Dr Reddy’s Laboratories Ltd. (RDY) announced that it has entered into a non-exclusive licensing agreement to manufacture and sell Gilead Sciences Inc.’s (GILD) coronavirus drug candidate remdesivir.

The agreement grants Dr. Reddy’s the right to register, manufacture and sell Gilead’s investigational drug remdesivir, a potential treatment for COVID-19, in 127 countries including India. Financial terms of the agreement weren’t disclosed.

As part of the pact, Gilead will provide technology transfer for the manufacturing of the potential drug. However, Dr. Reddy’s will be in charge of ramping up manufacturing and obtaining regulatory approval for the marketing of remdesivir in respective countries.

Gilead’s investigational antiviral therapy has received Emergency Use Authorization (EUA) by the U.S. Food and Drug Administration (FDA) to treat Covid-19.

Shares in Gilead have dropped about 5% over the past week and were trading at $73.20 as of Friday’s close.

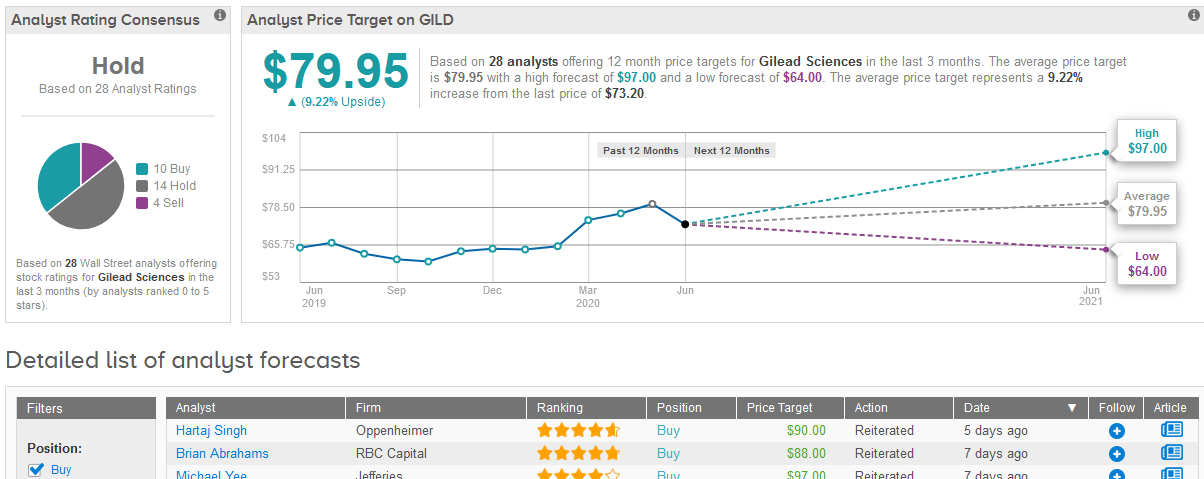

Five-star analyst Hartaj Singh at Oppenheimer last week reiterated his Buy rating on the stock with a $90 price target (23% upside potential), saying that investors are ascribing little value to Gilead’s quality emerging pipeline, and that any sustained weakness into 2Q20 should be viewed as a buying opportunity.

Singh noted that although the stock has this year outperformed the broader market and its peer-group indices, the trend has reversed over the past month. He attributes three reasons for this: a rotation from biotech into other sectors, concerns around monetizing remdesivir’s potential in COVID-19 and a tricky 2Q20 earnings report coming up in late July.

The analyst added that Gilead’s $1 billion investment in remdesivir manufacturing, R&D and sales and marketing efforts are potentially not reflected in 2Q/3Q20 consensus earnings estimates, which could potentially lead to earnings misses.

So what does the Street consensus say? TipRanks data shows that the majority of 14 analysts have a Hold rating on the stock, while the rest is divided between 10 Buys and 4 Sells, adding up to a Hold consensus. The $79.95 average price target is less optimistic than Singh’s as it indicates 9% upside potential in the shares in the coming 12 months. (See Gilead stock analysis on TipRanks).

Related News:

Israel Is Said To Be In Talks To Buy Moderna’s Covid-19 Vaccine Candidate

5 Promising Covid-19 Vaccines Picked For Trump’s Operation Warp Speed

AstraZeneca Inks Europe Deal For 400M Covid-19 Vaccine Doses