Shares in DraftKings are dropping 5.4% in Monday’s pre-market trading ahead of the US sports betting company’s share sale.

The stock is down at $60.33 in the pre-market session as Draftkings (DKNG) announced that it has commenced an underwritten public offering of 32 million shares of its Class A common stock. The offering consists of 16 million shares being offered by DraftKings and 16 million shares being offered by certain selling Draftkings stockholders. DraftKings will use the net proceeds it receives from the share sale for general corporate purposes.

DraftKings and the selling stockholders plan to grant the underwriters a 30-day option to purchase up to an additional 4.8 million shares of Class A common stock. The sports gambling company will not receive any proceeds from the sale of Class A common stock offered by the selling stockholders.

“The offering is subject to market and other conditions, and there can be no assurance as to whether or when the offering may be completed,” the company said in a statement.

Credit Suisse Securities and Goldman Sachs are acting as joint book-running managers and as representatives of the underwriters for the offering.

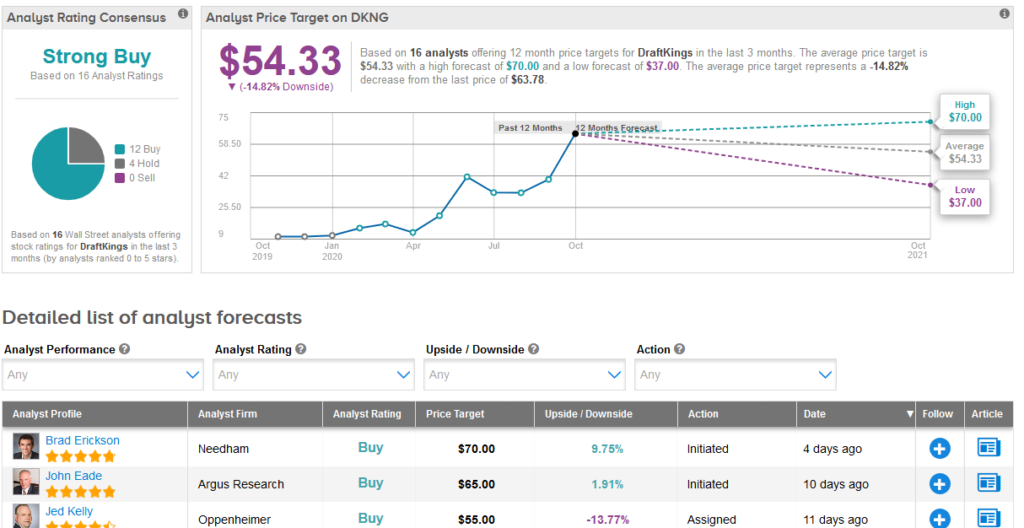

Shares in DraftKings have quadrupled since their Nasdaq debut at the end of April. That’s with a Strong Buy analyst consensus scoring 12 Buys versus 4 Holds. Meanwhile, the $54.33 analyst price target implies 15% downside potential over the coming year.

Needham analyst Brad Erickson last week initiated the stock with a Buy rating and a $70 price target (9.8% upside potential), saying that he views DKNG as one of the leading beneficiaries as online sports betting and gambling take off in the U.S.

“We believe the company has a leading brand with a target-rich rolodex related to its market-leading fantasy sports business,” Erickson wrote in a note to investors. “DKNG is pursuing a product & experience-first mentality that we believe will be the primary determinant of success in the space.”

“Also, the company actively uses a data-centric approach to customer acquisition with both operational and capital advantages versus competitors,” Erickson added. (See DraftKings stock analysis on TipRanks)

The analyst believes that the company has the potential to regularly exceed top-line forecasts, although in the near-term, he cautions that EBITDA expectations could be too aggressive.

“Risks are mainly COVID’s effect on sports and competition, while valuation will be a debate for profit-focused investors, less so for growth-oriented investors,” he summed up.

Related News:

Alibaba To Take Dufry Stake, As Part Of Online Travel Venture

Alibaba-Backed XPeng Posts Record EV Deliveries; UBS Sees 37% Upside

Amazon Teams Up With Universal, Warner To Remaster Thousands of Songs