American computer networking company Arista Networks (ANET) has reported solid third-quarter 2021 results.

Adjusted earnings per share (EPS) rose 22.3% year-over-year to $2.96, surpassing the Street’s estimate of $2.73 per share. (See Insiders’ Hot Stocks on TipRanks)

Total revenue soared 23.7% to $748.7 million and outpaced the consensus estimate of $738.3 million. Product revenue (80.7% of net sales) increased 25.8% to $604.2 million. Service revenue rose 15.5% to $144.5 million.

Alongside earnings, the company announced an increase in its share buyback program by up to $1 billion. Further, its board of directors approved a four-for-one stock split. Each shareholder of record at the close of business on November 11, 2021 will receive three additional shares for every share held.

CFO of Arista Networks, Ita Brennan, said, “The business continued to perform well in the quarter, exceeding on all key financial metrics, while the team navigates a difficult supply environment.”

Looking ahead, Arista Networks expects fourth-quarter revenue to be between $775 million to $795 million. Adjusted gross margin is anticipated to be in the range of 63% to 65%.

Following the release, Piper Sandler analyst James Fish maintained a Hold rating on the stock, and raised his price target to $500 from $379.

Fish is of opinion that the extended trade rally is due to 2022 and medium-term targets that exceed estimates by 15%, increased visibility and the inflection point of the 200/400G cycle.

Also, Needham analyst Alex Henderson maintained a Hold rating on Arista Networks. The analyst said, “Arista’s adroit Supply Chain commitments appear to be getting them better access to Supplies and enabling share gains in CY22. The spike in FB Capex, a 400G upgrade refresh, strong Enterprise and Arista’s 10% Price hike and the growth in CY22 is twice the sustainable rate.”

The Street is cautiously optimistic about the stock and has a Moderate Buy consensus rating based on 12 Buys and six Holds. The average Arista Networks price target of $469.94 implies 7.9% downside potential.

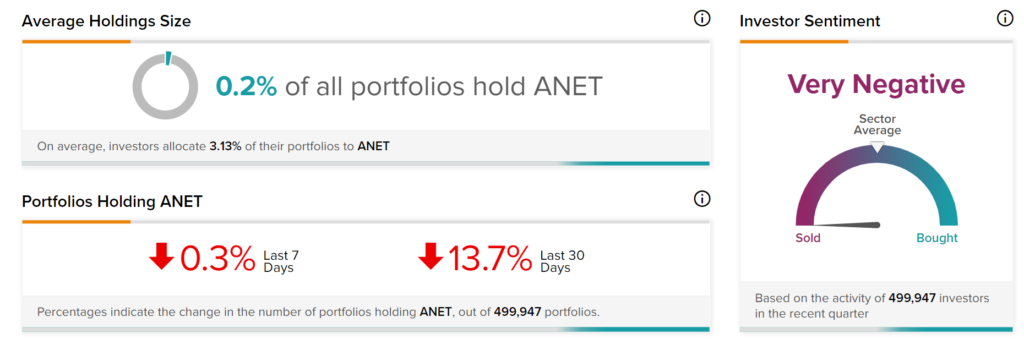

TipRanks’ Stock Investors tool shows that investors currently have a Very Negative stance on Arista Networks, with 13.7% of investors decreasing their exposure to ANET stock over the past 30 days.

Related News:

Diamondback Books Better-than-Expected Q3 Profit, Boosts Dividend

Hologic Posts Upbeat Fourth Quarter Results

Aon’s Q3 Results Exceed Expectations