BP PLC has inked a deal to sell a 20% participating interest in Oman’s gas Block 61 to Thailand’s PTT Exploration and Production Public Company Ltd. (PTTEP) for a total of $2.6 billion.

As part of the agreed terms, BP (BP) will get $2.450 billion at deal completion, which is expected during 2021, and another $140 million will be payable subject to pre-agreed future conditions. Upon closure of the sale, the oil giant will remain the block’s operator with a 40% interest. Other stakeholders include Petronas and Oman’s state oil company OQ. Gas from Block 61 is exported for domestic consumption into Oman’s national gas grid.

Block 61 covers around 3,950km in central Oman and contains the largest tight gas development in the Middle East. The block has already had two phases of development – Khazzan, which began production in 2017, and Ghazeer in Oct. 2020. The two developments, targeted at developing a total of 10.5 trillion cubic feet of gas resources, have a combined daily production capacity of 1.5 billion cubic feet of gas and more than 65,000 barrels of condensate. PTTEP is Thailand’s national petroleum exploration and production company, with interests in 15 countries, including Oman.

“We are committed to bp’s business in Oman – this agreement allows us to remain at the heart of this world-class development while also making important progress in our global divestment programme,” BP CEO Bernard Looney said.

The deal is part of BP’s divestment plan, which targets proceeds of $25 billion by 2025. The oil giant recently completed the $5 billion sale of its petrochemicals business to INEOS.

Shares in BP have seen some recovery, with a 38% gain over the past three months after losing 37% of their value over the past year as the coronavirus pandemic pushed oil prices to multi-year lows, leading to declines in oil and gas output. (See BP stock analysis on TipRanks)

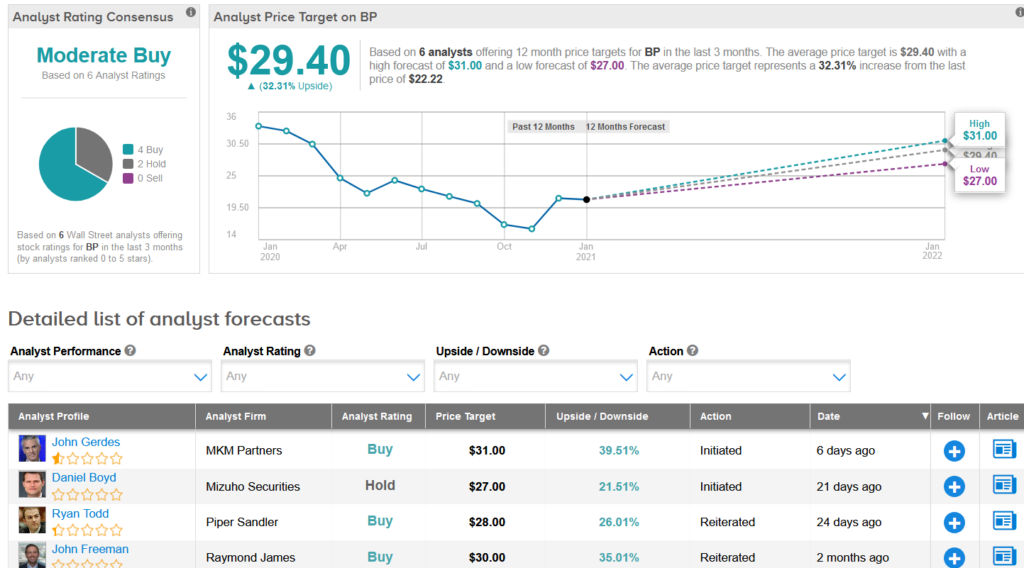

Meanwhile, MKM Partners analyst John Gerdes last week initiated the stock’s coverage with a Buy rating and a $31 price target. Gerdes expects BP to generate $26 billion of free cash flow during 2021-2025, which he noted is about 33% of the company’s market capitalization.

The rest of the Street has a cautiously optimistic outlook on the stock with a Moderate Buy consensus rating. What’s more, the average analyst price target of $29.40 implies upside potential of about 32% over the coming 12 months.

Related News:

Church & Dwight’s 4Q Profit Tops Analysts’ Estimates; Street Sees 14% Upside

Roper Technologies Dips 7% On 1Q Profit Outlook Miss

FB Financial Ramps Up Dividend By 22%