Arrival said it raised $118 million from funds managed by BlackRock to support the company’s global growth plans as it ramps up vehicle production, including the launch of its first US microfactory in South Carolina.

BlackRock (BLK) joins a list of strategic investors including Hyundai Motor, Kia Motors and UPS. Arrival, which was founded in 2015 and has over 1,200 employees, is focused on the development of electric commercial vehicles, including vans and buses. The startup has scored an order of 10,000 electric vans from UPS, with the option for another 10,000 vehicles. Its microfactories produce 10,000 vans or 1,000 buses per year.

“We are excited to welcome BlackRock as a strategic financial investor with its excellent track record in ESG,” said Arrival CEO Denis Sverdlov. “This additional capital will be invested into Arrival’s growth, as we deepen and expand our presence in the US and other new markets globally. With our new microfactory in South Carolina, we are looking forward to partnering with more cities and companies to create a sustainable future.”

BlackRock’s investment will fund Arrival’s plans to scale its microfactory footprint in both the US and Europe. Its first US microfactory in South Carolina is expected to begin operations in Q2 2021, with start of production in Q4 2021.

Arrival said that the BlackRock funding is a reflection of the significant market opportunity for electric vehicles, particularly in the commercial segment, which continues to grow with rising demand for e-commerce and is predicted to reach 8 million commercial and passenger fleets by 2030 in the US alone.

The EV startup believes that its new approach to the design and assembly of electric vehicles combined with proprietary in-house developed components, materials and software, enable the production of best in class vehicles that are competitively priced to fossil fuel variants. The transformative approach reduces the production costs and emissions of shipping, and does not require massive upfront investment, creating strong unit economics, Arrival said.

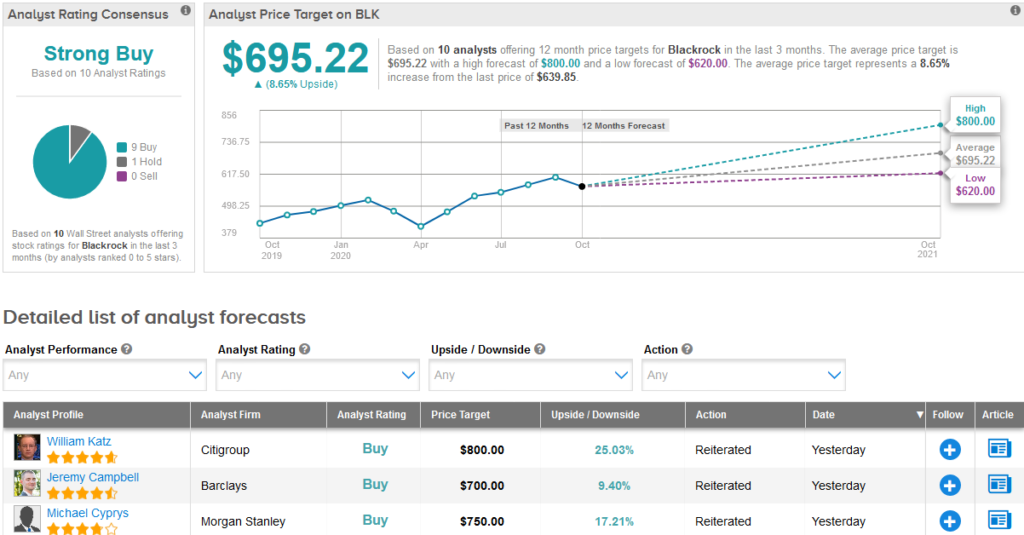

Following the US fund manager’s better-than-expected quarterly earnings this week, Citigroup analyst William Katz ramped up BLK’s price target to a Street high of $800 (25% upside potential) from $690 and maintained a Buy rating.

Katz pointed to the “favorable takeaways” from the earnings release citing the firm’s “differentiated” near and long-term drivers and strategic positioning, which are driving his expectations for multiple expansion. (See BLK stock analysis on TipRanks)

In line with Katz’s outlook, the Street has a Strong Buy analyst consensus on the stock with 9 Buys versus only 1 Hold. With shares up 27% year-to-date, the average price target of $695.22 implies upside potential of about 8.7% to current levels.

Related News:

Citigroup Tops 3Q Profit; Oppenheimer Sees 129% Upside

J.P. Morgan Surprises With 3Q Profit Beat Fueled By Capital Markets Boom

BlackRock Gains 4% On 3Q Profit Beat; Street Says Buy