Bristol Myers Squibb announced on Feb. 5 that the US Food and Drug Administration (FDA) has approved its lymphoma drug, Breyanzi, a CAR-T (chimeric antigen receptor T-cell) therapy for the treatment of adult patients suffering from relapsed or refractory large B-cell lymphoma.

Breyanzi will be administered to adult patients who have not responded to two or more lines of other systemic treatments or have relapsed following these treatments.

Lymphoma is a type of cancer that starts in the lymphocytes – infection-fighting cells in the body. In the clinical trial study of 268 adult patients who received Breyanzi, 54% of patients achieved complete remission.

Bristol Myers Squibb’s (BMY) Chief Medical Officer said, “Breyanzi, a CAR T cell therapy, will have an important role in clinical practice, offering people living with relapsed or refractory large B-cell lymphoma the chance for sustained response with an individualized treatment experience.”

Doses of Breyanzi will be administered to individual patients by using the patient’s T-cells, genetically modifying them and infusing them back into the patient. (See Bristol Myers Squibb stock analysis on TipRanks )

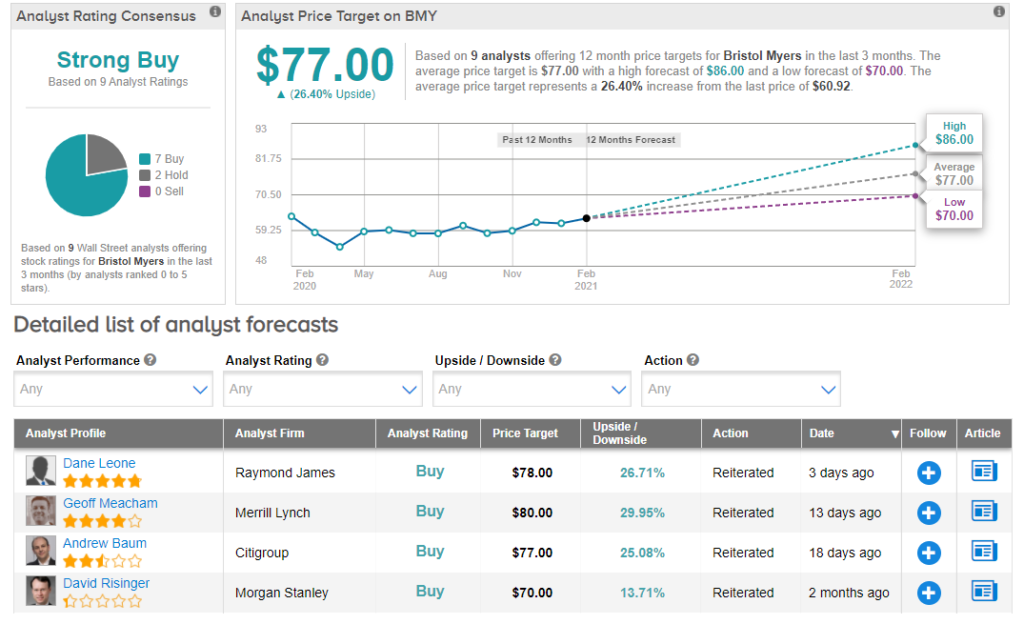

On Feb. 4, after the announcement of BMY’s 4Q and FY20 results, Raymond James analyst Dane Leone reiterated a Buy and a price target of $78 on the stock. Leone said about the company’s drug pipeline, “…based upon the current drug pipelines for solid tumors BMS [Bristol Myers Squibb] needs several high risk programs to be successful while competitor programs fail. To mitigate this risk, we think that BMS will need to become more aggressive with external asset deals during 2021.”

“We would argue against doubling down anymore on the IO [immuno-oncology] target list, and look more towards antibody-drug conjugates, bi-specifics, and targeted oncology (which has been a long-standing hole within the portfolio),” the analyst wrote in a note to investors.

The rest of the Street is bullish about BMY with a Strong Buy consensus rating. That’s based on 7 analysts recommending a Buy and 2 analysts suggesting a Hold on the stock. The average analyst price target of $77 implies 26.4% upside potential to current levels. Shares of BMY fell 1% to $60.92 on Feb. 5.

Related News:

J&J Files For FDA Approval Of COVID-19 Vaccine; Street is Bullish

Snap Faces A Challenging 1Q; Shares Drop 7.5% After-Hours

CoreLogic Snapped Up For $6B By Stone Point Capital and Insight