Cowen & Co. upgraded Domino’s Pizza to Buy from Hold and lifted the stock’s price target to $450 (14.2% upside potential) from $445. Shares of the pizza delivery chain closed 1.5% higher on Friday after the rating change.

Cowen analyst Andrew Charles believes that Domino’s Pizza (DPZ) has room for multiple expansion. “Domino’s off-premise oriented, digitally-led (75% of 2Q20 sales) business model has executed strongly through the first 6 months of COVID-19. In our view, DPZ is implementing a successful LT (long term) playbook to help extend the brand’s success. These tactics include menu & technological innovation, expanded value offerings and an ad fund that grows in-line with the U.S.’ robust sales growth,” Charles wrote in a note to investors.

The 5-star analyst further added that “We model upside to 2020-22 U.S. comps & EPS given proactive measures executed to advance DPZ’s position of strength brought about by COVID-19. We expect share gains from the 51% of the QSR (quick service) pizza category comprised of regionals + independents.” (See DPZ stock analysis on TipRanks).

In mid-July, Domino’s Pizza reported upbeat 2Q earnings and revenues. Earnings of $2.99 per share surpassed Street estimates of $2.24 per share, while 2Q revenues of $920 exceeded analysts’ expectations of $915 million.

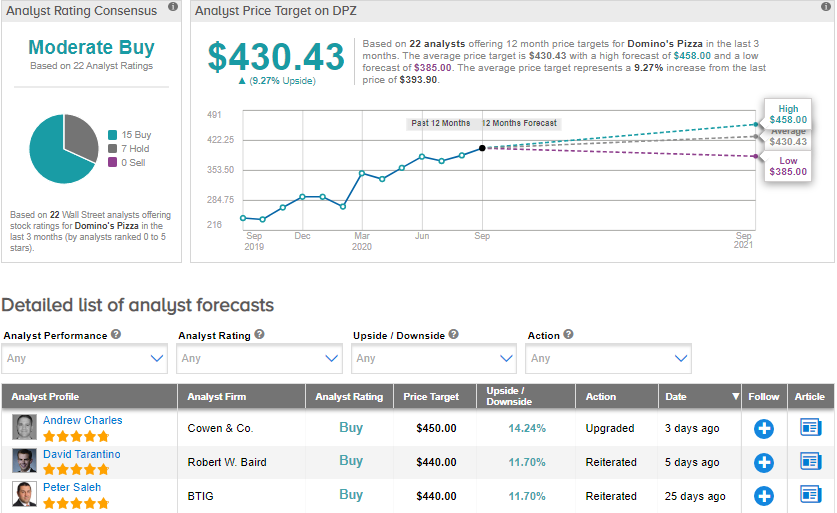

Currently, the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 15 Buys and 7 Holds. The average price target of $430.43 implies upside potential of about 9.3% to current levels. Shares have gained 34.4% year-to-date.

Related News:

Nvidia To Buy Softbank’s Arm Holdings For $40B

ByteDance To Join Up With Oracle, To Abandon TikTok US Sale – Report

Buffett’s Berkshire Divests Shares In Liberty Global, Axalta Coating