Shares of Crocs closed 4.9% higher on Tuesday after the shoe manufacturer’s 3Q EPS surged 65% to $0.94 year-over-year and crushed analysts’ estimates of $0.70. The company’s 3Q revenues increased 15.6% to $361.7 million and came ahead of the consensus estimate of $344 million, thanks to the 35.5% growth in digital sales.

By sales channels, Crocs’ (CROX) e-commerce revenues in 3Q grew 36.3% year-on-year. Wholesale and retail channel revenues increased by 12.4% and 8.9%, respectively, during the same comparative period. The company’s retail comparable store sales rose 16.2%, despite COVID-19 challenges.

For 4Q, Crocs forecasts revenue growth of 20% to 30%, compared with analysts’ expectations of 8.8% growth. For the full-year, sales growth is pegged at 5% to 7%, which is way higher than analysts’ estimates of a mere 1%. (See CROX stock analysis on TipRanks).

Following the results, Susquehanna analyst Sam Poser raised the stock’s price target from $53 to $68 (24.04% upside potential) and maintained a Buy rating. He said that “the improving positioning of the Crocs brand, evident by strong 3Q20 results, will continue for the foreseeable future. We think demand for Crocs will continue to exceed supply, which should lead to positive long-term sales and margin improvement.”

Poser added that “Support of front-line medical workers, ever-increasing personalization options, and successful collaborations have driven an increase in brand consideration, and this should lead to improved momentum in Crocs’ clog and sandal businesses going into next year.”

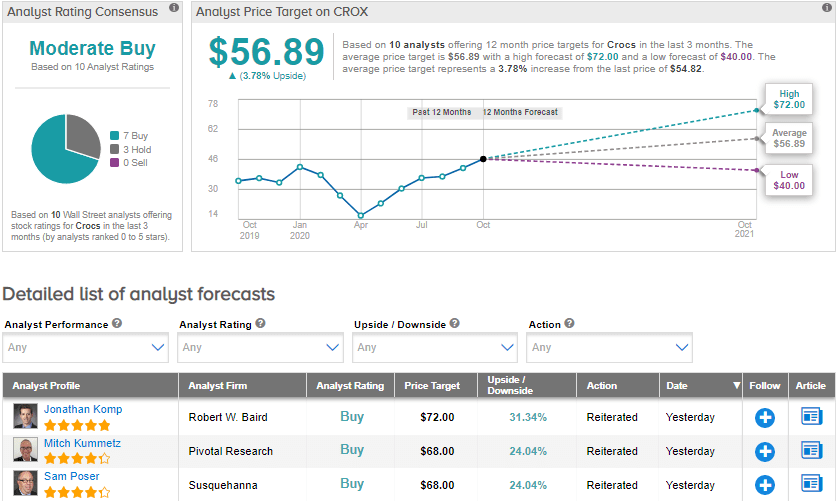

Currently, the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 7 Buys and 3 Holds. The average price target of $56.89 implies upside potential of about 3.8% to current levels. Shares have advanced about 30.9% year-to-date.

Related News:

Crocs Gains 8% On Upbeat 3Q Sales Outlook

FireEye’s 3Q Profit Explodes 450%; Shares Rise 4%

MSCI’s 3Q Profit Outperforms Amid Trading Boom