Amazon announced plans to build a second infrastructure region in India by mid-2022, to meet the demand for increased adoption of its cloud solutions.

Amazon (AMZN) disclosed that the plan for the new Amazon Web Services (AWS) Asia Pacific cloud region located in the southern Indian state of Telangana includes a number of data centers. The new region will enable even more developers, startups, and enterprises as well as government, education, and non-profit organizations to run their applications and serve end users from data centers located in India, the e-commerce giant said.

“Businesses in India are embracing cloud computing to reduce costs, increase agility, and enable rapid innovation to meet the needs of billions of customers in India and abroad,” said Peter DeSantis, Senior Vice President at AWS. “Together with our AWS Asia Pacific (Mumbai) Region, we’re providing customers with more flexibility and choice, while allowing them to architect their infrastructure for even greater fault tolerance, resiliency, and availability across geographic locations.”

Amazon said that AWS is already used by a number of businesses in India, which include automobile company Ashok Leyland, life insurer Aditya Birla Capital, Axis Bank, Bajaj Capital, ClearTax, Freshworks, HDFC Life, Mahindra Electric, RBL Bank, and Sharda University.

The e-commerce giant opened its first AWS Asia Pacific region in Mumbai in June 2016. Since then, AWS has expanded its services through edge locations in Bangalore, Chennai, Hyderabad, Mumbai, New Delhi, and Kolkata.

Companies like Amazon are weathering the Covid-19 crisis relatively well as the pandemic has led to an unprecedented wave of orders and delivery services. As the e-commerce giant sees the online growth trend continuing post-pandemic, the company has also been looking to increase its reach and boost market share.

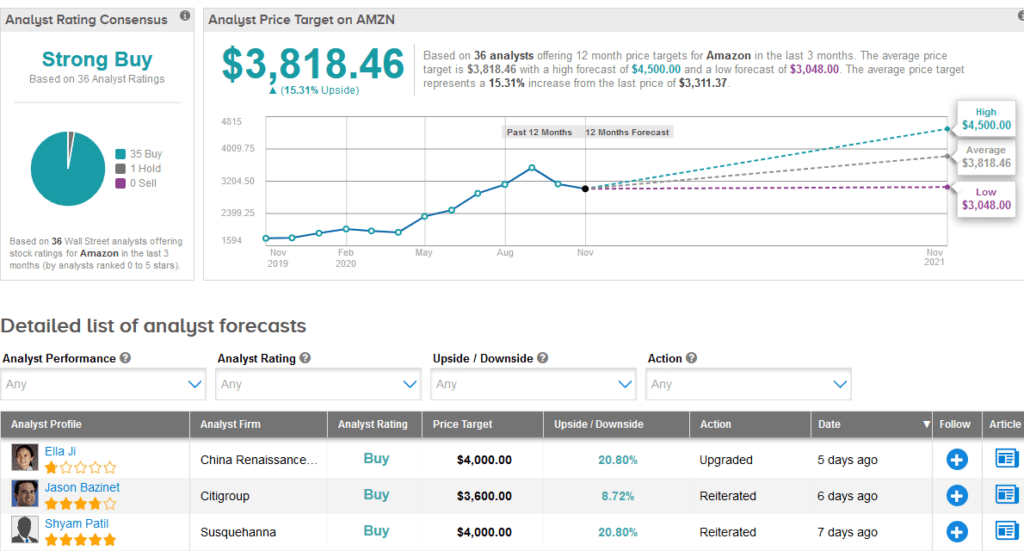

Shares of Amazon have been on a steady gaining streak jumping a stellar 79% so far this year, with the $3,818.46 average analyst price target implying an additional 15% upside potential is lying ahead in the coming 12 months.

Earlier this month, Citigroup analyst Jason Bazinet raised the stock’s price target to $3,600 from $3,550 and reiterated a Buy rating, after AMZN posted “strong” Q3 results and provided Q4 sales guidance above the Street consensus.

Bazinet believes that looking ahead Amazon’s sales growth should offset any near-term margin weakness.

Overall, AMZN scores a Strong Buy analyst consensus with 35 Buy ratings vs. only 1 Hold rating. (See Amazon stock analysis on TipRanks).

Related News:

Livent Pops 15% On Lithium Joint Venture, Tesla Contract Extension

Buffett’s Berkshire Operating Profit Sinks 32%, Buys Back $9B In Stock

Uber Posts Worse-Than-Feared Loss On Weak Rides Demand; Wedbush Raises PT