Data and analytics provider Equifax has acquired income and employment verification provider i2verify. The acquisition will help Equifax expand its automated verification solutions.

Equifax’s (EFX) CEO, Mark W. Begor said, “We continue to invest in unique, differentiated data – establishing Equifax as the clear industry leader in the best position to bring new and differentiated solutions to our customers and their consumers.”

Begor further added, “Our ability to integrate new data and drive synergies is powered by our cloud-native capability that only Equifax can provide. This enables rapid adoption and integration of bolt-on M&A and innovation that we can deploy more quickly into the marketplace and drive Equifax growth.”

The bulk of the i2verify’s clients are from the healthcare and education industry. The acquisition will augment Equifax’s current services offering through its product, The Work Number. (See Equifax stock analysis on TipRanks)

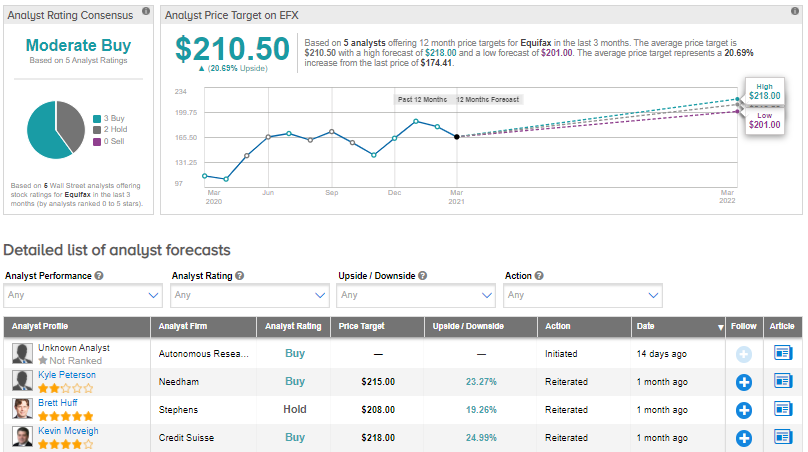

Last month, Needham analyst Kyle Peterson reiterated a Buy rating on the stock and raised its target price to $215 (23.27% upside potential) from $210. Commenting after meeting with Equifax’s management, Peterson said, “we remain positive on EFX’s avenues for growth, particularly within EWS, which we believe has a wide competitive moat and untapped opportunities for growth.”

Peterson further added, “Given the strong EWS trends, steady rollout of new products, and focus on acquiring businesses in high growth markets, we believe there could be upside to both our and Street estimates.”

Turning to rest of the Street, the stock has a Moderate Buy consensus rating alongside an average analyst price target of $210.50 (20.7% upside potential) based on 3 Buys and 2 Holds. Shares have rallied about 67.7% over the past year.

Related News:

ViacomCBS Drops 23% After Pricing New $3B Stock Sale

CuriosityStream’s 2021 Revenue Outlook Tops Estimates After 4Q Beat

Adobe Lifts FY21 Outlook After 1Q Beat; Street Sees 22% Upside