A group of lenders to AMC Entertainment (AMC) claim that the theater chain violated its credit agreement by not providing the necessary information about its July 10 debt deal.

Representing a majority of AMC’s $2 billion term loan, the group issued AMC a default notice. In a July 22 report by Bloomberg, the lenders said that AMC provided a “completely inadequate” response to questions about the permissibility of an agreement and planned debt swap with the private equity firm Silver Lake.

AMC provided additional information to the lenders but the group said that it was still not sufficient and so they are proceeding to handle AMC as though it has defaulted. The lender additionally stated that Silver Lake was a company insider and that AMC’s “blatant refusal” to provide additional information means that “there is no reasonable basis” to believe that the exchange is allowed.

Bloomberg says that a person involved with the deal noted that Silver Lake has a seat on AMC’s board but removed itself from discussions related to the transaction of debt. A Silver Lake spokesperson declined to comment and AMC representatives did not respond to requests for comment either.

Last month, AMC made an agreement with a majority of its bondholders that would give liquidity to the company to repay the mounting debt accumulated as a result of shuttered AMC theaters since the onset of the pandemic.

The plan saw Silver Lake – which owns a majority of AMC’s convertible bonds – agreeing to a buy of $100 million in new first-lien notes for near-face value of 90%. Additionally, AMC’s existing subordinated shareholders would swap their debt for new second-lien secured notes due in 2026, with a $200 million purchasable option of new 10.5% first-lien notes due the same year. Bondholders have a July 24 deadline to return their securities at the most favorable terms.

The news comes in light of another setback for AMC after Warner Bros. announced on July 21 that its anticipated summer blockbuster, Tenet, would be delayed indefinitely due to the impact of the pandemic.

AMC plans to open 450 locations on July 30, followed by 150 more in August. The re-opening will coincide with the August release of Disney’s (DIS) Mulan, the only other major blockbuster draw for this summer.

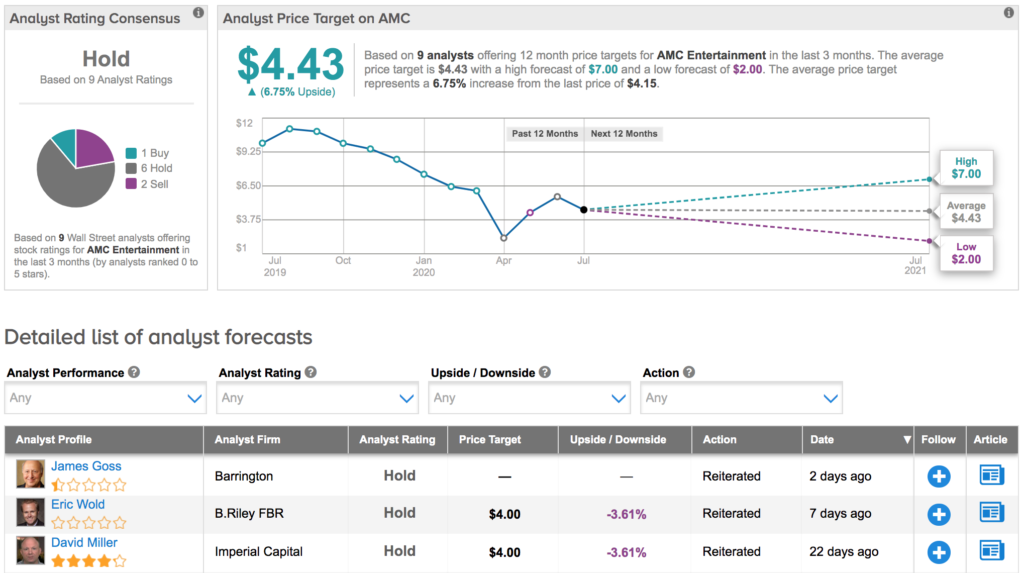

On June 30, Imperial Capital analyst David Miller reduced fiscal 2020 estimates to reflect a later opening of AMC’s theaters. He anticipates higher rent expenses in fiscal 2021. The analyst reiterated a Hold rating on AMC and reduced his price target from $6 to $4, implying 4% downside potential.

The stock is down 43% year-to-date with a Hold analyst consensus that breaks down to 1 Buy rating, 6 Hold ratings, and 2 Sell ratings. The $4.43 average price target implies 7% downside potential for the shares in the coming 12 months. (See AMC’s stock analysis on TipRanks).

Related News:

AMC Pops 12% In After-Market Amid Report Of New Restructuring Deal To Avert Bankruptcy

Canada’s Cineplex Starts Legal Action To Sue Cineworld For Damages

AMC To Cut Debt By Up To $630M Lifting Shares By 7% In Pre-Market