Shares in AMC Entertainment Holdings Inc. (AMC) jumped almost 7% in pre-market trading after the cash-strapped U.S. theater chain said it reached an agreement with bondholders to reduce its debt pile by as much as $630 million.

The stock rose to $4.55 in Tuesday’s pre-market trading as the world’s largest theater operator announced that the accord reached with about 73% of a group of lenders of its $2.3 billion in senior subordinated bonds would cut its total debt by between $460 million and $630 million. In addition, AMC’s noteholders have agreed to invest $200 million in new AMC first lien notes.

Separately, AMC said it has also reached an agreement to restructure some $600 million of convertible notes issued in 2018 to Silver Lake. Upon the closure of the private debt exchange, Silver Lake will provide AMC with $100 million in additional cash in the form of incremental first lien financing.

AMC expects the restructuring steps will save the theatre operator between $100 million and $200 million of cash in the near-term.

“Today is an important day for AMC as we have reached agreements that strengthen AMC’s financial position over the long term,” said AMC CEO Adam Aron. “Upon the closing of these consensual bond restructurings, we materially will reduce our debt load, increase our cash and extend our maturities.”

Aron added that AMC “will continue to take bold actions” to shore up its financial position.

Since mid-March, AMC Entertainment has been forced to close its movie theatres worldwide and temporarily suspend operations as a result of the global lockdowns triggered by the coronavirus outbreak. The company said recently that it is postponing the reopening of the bulk of its U.S. theatres until July 30, following date changes for the releases of two major movies the live-action remake of Mulan and science-fiction thriller Tenet.

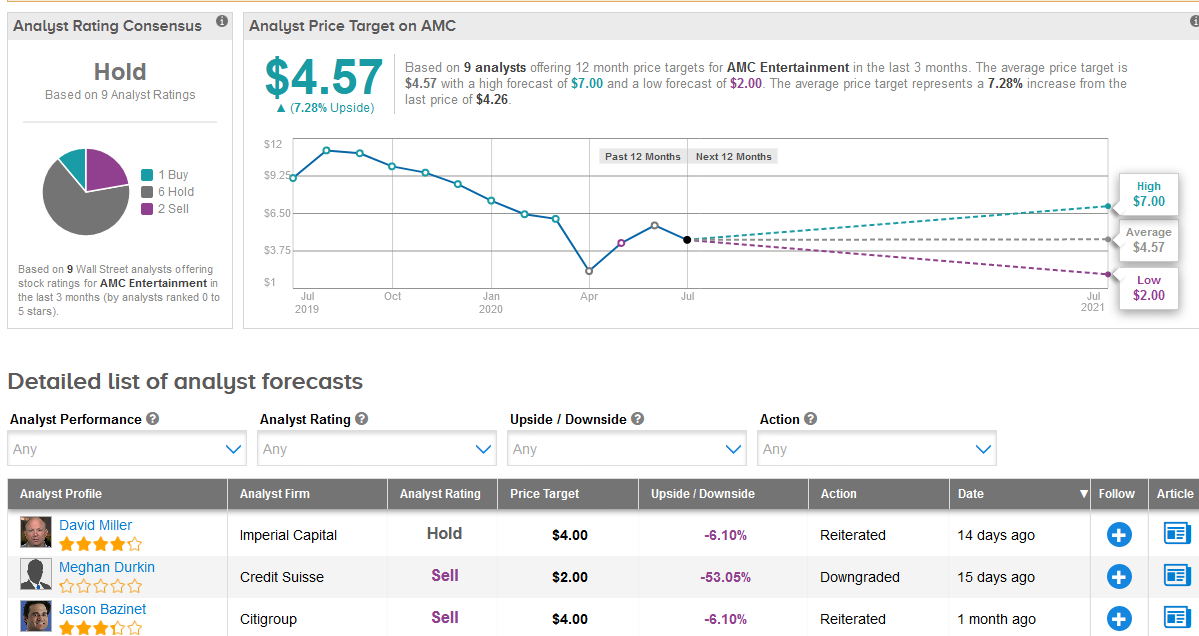

Imperial Capital analyst David Miller cut the firm’s price target to $4 (6% downside potential) from $6 and maintained a Hold rating on the shares to reflect a later opening of the theater locations than he expected and added that he also believes that rent expenses will be higher in fiscal 2021.

Shares in AMC have been hard hit and have plunged 41% this year. So, it’s not surprising that the consensus of Wall Street analysts is on Hold on the company’s stock. Out of the 9 analysts covering the stock in the past three months, 6 have Holds, 2 have Sells and 1 has a Buy.

Meanwhile, the $4.57 average price target implies 7.3% upside potential in the shares in the coming 12 months. (See AMC stock analysis on TipRanks).

Related News:

AMC Pops 12% In After-Market Amid Report Of New Restructuring Deal To Avert Bankruptcy

Canada’s Cineplex Starts Legal Action To Sue Cineworld For Damages

Lucky Brand Files For Bankruptcy Protection Due To Covid-19