Shares of Dynavax Technologies Corp. rose about 6% on Feb. 19 after the biopharmaceutical company announced that its hepatitis B vaccine, Heplisav B has received marketing authorization from the European Commission.

Dynavax (DVAX) was granted the approval after getting a positive opinion from the European Medicines Agency (EMA) Committee for Medicinal Products for Human Use (CHMP). The approval is based on positive risk-benefit for the vaccine backed by results from three Phase 3 trials.

Dynavax CEO Ryan Spencer said, “With a two-dose regimen that takes only one month to complete and a statistically significantly higher seroprotection rate in heat to head clinical trials, Heplisav B provides a unique opportunity to address known challenges with compliance while delivering higher levels of protection compared to the three-dose regimen of the comparator vaccine.”

Hepatitis B virus is 50x to 100x more infectious than HIV with over 250 million infected worldwide.

Earlier this month on Feb. 4, Dynavax in collaboration with Serum Institute of India dosed the first participant in a Phase 1 trial, which is evaluating a tetanus, diphtheria and acellular pertussis (Tdap) booster vaccine candidate. (See Dynavax stock analysis on TipRanks)

Notably, China’s Clover Biopharmaceuticals is collaborating with Dynavax on developing a COVID-19 vaccine. Global Phase 2 and 3 trials are expected to begin this year with vaccine efficacy data potentially available by the middle of the year.

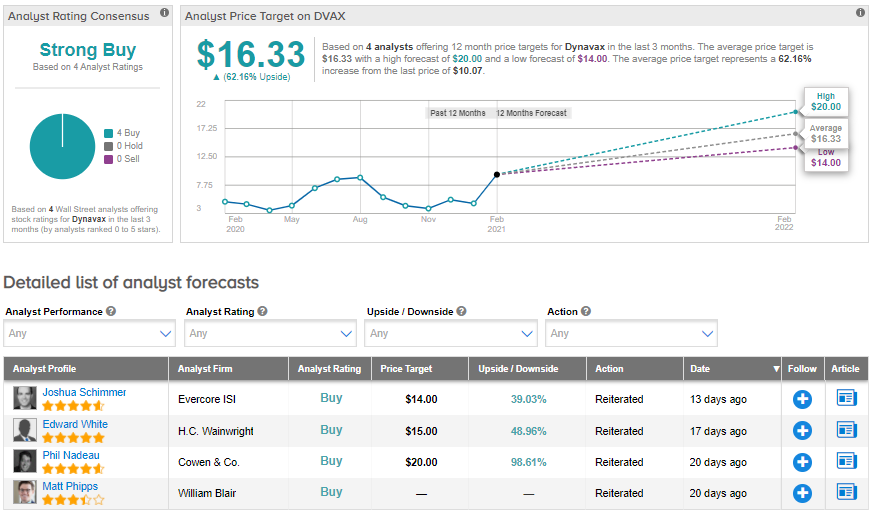

Evercore ISI analyst Joshua Schimmer on Feb. 8 reiterated a Buy rating on the stock with a price target of $14 (39% upside potential). Schimmer noted, Clover selected Dynavax’s CpG1018 + alum as adjuvant for its recombinant vaccine approach and “expects to produce hundreds of millions of doses this year” in what “could emerge as a lucrative partnership” for Dynavax.

The rest of the Street has a Strong Buy consensus rating on the stock based on 4 Buys. The average analyst price target of $16.33 implies about 62% upside from current levels. Thats after the stock has surged about 106% over the past year.

Related News:

NiSource Outperforms 4Q Earnings Estimates, Misses On Revenues

Q2 Holdings’ 1Q Sales Outlook Exceeds Street Estimates; Street Is Bullish

Shopify’s 4Q Sales Pop 94% As Online Buying Booms; Shares Dip 3.3%