Alternative investment management company Blackstone Inc. (NYSE:BX) recently revealed that funds managed by Blackstone Infrastructure Partners have entered into an agreement to make an equity investment of $3 billion in Invenergy Renewables Holdings LLC, one of the largest private renewable energy companies in North America.

Following the news, shares of the company declined 2.1% on Friday. However, the stock pared its losses slightly to close at $117.32 in the extended trading session.

Strategic Impact

The move is in line with Blackstone’s strategy of investing in clean energy companies. With more than 175 projects totaling about 25,000 megawatts, Invenergy’s operations span across four continents. The company has long-lasting partnerships with organisations operating in a diverse range of industries.

Further, Invenergy is also building the largest wind and solar projects in the United States, which combined will deliver nearly 3 gigawatts (GW) of clean energy by 2023.

Executive Comments

The Senior Managing Director in the Infrastructure Group at Blackstone, Matthew Runkle, said, “We are proud to have the opportunity to work with Michael Polsky and the world-class team at Invenergy. Invenergy has built an outstanding platform for delivering clean energy – which is essential to our future – and we are honored to be a part of their mission.”

Price Target

Recently, Deutsche Bank analyst Brian Bedell reiterated a Buy rating on the stock. The analyst, however, raised the price target from $152 to $190, which implies upside potential of 62.9% from current levels.

The Wall Street community is cautiously optimistic about the stock and has a Moderate Buy consensus rating based on 8 Buys and 3 Holds. The average Blackstone stock prediction of $154.55 implies that the stock has upside potential of 32.5% from current levels. Shares have gained about 86.1% over the past year.

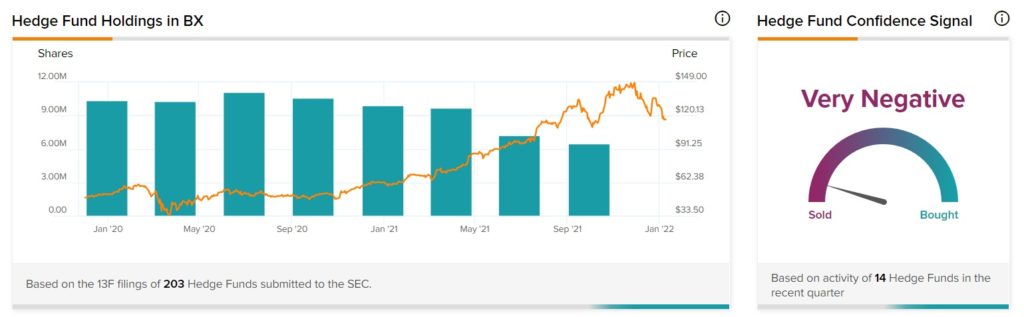

Decreased Hedge Fund Trading

TipRanks’ Hedge Fund Trading Activity tool shows that the confidence in Blackstone is currently Very Negative, as some of the top hedge funds that were active in the last quarter decreased their cumulative holdings by 770,800 shares.

Download the TipRanks mobile app now.

Related News:

Viatris Bumps up Quarterly Dividend by 9%

ATS Buys System Integrator HSG Engineering

Nikola Signs LOI with Saia; Shares Soar Above 9%