Coupa Software Inc. (COUP) said that it is offering to sell $1.1 billion in aggregate principal amount of convertible senior notes due 2026 subject to market conditions.

The software company intends to grant the purchasers of the bonds an option to buy up to an additional $165 million aggregate principal amount of the notes.

The company expects to use net proceeds from the offering to repurchase a cash portion of its outstanding convertible notes due 2023 and for general corporate purposes, potential acquisitions, strategic transactions and working capital.

The offered notes will be senior, unsecured obligations of Coupa, and interest will be payable semi-annually in cash on June 15 and December 15 of each year. Prior to March 15, 2026, the bonds will be convertible at the option of holders during certain periods, subject to certain conditions.

After this, the notes will be convertible at any time until the close of business on the second scheduled trading day immediately preceding the maturity date. Upon conversion, they may be settled in shares of Coupa common stock, cash or a combination of cash and shares.

Coupa may redeem all or any portion of the notes, at its option, on or after June 20, 2023 and prior to the 21st scheduled trading day immediately preceding the maturity date, at a redemption price equal to 100% of the principal amount of the notes to be redeemed, plus accrued and unpaid interest.

Shares in Coupa have more than doubled in value since dropping to a low in March and are now trading 46% higher than at the start of the year.

The debt offering come as the company this week reported a net loss of $14.8 million, or 23 cents a share, down from a loss of $20.5 million, or 34 cents a share, in the year-ago period. Revenue rose 47% to $119.2 million compared with the same period last year.

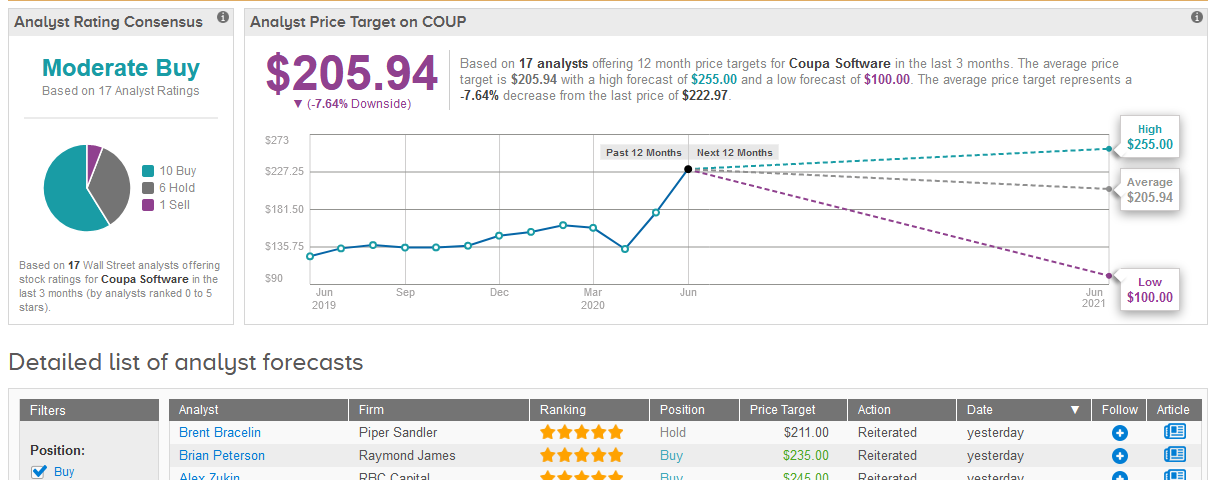

Following the earnings’ results, five-star analyst Brent Bracelin at Piper Sandler raised the stock’s price target to $211 from $130, while maintaining a Hold rating due to valuation.

“Solid Q1 execution contributed to a $7 million revenue beat and $1 million full-year raise, despite COVID-19 headwinds in March that began to ease in April”, Bracelin wrote in a note to investors.

The stock’s recent reviews show 10 Buys versus 6 Holds and 1 Sell adding up to a Moderate Buy analyst consensus. After the stock’s recent outperformance, the $205.94 average price target now indicates 7.6% downside potential. (See Coupa stock analysis on TipRanks).

Related News:

Grubhub Shares Lifted On Report Of European Acquirers Lining Up

Lululemon Earnings Preview: Will LULU Live Up To The Hype?

Apple Seeks To Boost Sales Via Mac Trade-Ins, Payment Plans- Report