Billionaire Warren Buffett’s investment conglomerate Berkshire Hathaway built up a new position in Toronto-based miner Barrick Gold and continued to divest shares in a number of large US banks during the second quarter.

According to a SEC filing released late on Friday, Berkshire (BRK.A) bought 20.9 million shares in Barrick Gold worth about $563.6 million. Following the disclosure, the stock surged 8.1% to $29.18 in after-market trading.

Barrick shares (GOLD) have been on a steady gaining streak since mid-March appreciating some 45% this year, as surging gold prices have driven stock prices of gold miners to multi-year highs. This comes as the coronavirus pandemic has spurred investors to buy into the relative safety of gold.

Meanwhile, Berkshire shed 85.6 million Wells Fargo (WFC) shares, which translated to about 26% of its stake and the company now owns 237.6 million shares. The US investment bank’s stock is down 53% so far this year. In addition, Buffett’s investment conglomerate sold 35.5 million shares of JPMorgan shares, reducing over 60% of its position. Furthermore, Berkshire divested its entire holding in Goldman Sachs but continued to invest in Bank of America during the reported period.

As previously announced, the investment vehicle exited its airlines holdings, including American Airlines, Delta Airlines and Southwest Airlines. Apple Inc. (AAPL) was among the holdings Berkshire maintained.

Buffet’s Berkshire is a stakeholder of other major conglomerates ranging from Coca-Cola to Kraft Heinz (KHC).

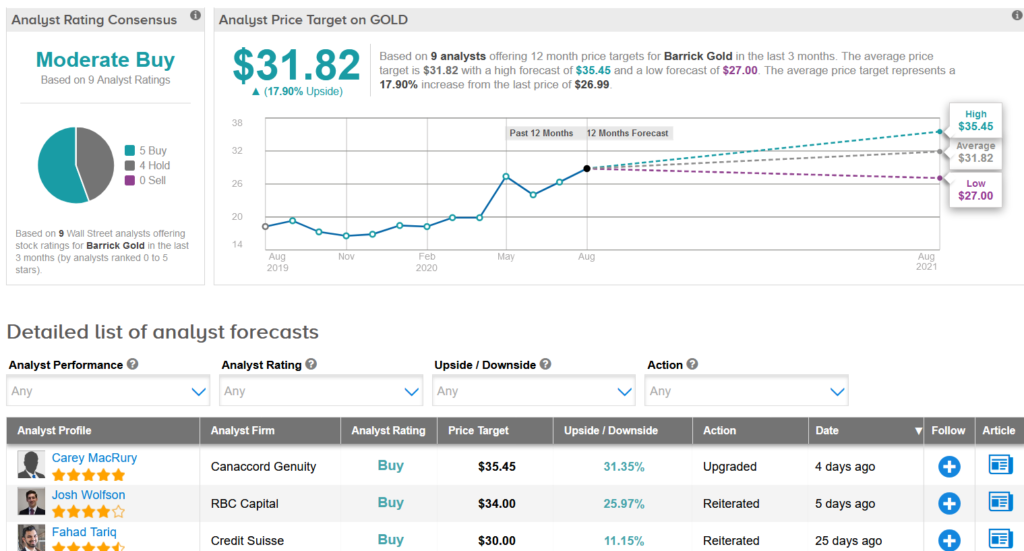

Last week, Canaccord analyst Carey MacRury upgraded Barrick Gold to Buy from Hold with a $35.45 price target (31% upside potential), citing the stock’s valuation. (See GOLD stock analysis on TipRanks)

“In our view, Barrick has a steady production profile of ~5Moz through 2026, strong FCF generation (~8% 2021E FCF yield at spot prices) and we expect the company to achieve a net cash position in 2021,” MacRury wrote in a note to investors. “Our target price remains predicated on a 50/50 blend of a 1.25x multiple applied to our operating NAVPS estimate plus net debt and other corporate adjustments, and a 10.0x multiple applied to 2020E EBITDA.”

Overall, Wall Street analysts are cautiously optimistic on the stock. The Moderate Buy consensus shows 5 Buys versus 4 Holds. The $31.82 average price target implies another 18% upside potential to current levels.

Related News:

iQIYI Tumbles 12% On SEC Probe Over Fraud Allegations

DraftKings Sinks As IRS Tax Threat Hits; Street Stays Bullish

Altria vs Philip Morris: Which Stock Is A More Compelling Buy?