Car rental company Hertz Global Holdings (HTZ) is reportedly asking a bankruptcy judge for permission to raise as much as $1 billion from a stock sale, to benefit from its recent share rally.

The stock surged 51% in pre-market trading after closing 18% lower at $2.06 on Thursday. Shares more than doubled this month as investors piled up on the stock amid some optimism that Hertz may be able to work its way through bankruptcy proceedings, while travel is poised to rebound following the coronavirus crisis.

As part of the plan, Hertz is offering as many as 246.78 million common shares with help from Jefferies LLC, according to a court filing seen by Bloomberg.

“The recent market prices and the trading volumes in Hertz’s common stock potentially present a unique opportunity for the debtors to raise capital on terms that are far superior to any debtor-in-possession financing,” the company said, referring to a traditional bankruptcy loan.

A share offering would avoid new interest, fees and restrictions on Hertz’s finances and wouldn’t impose any claims from a bankruptcy loan that would outrank existing creditors, the company said.

In addition, Hertz said it would warn any potential buyers “the common stock could ultimately be worthless.”

Its lawyers requested an emergency ruling “given the volatile state of trading in Hertz’s stock.”

Meanwhile, Hertz earlier this week pledged to challenge plans by the New York Stock Exchange (NYSE) to delist its common stock from the exchange. The debt-strapped car rental company appealed the determination and has requested a hearing before the NYSE.

The exchange made the decision after Hertz disclosed on May 22 that it has commenced voluntary petitions for reorganization under chapter 11 of the Bankruptcy Code.

“At this time, the common stock of the company will continue to be listed and trade on the NYSE pending resolution of such appeal” Hertz said.

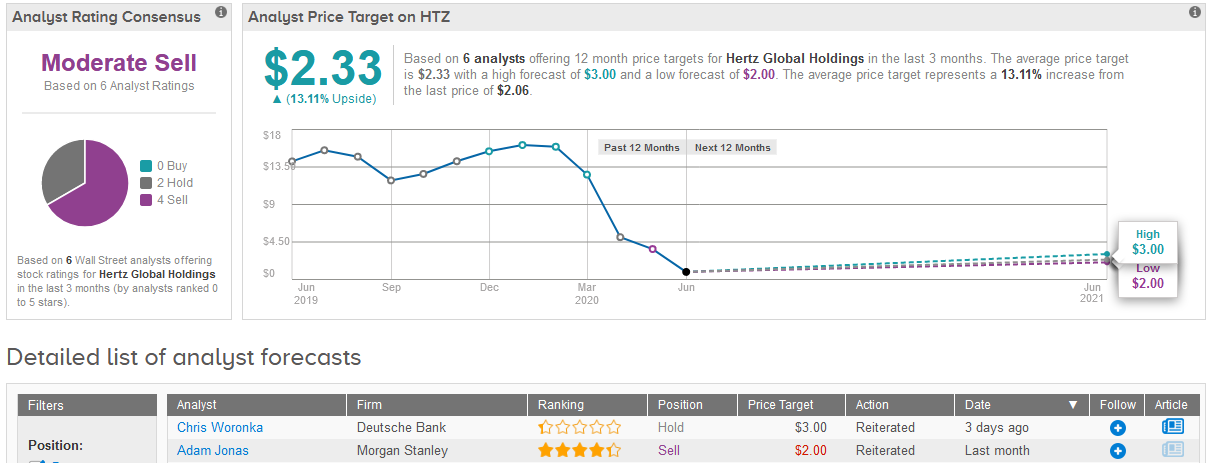

The company’s stock plunged over 70% in value year-to-date. The troubled car rental company has a bearish Moderate Sell consensus from the Street with 2 recent Hold ratings and 4 Sell ratings. (See Hertz stock analysis on TipRanks).

The average analyst price target stands at just $2.33, implying 13% upside potential in the shares over the coming year. Deutsche Bank analyst Chris Woronka has a Hold rating on the stock with a $3 price target, saying “it’s difficult to fundamentally analyze the company” due to the bankruptcy proceedings.

While the “reopening trade” for stocks set to improve post-lockdown has become popular, Woronka nevertheless finds himself “questioning the true depth of the buying in what increasingly feels like a capitulation-type short squeeze being exacerbated by high frequency trading programs.”

Related News:

Beleaguered Hertz Sinks 36% In After-Market On Bankruptcy Protection Filing

Hertz Down 11% After-Hours As Carl Icahn Sells Stake At $1.8B Loss

Global Airlines Are Set To Lose $84.3 Billion In 2020, IATA Says