The US economy contracted 31.7% (revised estimate) on an annualized basis in the second quarter, marking the steepest decline ever. The COVID-19 pandemic erased millions of jobs and crushed several businesses. The fate of the companies in the industrial sector is closely tied to the economy.

Heavy equipment manufacturers like Deere and Caterpillar are significantly impacted by the economic downturn. However, Deere’s recent results indicated that the situation may be better-than-feared.

We will analyze the recent performance of Deere and Caterpillar and use the TipRanks’ Stock Comparison tool to see which stock offers a more compelling investment opportunity.

Deere (DE)

Deere impressed investors with its better-than-anticipated results for the third quarter of fiscal 2020 (ended August 2) and a better outlook for the full fiscal year despite continued uncertainty. The company’s fiscal third-quarter revenue declined 11.1% to $8.93 billion and EPS fell 8.5% Y/Y to $2.57 as shipments dropped amid the crisis.

The farm equipment company, which derived about 68% of its last year’s net sales from the Agriculture and Turf business, stated that the demand for small tractors remained strong in the quarter due to an increase in projects for home and property owners amid the pandemic. The segment’s sales declined 5% to $5.67 billion due to lower shipment volumes. But the decline was lower than anticipated supported by higher pricing.

It now expects fiscal 2020 sales for the Agriculture and Turf business to fall 10% compared to the previous forecast of 10% to 15% decline. That’s thanks to the benefit from replacement demand as the farm equipment fleet continues to age out.

Deere’s Construction and Forestry segment’s sales fell 28% to $2.19 billion reflecting lower shipment amid the crisis, partially offset by higher pricing to some extent. The company is now anticipating a 25% fall in the segment’s fiscal 2020 sales, reflecting an improved outlook compared to the previous forecast of a 30% to 40% drop.

Most importantly, Deere has been curbing its production to right-size its inventory levels and is also cutting down costs amid challenging market conditions. These efforts and a faster than anticipated recovery helped the company raise its fiscal 2020 net income forecast to $2.25 billion, up from the previous projection of $1.6 to $2.0 billion.

At the same time, Deere plans to intensify its investments in Precision Agriculture as farmers are seeking advanced technologies and more automation. It is also enhancing its capabilities in the aftermarket and retrofit business.

Following the results, RBC Capital analyst Seth Weber increased his price target for Deere stock to $228 from $180. The analyst maintained his Buy rating as the company’s fiscal third-quarter results and improved guidance for fiscal 2020 highlight its “ability to navigate fluid markets”.

Weber also raised his fiscal 2020 EPS estimate to $7.21 from $6.15 and fiscal 2021 view to $9.45 from $8.65. He believes that the company is well-positioned for fiscal 2021 based on its agriculture orders and declining inventory in construction. (See DE stock analysis on TipRanks)

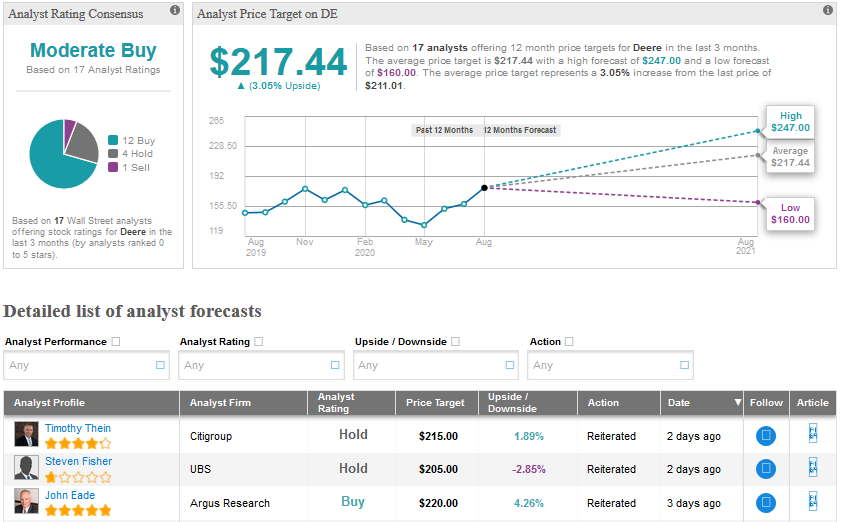

Based on 12 Buys, 4 Holds and 1 Sell, Deere scores a Moderate Buy consensus from the Street. Deere stock was up about 21.8% year-to-date as of August 26. An average analyst price target of $217.44 indicates a further upside of 3.1% over the next 12 months.

Caterpillar (CAT)

Caterpillar beat analysts’ predictions for the second quarter but COVID-19 caused a significant decline in its top-line and earnings due to lower demand in the company’s end markets. The second-quarter revenue fell 30.7% Y/Y to $10 billion while its adjusted EPS plunged 70.3% to $0.84.

The pandemic caused Caterpillar’s dealers to cut machine and engine inventories by about $1.4 billion compared to an increase of $500 million in 2019’s second quarter. Revenue from the company’s larger segments–Construction Industries and Energy & Transportation fell 37.4% and 24.4%, respectively. And revenue from Resource Industries and Financial Products declined 35.2% and 12.6%.

One favorable trend in the second quarter was that the Asia Pacific business fared better than North America due to improved demand in China. Caterpillar did not provide any full-year guidance, unlike Deere. But, it cautioned that it expects dealers to reduce their inventory by over $2 billion by year-end.

The company expects the residential construction business to improve in North America and drive the demand for small equipment. Deere is also optimistic about the medium and long-term prospects for mining, although it expects the overall demand for Resource Industries to remain soft.

Within the Energy & Transportation business, the company expects to benefit from demand for data centers and emergency power while continued challenges in oil and gas might hurt the demand for reciprocating engines.

On August 3, Credit Suisse analyst Jamie Cook raised her price target for Caterpillar to $159 from $144 and maintained a Buy rating based on a better-than-expected quarter. Cook noted that the market was disappointed by Caterpillar’s third-quarter forecast which indicates that the sales and margins will be down sequentially, implying that the second quarter is not the trough of earnings.

However, the analyst believes that Caterpillar’s earnings will bounce back next year and that the company’s bottom line has been more resilient than in prior downturns. (See CAT stock analysis on TipRanks)

Caterpillar stock has declined about 4% so far in 2020 and the average analyst price target of $141.07 does not indicate a possible upside. Eight Buys, 9 holds and 1 Sell add up to a Moderate Buy rating for Caterpillar stock.

The better stock

Deere stock has outperformed Caterpillar on a year-to-date basis. Also, analysts on average see more upside in Deere stock compared to Caterpillar. Deere’s recent performance has shown that it is more resilient compared to Caterpillar. In particular, Deere has more exposure to farming, while Caterpillar relies more on construction, mining and power equipment.

Meanwhile, Caterpillar’s valuation multiple is lower than Deere and it has a higher dividend yield of 2.9% compared to Deere’s 1.4%. However, Deere looks more poised to recover faster post COVID-19. About 70% of analysts covering Deere have a Buy rating vs 44% in the case of Caterpillar.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment