The Carlyle Group (CG) announced that it has agreed to purchase a 20% stake in the pharmaceutical business of Indian Piramal Enterprises Ltd. for about $490 million.

Carlyle shares rose 3% to $27.25 in afternoon trading on Monday.

The deal values the pharma business at an enterprise value (EV) of $2.7 billion with an upside component of up to $360 million depending on the company’s FY21 performance. The final amount of equity investment will depend on the net debt, exchange rate and performance against the pre-agreed conditions at the time of closing of the deal, the private equity fund said in a statement.

“Piramal Pharma has built a strong, diversified pharma business with a solid market position and scale in each of its core business segments of Pharma Solutions, Critical Care and Consumer Products,” said Neeraj Bharadwaj, Managing Director at Carlyle Asia Partners. “Given global pharma industry trends, we see attractive opportunities for organic as well as inorganic growth in each of these businesses.”

Carlyle added that India is a strategic part of Carlyle’s Asia business, and a market where it continues to see “many attractive investment opportunities”.

This transaction, which is one of the largest private equity deals in the Indian pharmaceutical sector, is expected to close in 2020, subject to customary closing conditions and regulatory approvals.

Carlyle has been investing in the healthcare sector in India. Last month, the private equity firm announced a majority stake investment in SeQuent Scientific, the largest Indian pure-play animal healthcare company, which is expected to close in the third quarter of 2020. Its other investments in the Indian healthcare sector include Medanta Medicity Hospital, a hospital in the National Capital Region of Delhi, and Metropolis Healthcare, a chain of diagnostic centers and laboratories. Since 2000, Carlyle has invested a total of more than $2.5 billlion in India.

Shares in Carlyle have surged 59% since dropping to a low in mid-March and are now trading well above their start-of-the year level.

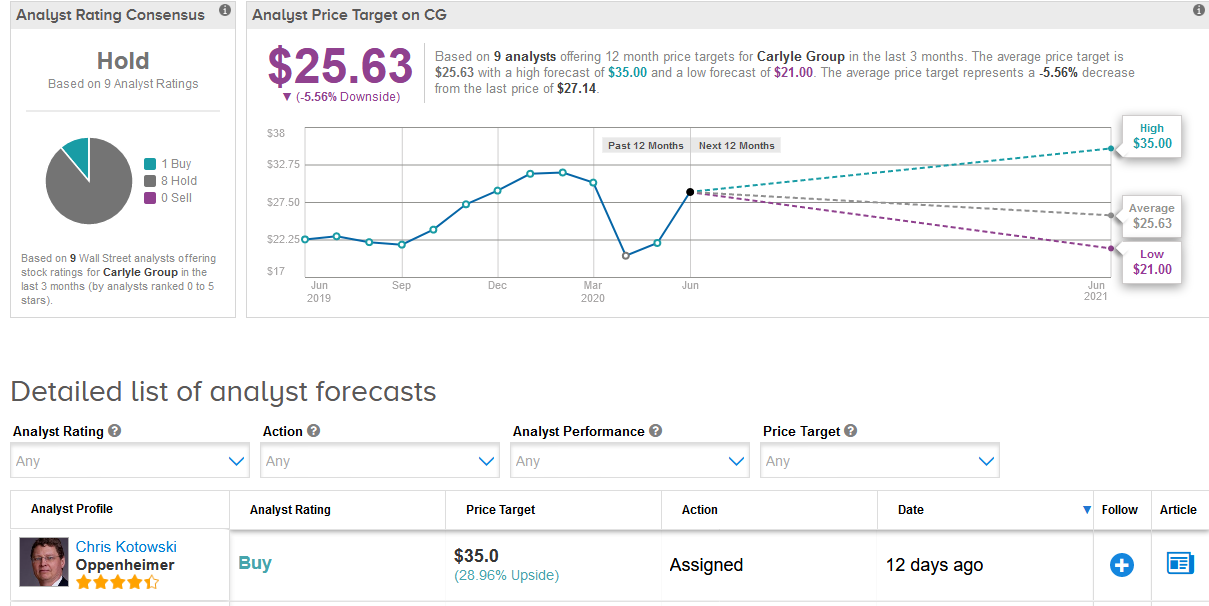

Earlier this month, Chris Kotowski at Oppenheimer raised the stock’s price target to $35 (29% upside potential) from $31 with a Buy rating, saying that Carlyle is well positioned due to the firm’s well-diversified private equity assets under management (AUM).

Overall, Wall Street analysts are sidelined on the stock. The Hold consensus is divided into 8 Hold ratings versus 1 Buy rating. The $25.63 average price target indicates 5.6% downside potential in the shares in the coming 12 months. (See Carlyle stock analysis on TipRanks) .

Related News:

BP To Sell Petrochemicals Business To Ineos For $5 Billion

AstraZeneca Strikes $127 Million Deal With Brazil For Covid-19 Vaccine

Debt-Laden Chesapeake Energy Files For Chapter 11 Proceedings