Shake Shack (SHAK) announced on Tuesday that it has opened four new burger restaurants even as preliminary quarterly sales figures fell short of analysts’ expectations sending shares down more than 5%.

The stock dropped to $50.75 in early afternoon trading. The burger chain said that total revenue for the second quarter ended June 24 was $91.8 million, which is lower than the $101.0 million estimated by analysts. As a result of the nationwide protests against racism and the resulting curfews, which led to temporary restaurant closures and reduced operating hours, Shake Shack lost $3.2 million in sales in June, the company said.

Same-Shack sales dropped 49% in the reported quarter year-on-year due to traffic decline of 60.1% and a price mix increase of 11.1%. Same-Shack sales for the most recent week ended July 1 were down 39%, with the “overall speed of company-wide sales recovery remaining uncertain due to COVID-19”, the company said.

Shake Shack is scheduled to release second-quarter earnings results on July 30.

“Amidst our gradual sales recovery, we’ve started to open new Shacks again and are looking to the significant growth opportunity that we believe lies ahead for Shake Shack,” said Shake Shack CEO Randy Garutti.

As of now, 6 Shacks remain fully closed, an improvement from the end of the first quarter at which point 17 Shacks were fully closed. All remaining Shacks at that time were operating in a to-go capacity only, with closed dining rooms to contain the spread of the coronavirus pandemic. As of the end of the second quarter, about 60% of Shacks are operating with dining rooms open at limited capacity. However, in recent days, some of these interior and patio dining rooms have once again closed for safety reasons.

Shake Shack shares have recouped some of this year’s earlier losses but are still down almost 15% from the start of 2020.

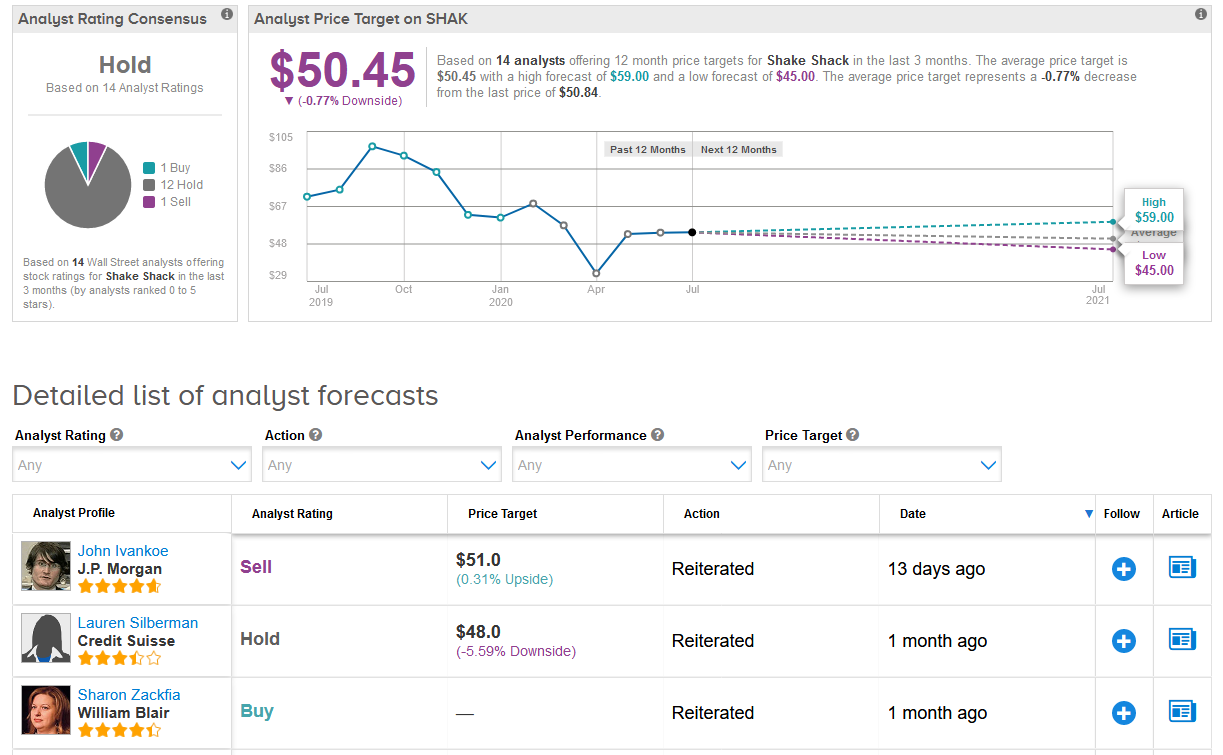

William Blair analyst Sharon Zackfia last month reiterated a Buy rating on the stock after hosting a virtual fireside chat with senior management, saying that the company sees the opportunity for more favorable lease terms on some sites.

Overall though Wall Street analysts are cautiously optimistic on the stock. The Hold consensus breaks down into 12 Holds and 1 Sell versus 1 Buy. The $50.45 average price target suggest shares almost fully priced. (See SHAK stock analysis on TipRanks).

Related News:

Billionaire Buffett’s Energy Unit To Buy Dominion Energy Assets For $4B

Uber Snaps Up Postmates In $2.65B Stock Deal- Report

Luckin Coffee’s Chairman Finally Ousted By Shareholders- Report