Bombardier (BDRBF) announced that it will cut 2,500 jobs or about 10% of the workforce at its aviation business as a result of the “extraordinary” aviation industry interruptions and challenges caused by COVID-19.

Bombardier Aviation suspended its manufacturing operations in March to slow the spread of the virus and to protect the health and safety of employees, partners and customers, the company said. Over the past month, manufacturing operations at the aviation unit have been resuming.

“Now with business jet deliveries, industry-wide, forecasted to be down approximately 30% year-over-year due to the pandemic, Bombardier must adjust its operations and workforce to ensure that it emerges from the current crisis on solid footing,” the company said in a statement.

Global planemakers from Airbus Group SE (EADSF) to Boeing Co (BA) have seen demand for new aircraft throttle as the crisis in the aviation industry has resulted in a deep cut in the number of commercial jets and services its customers need over the next few years with some asking for delivery delays or order cancellations.

The planemaker said that the majority of the job reductions will affect manufacturing operations in Canada and will be carried out progressively throughout 2020. At the same time worldwide customer service operations have continued to operate largely uninterrupted throughout the pandemic, Bombardier added.

It expects to record a special charge of about $40 million in 2020 due to the workforce reductions and will provide additional information on its market outlook when it reports its second quarter financial results on August 6.

The value of the planemaker’s shares have shed over 70% this year and were trading at $0.35 on Friday.

Five-star analyst Cai Rumohr at Cowen & Co. last month maintained a Hold rating on the stock with a $0.50 price target saying that even with expected negative cash flow over the balance of the year, Bombardier should be able to make it to year-end with at least $1.5 billion in cash (+ $0.9 billion revolver).

“But 2021 looks challenging,” Rumohr wrote in a note to investors. “Since Q1 is always negative (2014-19 average is $0.8 billion), and Bombardier has a $450 million debt maturity in May, 2021 with another $1 billion due in December.”

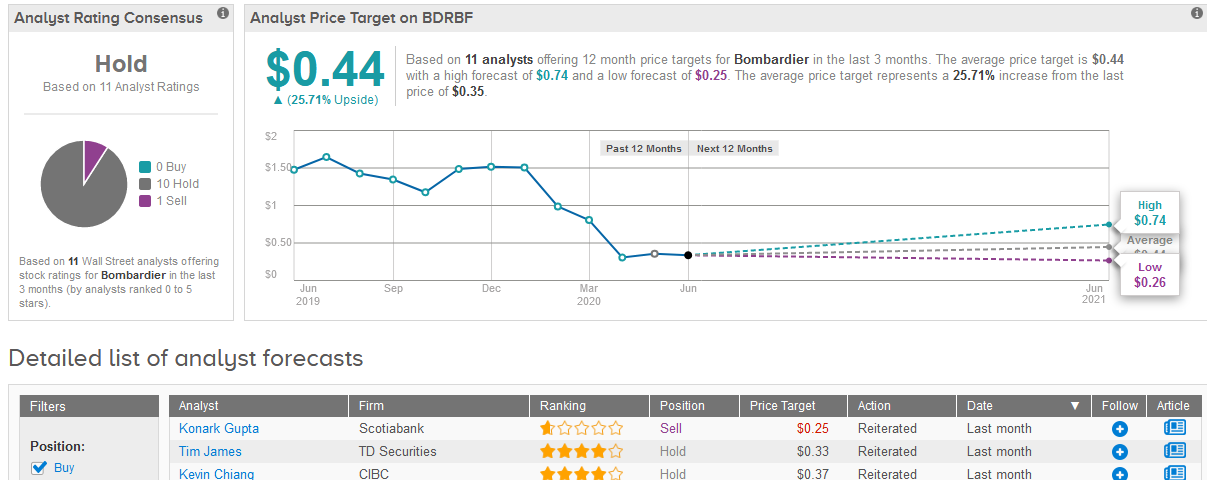

Mostly in line with Rumohr other Wall Street analysts are also sitting on the sidelines when it comes to Bomardier’s stock. The Hold consensus is made of 10 Hold ratings versus 1 Sell rating. The $0.44 average analyst price target suggests 26% upside potential in the shares in the coming 12 months.

Related News:

Airbus Gets No New Aircraft Orders In May Amid Aviation Crisis

Boeing CEO Says ‘Likely’ A Major Airline Could Fold In 2020

Colombian Carrier Avianca Files for Bankruptcy Protection Due to Coronavirus Woes