Hardware platform and supply chain solutions provider Celestica Inc. (CLS) provided a business update after hosting a virtual roundtable for analysts and investors on the company’s capital equipment business.

Major takeaways from the event include an expected growth of over 30% year-over-year in Celestica’s capital equipment revenue, which is expected to exceed $700 million in 2021.

Under its diversification strategy, the company is seeking new avenues in adjacent Capital Equipment markets, including robotics, automated warehousing systems, synthetic diamond manufacturing, and smart vending. (See Celestica stock analysis on TipRanks)

Over the last ten years, Celestica has gained vertical expertise and a global presence in serving original equipment manufacturers in the wafer fabrication equipment (WFE) and display equipment markets.

According to Gartner Research, the WFE market is expected to touch $86 billion by 2024 at a CAGR of 9%. Further, the size of display markets for OLED and mini LED is estimated to reach $64 billion and $63 billion respectively by 2025. This market growth is expected to drive spending on display equipment higher.

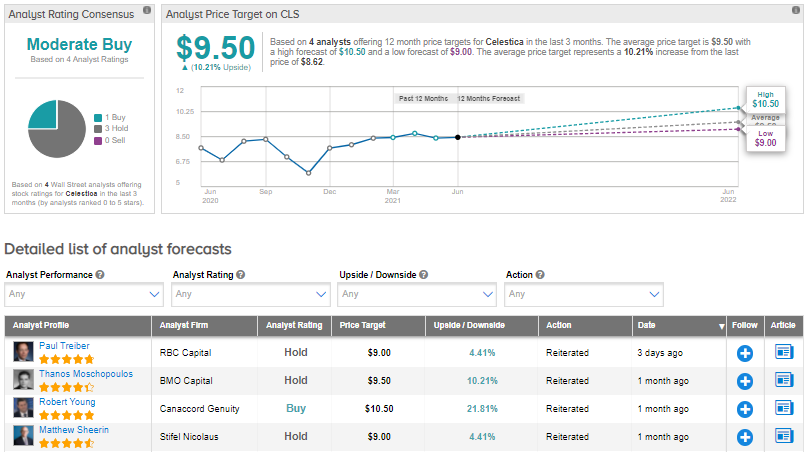

Recently, Canaccord Genuity analyst Robert Young reiterated a Buy rating on the stock and increased the price target to $10.50 (21.8% upside potential) from $10.

Reacting to Celestica’s Q1 performance, Young commented, “We believe recovery to operating margins of 3.75-4.5% is underway, alongside a robust balance sheet ready for buybacks or M&A; these, coupled with low valuation versus peers, provide investors a good entry point.”

Consensus among analysts is that Celestica is a Moderate Buy based on 1 Buy and 3 Holds. The average analyst price target of $9.50 implies 10.2% potential upside for Celestica stock.

Shares have gained about 7% so far this year.

Related News:

J.M. Smucker Tops Q4 Results; Shares Gain

Ciena Delivers Stronger-than-Expected Q2 Results; Shares Pop 7%

Semtech Reports Robust Q1 Results, Beats Expectations