XP Inc. (XP), a digital financial services broker announced the purchase of a majority ownership stake in Fliper, an automated investment consolidation platform. Following the news XP’s stock surged 12% to $41.04.

Financial terms of the deal weren’t disclosed. The provider of low-fee financial products and services in Brazil said that the transaction allows the company to offer additional resources for customers to manage their investments, as the open banking trend continues to accelerate in the country.

The acquisition is part of the digital broker’s growth strategy and reinforces the value it sees in innovative fintechs. The completion of the transaction is still subject to approval by the Brazilian Central Bank.

“The solution will allow us to improve the experience of our clients, who in many cases have accounts with more than one financial institution,” said Gabriel Leal, XP’s Commercial Director. Our intention is that XP customers consolidate all their investments and services within the group’s platforms.”

As part conditions of the transaction, Fliper’s founders, Felipe Bonani, Renan Georges and Walter Poladian, will remain stakeholders in the company and maintain full independence to manage the business with the support of XP’s structure – security, technology, back-office and marketing.

Fliper was founded in 2017 with the purpose of transforming its users’ relationship with personal finance, providing a single view of their investments across several financial institutions, allowing automatic consolidation, comparison of portfolio performance and asset monitoring. Fliper has over R$7 billion ($1.45 billion) of mapped assets on its platform and sees the potential to surpass 5 million users in the coming years.

“We believe the partnership has a great potential for long-term value creation,” said XP’s CFO Bruno Constantino.

Shares in XP have seen their value more than double since reaching a low in March.

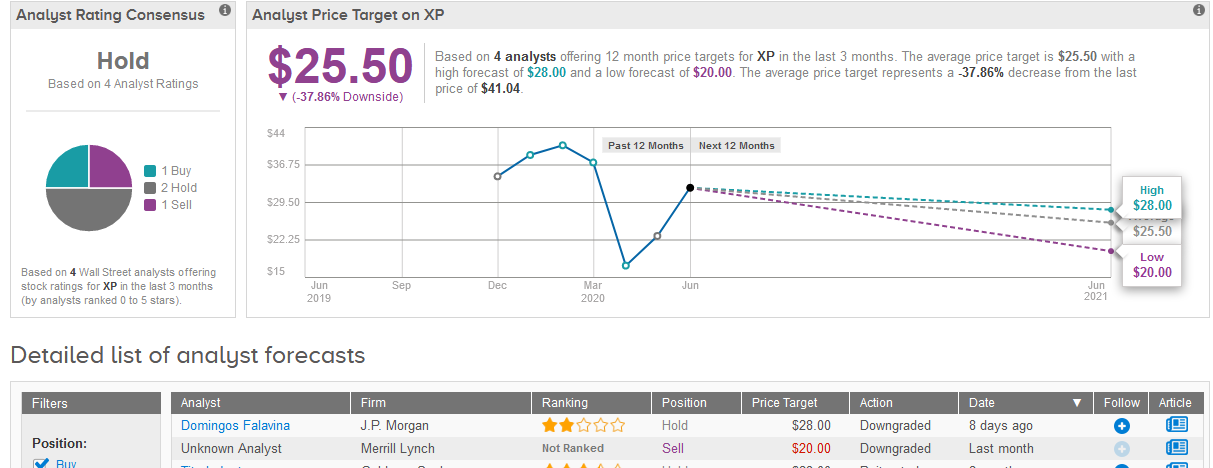

Earlier this month, JPMorgan analyst Domingos Falavina cut the stock’s rating to Hold from Buy and lowered the price target to $28 down from $33, citing valuation for the downgrade with the stock up 93% in local currency since its lows.

Falavina’s Hold rating is in line with the Hold analyst consensus for the stock. The $25.50 average price target implies 38% downside potential in the shares in the coming 12 months. (See XP stock analysis on TipRanks).

Related News:

Ebay Lifts Quarterly Sales and Profit Forecast; Shares Jump To All-Time High

Microsoft Buys Metaswitch For Cloud-Based Telecoms Move, 5G Expansion

Broadcom Reports Solid Results, Dividend As Analysts Boost PTs