Carnival said that early indications unveiled that the cyber attack detected in August involved a third-party gaining unauthorized access to personal information of some guests, employees and the crew at 3 of its brands – Carnival Cruise Line, Holland America Line and Seabourn – as well as casino operations. The news sent shares down 7.8% on Tuesday.

Carnival (CCL) said it acted quickly to shut down the intrusion, restore operations and prevent further unauthorized access. The company also hired a major cybersecurity firm to investigate the data breach and notified law enforcement and appropriate regulators of the event.

“Working with its cybersecurity consultants, the company took steps to recover its files and has evidence indicating a low likelihood of the data being misused,” Carnival said in a statement.

The cruise operator expects to complete the investigation within the next 30 to 60 days and will then send notifications to potentially affected individuals whose current contact information is available to the company. Affected individuals will also be offered complimentary credit monitoring.

The stock has this year shed more than 72% of its value following major coronavirus outbreaks on a number of cruise ships, including its Diamond Princess, earlier this year and amid ongoing delays of the resumption of cruise operations and sailings. (See CCL’s stock analysis on TipRanks).

Earlier this week, Carnival announced the cancellation for 6 ships operating cruises from PortMiami and Port Canaveral for November 2020. The company has also cancelled 5 cruises scheduled to operate from Sydney, Australia from Jan. 16 – Feb. 8, 2021.

Following the US Centers for Disease Control’s (CDC) recent decision to extend its no-sail order for cruise operations until Oct. 31, Carnival cancelled all but PortMiami and Port Canaveral cruises for the rest of the year.

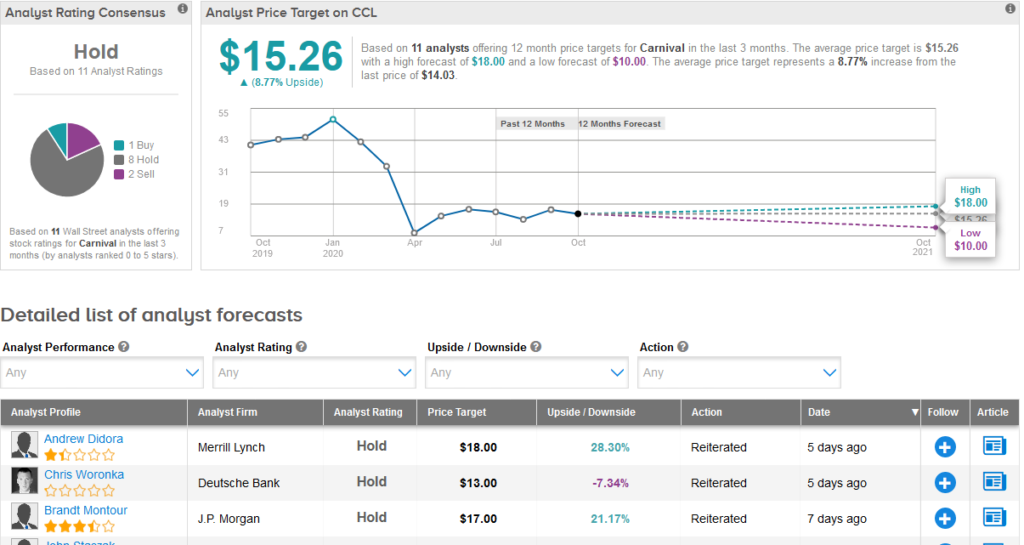

Merrill Lynch analyst Andrew Didora reiterated a Hold rating on the stock with a $18 price target (28% upside potential) saying that US cruise line spending is still virtually on hold.

“With the no sail order extended through the end of October, we expect to see similar trends in next month’s data, and we anticipate a slow recovery as cruise lines gradually add back ships to service at sub-50% occupancy levels,” Didora wrote in the note to investors.

The rest of the Street is also sidelined on the stock. The Hold analyst consensus shows 8 Hold ratings and 2 Sell ratings versus only 1 Buy rating. The $15.26 average price target implies 8.8% upside potential over the coming year.

Related News:

GameStop Explodes 44% On Major Microsoft Tie-Up, As Trading Resumed

Carnival To Sell Two Princess Cruises Ships; Street Stays Firmly Sidelined

Boeing Drops 7% On Trimmed Aircraft Demand Outlook