will] continue taking market share of digital ads, and position itself for even faster growth in FY21 and beyond.”

The analyst expects Facebook’s 2Q total revenue +4% y/y to $17.56B, which compares to consensus of $17.33B and represents a deceleration from prior quarters (+17% in 1Q:20, +25% y/y in 4Q, and +28% in both 3Q / 2Q:19). His 2Q GAAP EPS forecast of $1.47 is slightly above reported consensus of $1.39 estimate.

TipRanks data shows that overall Wall Street analysts have a bullish call on Facebook. The Strong Buy consensus boasts 30 Buy ratings versus 4 Hold ratings.

Related News:

Amazon To Create 1,000 Jobs In Ireland To Meet Cloud Services Demand

Google To Ban Ads Promoting ‘Dangerous Content’ On Covid-19 Theories

Facebook: COVID-19 and Ad Boycott Result in Top Analyst Slashing Estimates