Private equity major Blackstone Inc. (BX) recently revealed that the funds managed by Blackstone Tactical Opportunities have entered into a definitive agreement to make a strategic investment in healthcare supply chain solutions provider Life Science Logistics. The terms of the deal have not been disclosed so far.

Following the news, shares of the company gained 1% to close at $144.22 on Tuesday.

Implications of the Deal

With the proceeds from the investment, Life Science will be aiming to enhance its offerings in the pharmaceutical and medical device market. Opening of new facilities and expanding its customer base will also receive a boost through this investment.

Management Commentary

The Global Head of Healthcare at Blackstone, Ram Jagannath and Senior Managing Director at Blackstone, Todd Hirsch, said, “LSL sits at the intersection of two of Blackstone’s highest-conviction, firmwide investment themes – rapid advancement of life sciences innovation and next-generation logistics. The current environment has clearly demonstrated the critical need for resilient, high-quality healthcare supply chain solutions – and we look forward to helping accelerate the growth of a leader in this sector.”

See Insiders’ Hot Stocks on TipRanks >>

Price Target

Recently, Bank of America Securities analyst Craig Siegenthaler initiated coverage on the stock with a Buy rating. The analyst’s price target of $182 implies upside potential of 26.2% from current levels.

According to the analyst, growth visibility in the retail sector can drive earnings upwards for the company in the future.

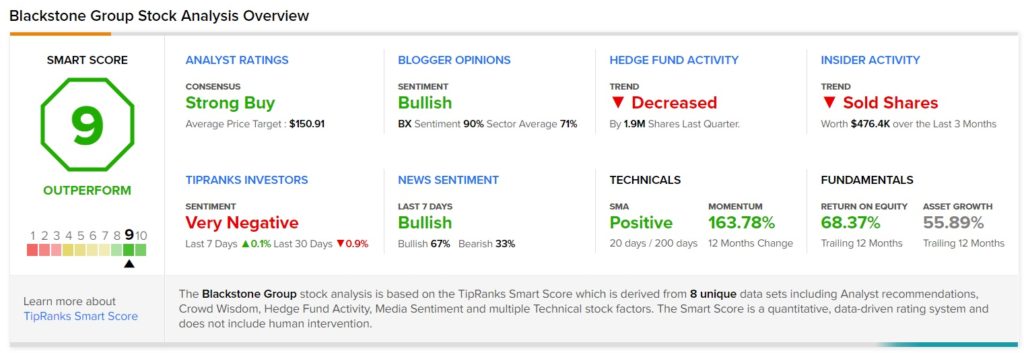

Consensus among analysts is a Strong Buy based on 9 Buys and 3 Holds. The average Blackstone price target of $150.91 implies upside potential of 4.6% from current levels.

Smart Score

Blackstone scores a 9 out of 10 from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations. Shares have gained 150% over the past year.

Related News:

TerrAscend Swings to Profit in Q3, Sales Rise

The Home Depot Q3 Results Surpass Estimates

Advance Auto Parts Posts Better-Than-Expected Q3 Results