Shares of CoStar Group were up 5.5% in pre-market trading on March 5 as the provider of commercial real estate information and online marketplaces withdrew its bid for CoreLogic.

CoStar Group (CSGP) said that rising interest rates have resulted in a significant decline in recent weeks of valuations of residential property technology companies, which changed its view on the CoStar deal. The company also said that the increase in interest rates is expected to adversely impact the mortgage refinancing market.

Shares of CarLogic (CLGX) , a provider of real estate, consumer and financial data analytics, dropped 3.4% before the bell. Shares of CoStar Group have tanked 16.5% in the past month.

CoStar Group CEO Andrew C. Florance said, “With interest rates moving up, now is not the time for us to aggressively buy into the residential mortgage market.”

CSGP added, “a strategic combination of CoStar and CoreLogic had the potential to create significant value for all shareholders…”

Early last month, CoreLogic had announced that it was going to be taken over by Stone Point Capital and Insight Partners in a deal valued at $6 billion.

On Feb. 16, CoStar Group made a counterbid to acquire CoreLogic for $95.76 per share, which was revised on March 1. Under the terms of the revised bid, CoreLogic shareholders were offered to receive $6 in cash for each CLGX share and 0.1019 shares of CoStar Group in exchange for each share of CoreLogic, representing a value of $90 per share based on CSGP’s closing share price as on Feb. 26. (See CoStar Group stock analysis on TipRanks)

This revised proposal was an $1.25 billion improvement over Stone Point Capital and Insight’s $6 billion offer for CLGX.

In reponse to the revised offer, CoreLogic stated, “The CoreLogic Board unanimously believes your Updated Proposal requires further improvement with respect to the following key areas: (i) value, (ii) certainty of value, and (iii) certainty of closing in a timely manner. We continue to believe that there is strategic potential in the combination of our two businesses and we request that you reconsider your positions on these important terms.”

CoreLogic further added, ““Since your February 16, 2021 proposal, CSGP shares have continued to decline – approximately 19%, or $177 per share (including a 12% decline since CoStar’s fourth quarter earnings release). As a result, your Updated Proposal represents a significantly lower implied total per share value than your prior proposal on February 16, 2021.”

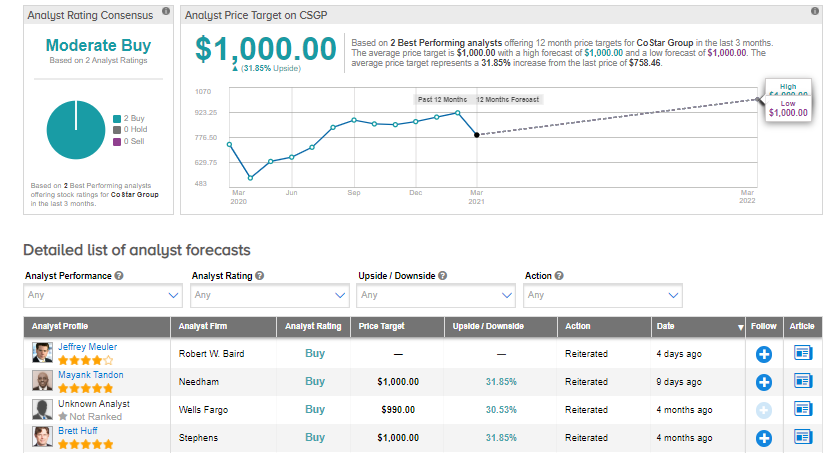

Last month, Needham analyst Mayank Tandon reiterated a Buy and a price target of $1,000 on CSGP stock.

Tandon said in a note to investors, “CSGP closed FY20 on a positive note, comfortably exceeding revenue, EBITDA, and EPS targets on broad based strength. Net new sales were strong once again, coming in at $49 million, with 2H bookings increasing 23% over 1H…”

“Management introduced guidance for 1Q and FY21 that is above on revenue but a shade below on EBITDA and EPS to reflect higher investments as management focuses on expanding and deepening its product portfolio both in commercial and residential,” the analyst added.

The rest of the Street is cautiously optimistic on the stock with a Moderate Buy consensus rating based on 2 Buys. The average analyst price target of $1,000 implies almost 32% upside potential to current levels.

Related News:

Snowflake’s Loss Doubles In 4Q; Shares Drop 3.8%

DraftKings Becomes UFC’s First Sportsbook In US, Canada

Zynga Snaps Up Echtra Games; Street Says Buy