BP Plc (BP) announced that it has agreed to sell its global petrochemicals business to Ineos for $5 billion sending shares up 3.3% in Monday’s U.S. pre-market trading.

Under the terms of the agreement, Ineos will make an upfront deposit payment of $400 million to BP and the remaining $3.6 billion will be paid upon completion of the transaction. An additional $1 billion will be deferred and paid in three separate installments of $100 million in March, April and May next year with the remaining $700 million payable by the end of June 2021. The deal is expected to completed by the end of this year, subject to regulatory and other approvals.

BP said the agreed sale is part of its strategic reinvention plan and means the company has now reached its $15 billion asset sale target a year earlier than originally scheduled. In addition, the transaction will further strengthen its balance sheet, the company said. The proceeds from the sale will be used by for general corporate purposes.

“I recognise this decision will come as a surprise and we will do our best to minimise uncertainty,” BP CEO Bernard Looney said. “Strategically, the overlap with the rest of BP is limited. As we work to build a more focused, more integrated BP, we have other opportunities that are more aligned with our future direction.”

“Today’s agreement is another deliberate step in building a BP that can compete and succeed through the energy transition,” Looney added.

Over the past two decades, Ineos has bought a number of businesses from BP, such as the $9 billion purchase of Innovene in 2005, which was BP’s subsidiary focused on chemicals assets and included two refineries.

Shares in BP have lost 40% of their value this year as the coronavirus pandemic pushed oil prices to multi-year lows leading to declines in oil and gas output. The stock depreciated 3.2% to $22.76 at Friday’s close.

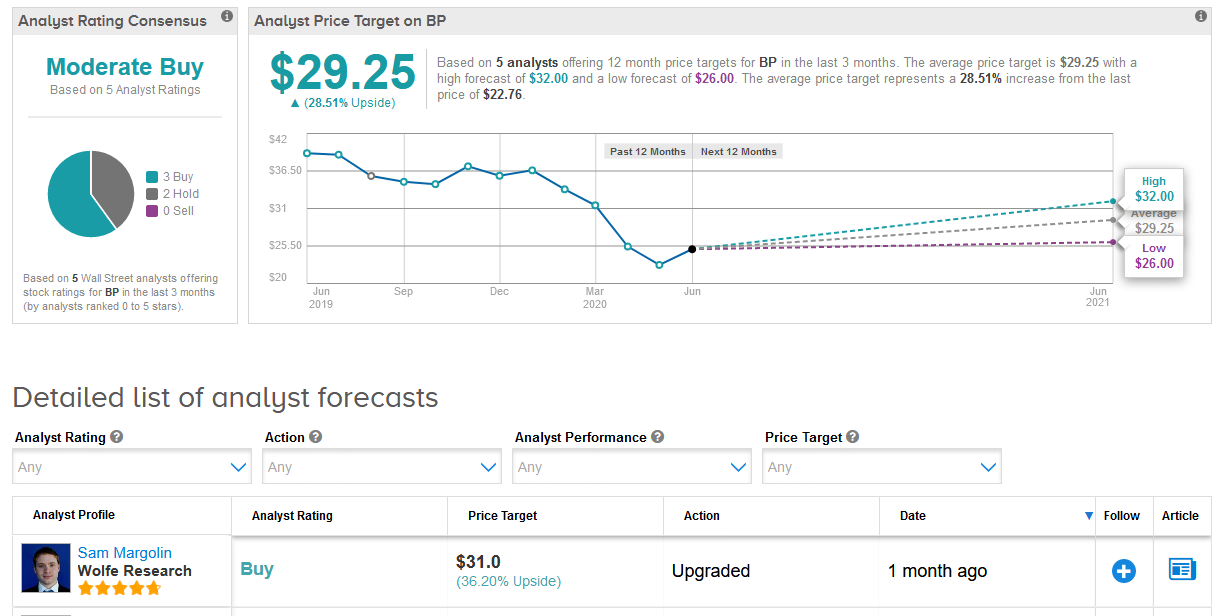

Meanwhile earlier this month, five-star analyst Sam Margolin at Wolfe Research raised BP’s rating to Buy from Hold with a price target of $31, up from $29, saying that the company has “a credible pathway” to deleveraging and dividend coverage in 2021.

Overall, Wall Street analysts have a cautiously optimistic outlook on BP. The stock’s Moderate Buy consensus splits into 3 Buy ratings versus 2 Hold ratings. The $29.25 average price target implies a potential 29% gain in the shares over the coming 12 months. (See BP stock analysis on TipRanks).

Related News:

Debt-Laden Chesapeake Energy Files For Chapter 11 Proceedings

BP Expects to Incur Up To $17.5 Billion In Charges in Q2; Shares Drop In Pre-Market

Extraction Oil & Gas Files For Bankruptcy; Announces $125M Funding Plan